A simple payment schedule template can make it easier to make a schedule for paying installments, seeing due dates, and managing various payment needs. The templates provided are designed to look professional and save you time. Your created schedule can be printed, saved, and shared with your business partners.

If you want to manage a business and personal finances easily, you can use a payment template. Payment Schedule templates can be used as transaction documents that protect sellers and buyers. You should use a schedule of payments template to create a payment plan.

What Should Be Included in the Payment Schedule Template?

A payment schedule template is like a calendar for your money, showing when you need to pay or receive money. Here’s what you should include:

- Dates: This is super important! Write down all the dates when payments need to be made or when you expect to receive money.

- Amounts: Next to each date, write how much money needs to be paid or will be received. This is like noting how many slices of cake you’ll need for each birthday party.

- Payment Reasons: Write down why each payment is being made. For example, is it for a bill, a loan, or something else? This helps you remember what each payment is for, just like how you write why you’re celebrating each date on your calendar.

- People Involved: Write down who you are paying to or who is paying you. It’s like writing down who the birthday party is for.

- Payment Method: How will the payment be made? Will it be a check, cash, or an online transfer? This is like deciding whether to go to a party by car, bike, or walking.

- Status: Keep a space to mark if the payment is made, like checking off something from your to-do list.

- Extra Notes: Sometimes, you should remember something special about a payment, like if it’s a final payment or if there’s a discount.

By including all these things, your payment schedule template becomes useful. It’s like having a map that guides you through all your money matters without getting lost!

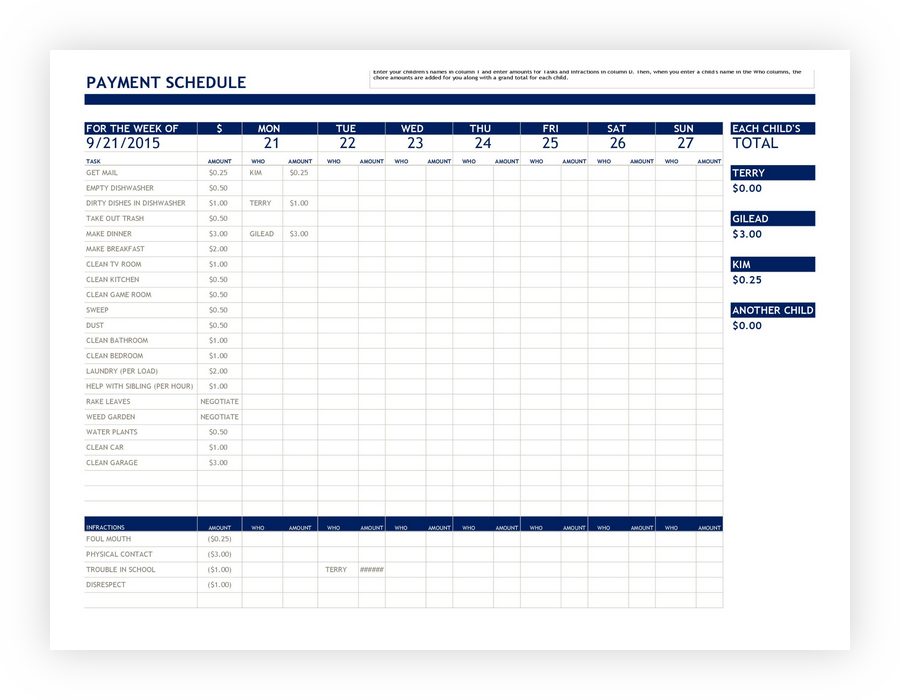

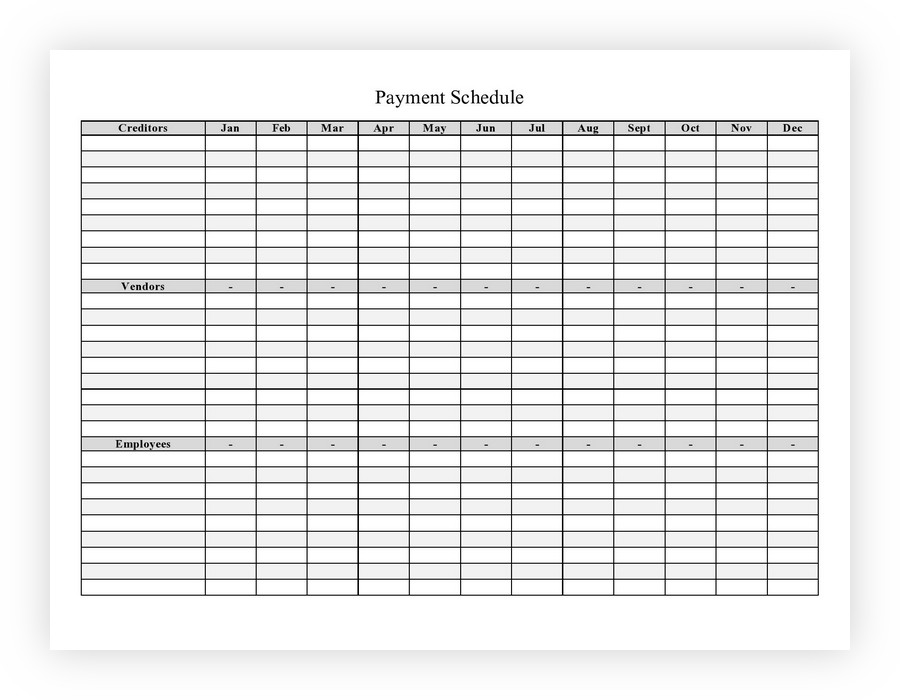

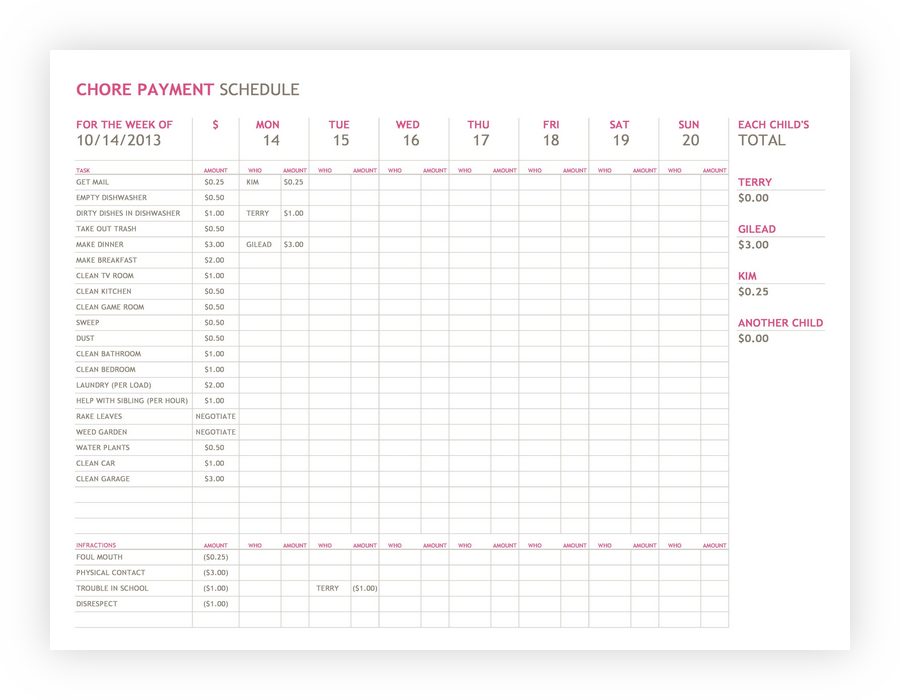

Simple Payment Schedule Template

- Simple Payment Schedule Template 01

- Simple Payment Schedule Template 05

- Simple Payment Schedule Template 07

- Simple Payment Schedule Template 08

- Simple Payment Schedule Template 09

- Simple Payment Schedule Template 11

- Simple Payment Schedule Template 14

- Simple Payment Schedule Template 16

- Simple Payment Schedule Template 24

- Simple Payment Schedule Template 25

- Payment Schedule Template 30

- Payment Schedule Template 33

- Payment Schedule Template 35

- Payment Schedule Template 38

- Payment Schedule Template 39

- Payment Schedule Template 43

Pros and Cons of Payment Schedules

A payment schedule is like a plan for when to pay money for things you buy or loans you have. Let’s look at both sides:

Pros

- Stay Organized: It’s like having a neat room. Payment schedules help you keep your money matters tidy. You know when and how much you must pay, so everything is in order.

- Avoid Late Fees: Following a schedule makes you less likely to forget to pay and get charged extra money for being late.

- Budgeting is Easier: It’s like planning your lunch for the week. When you know what payments are coming up, you can plan your money better and avoid surprises.

- Good for Credit Score: Paying on time can improve your credit score, which is important for getting loans.

Cons

- Can Be Stressful: Sometimes, keeping up with a payment schedule is like having a lot of homework.

- Inflexibility: Payment schedules are strict. It’s like eating lunch simultaneously daily, even if you’re not hungry. If your income changes, it can be hard to adjust.

- Over dependence: Relying too much on schedules can make it hard to handle unexpected money needs, like if you suddenly need to pay for a doctor’s visit.

- Hidden Fees: Sometimes, there are extra costs or fees you didn’t know about. It’s like finding out a toy costs more than the price tag because of taxes.

Types of payment schedule templates

There are variations of payment schedule templates that you can use as needed:

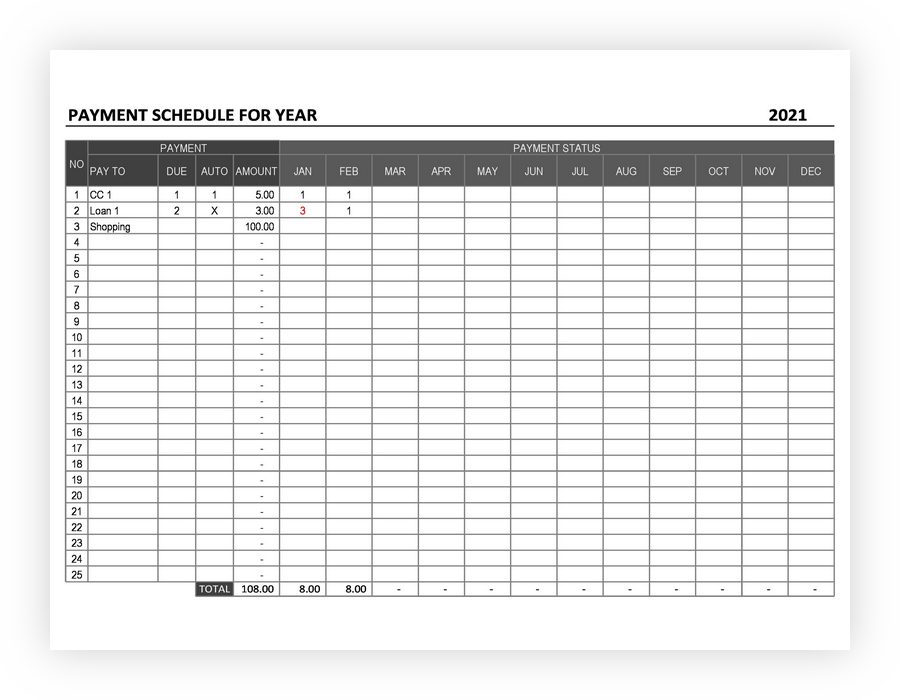

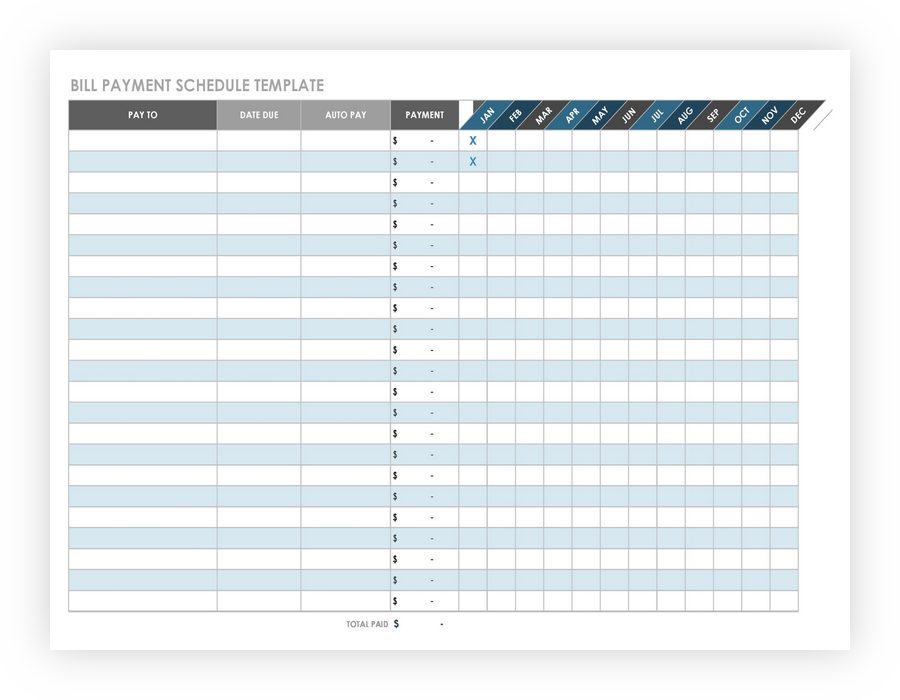

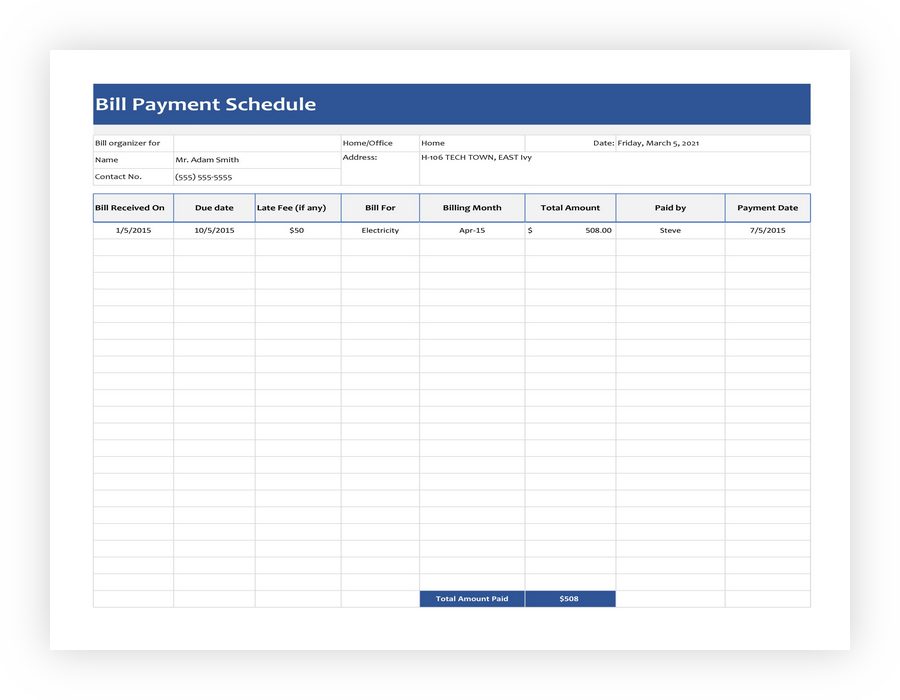

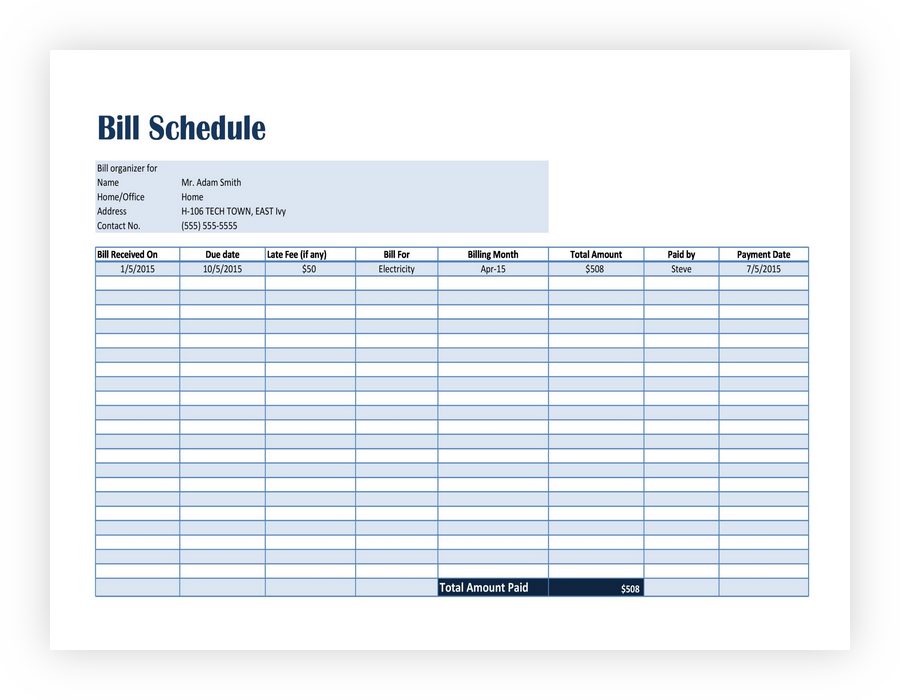

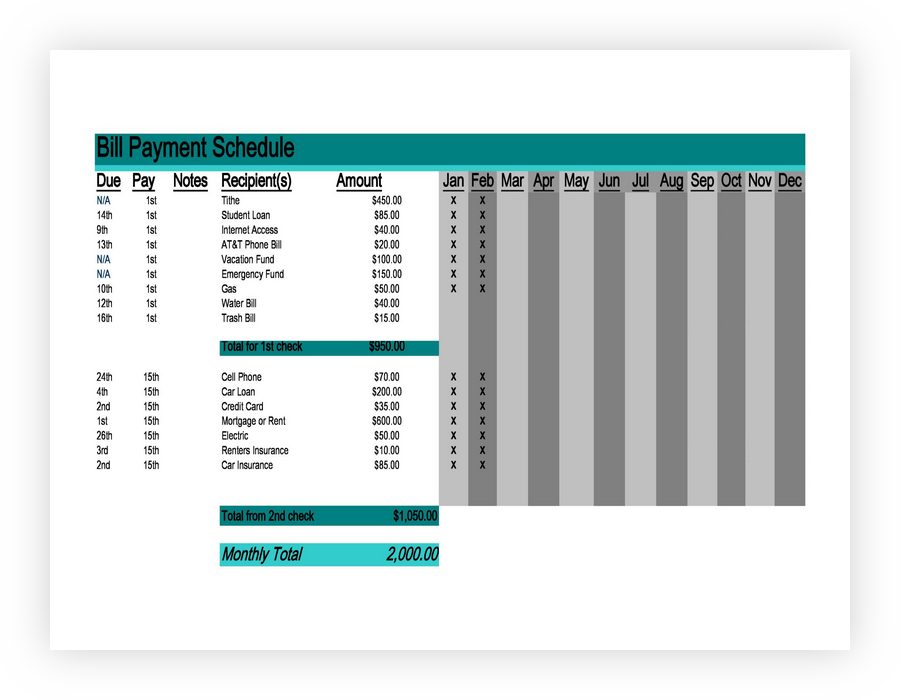

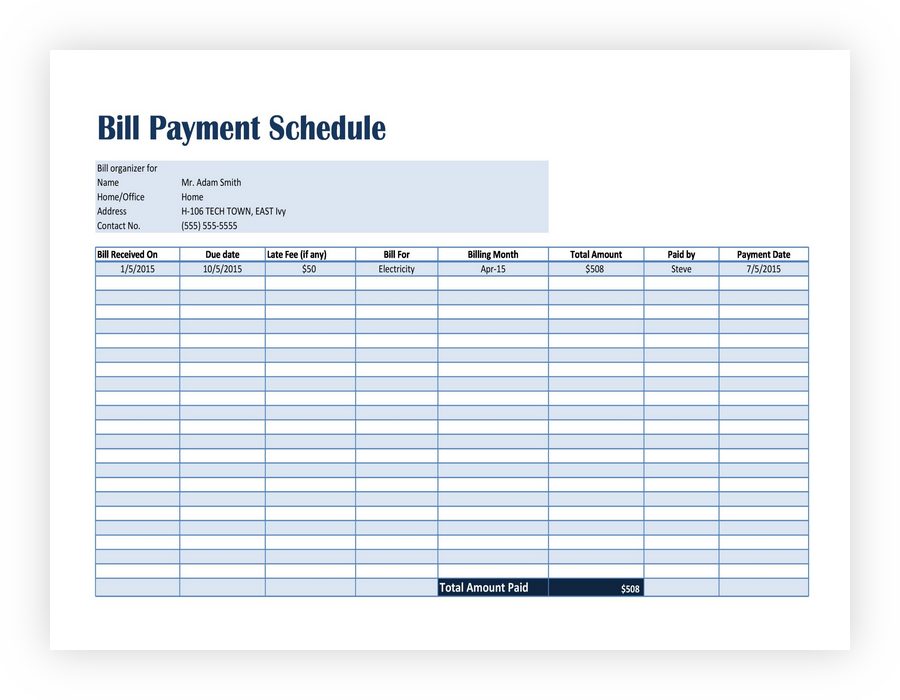

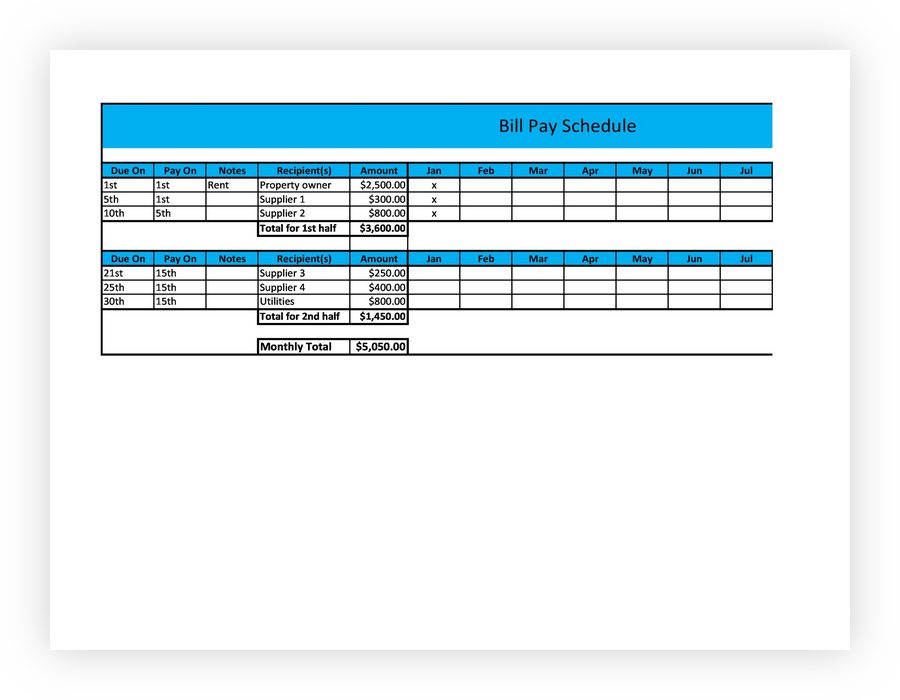

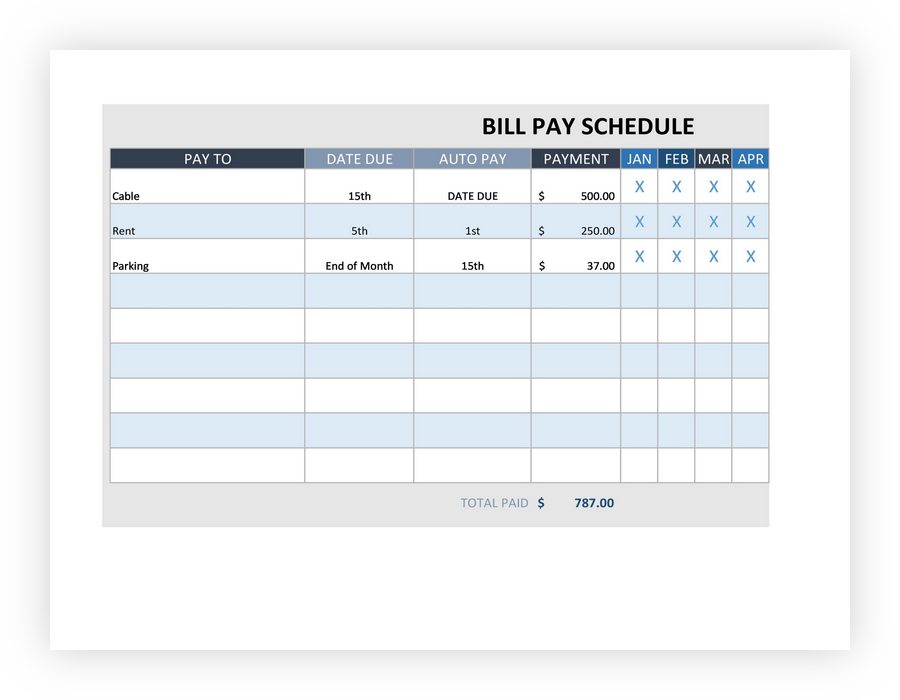

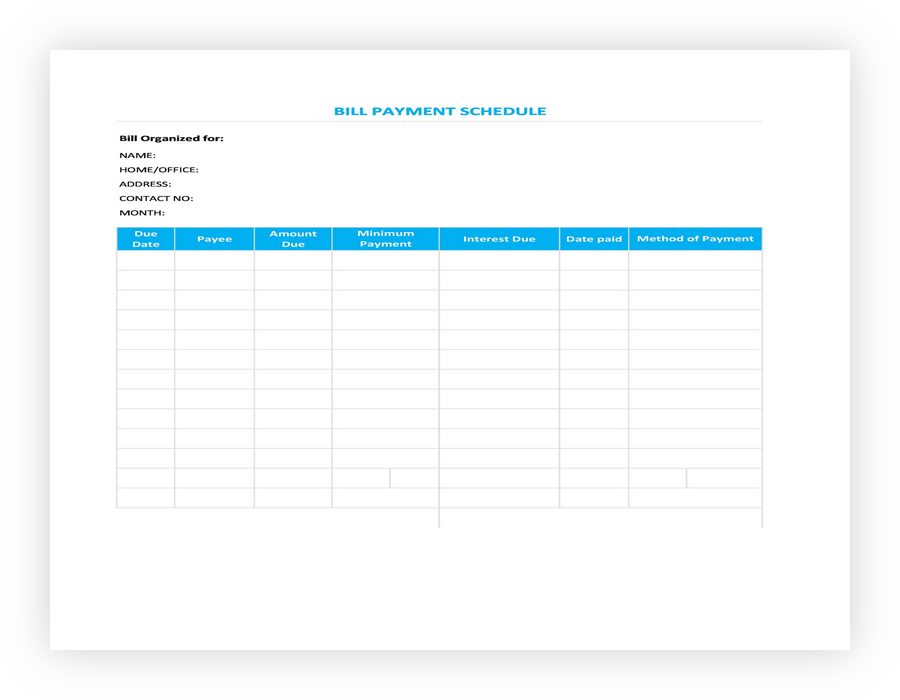

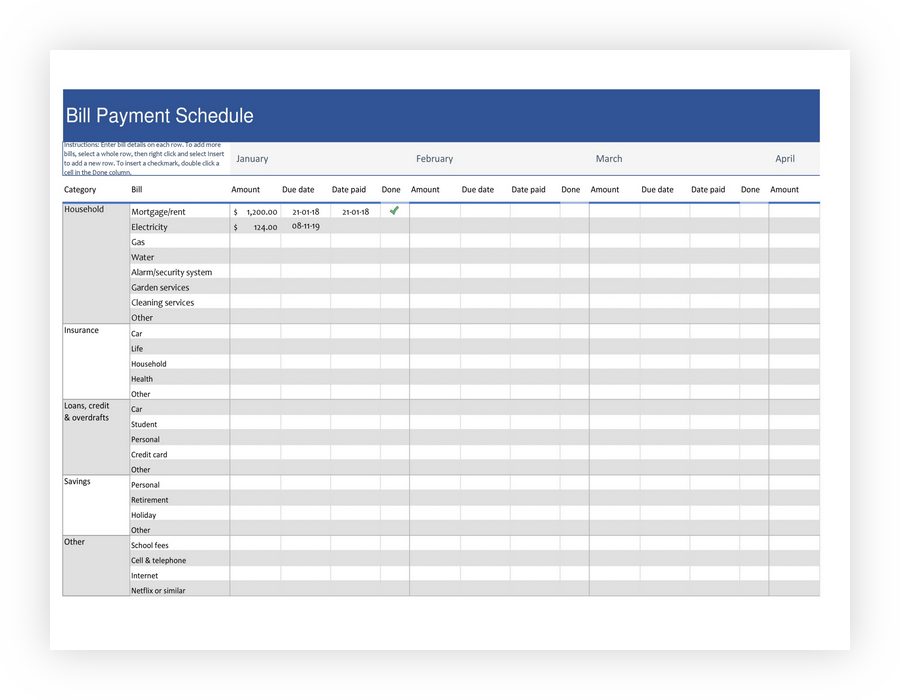

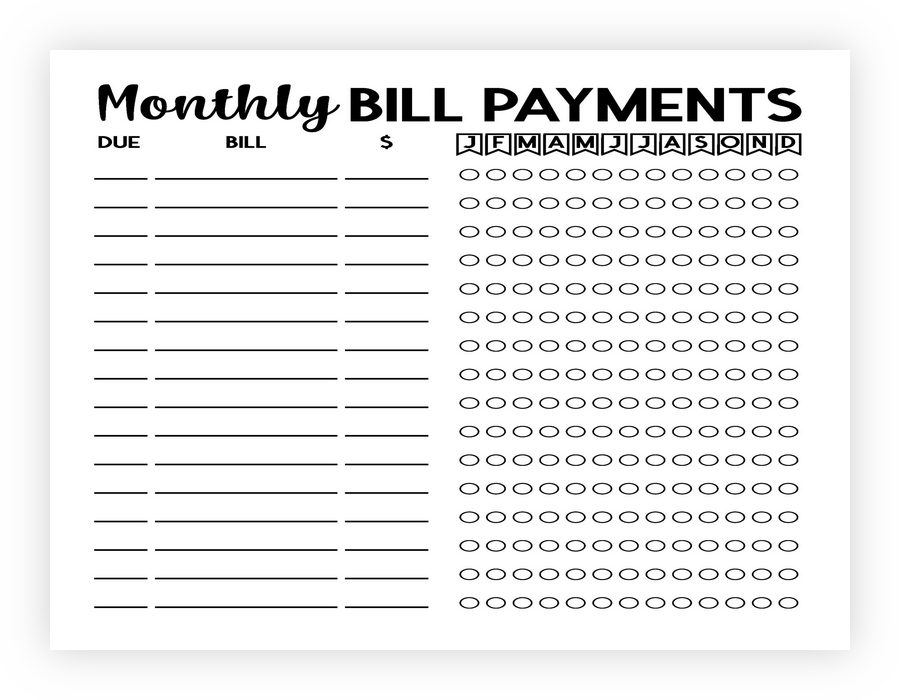

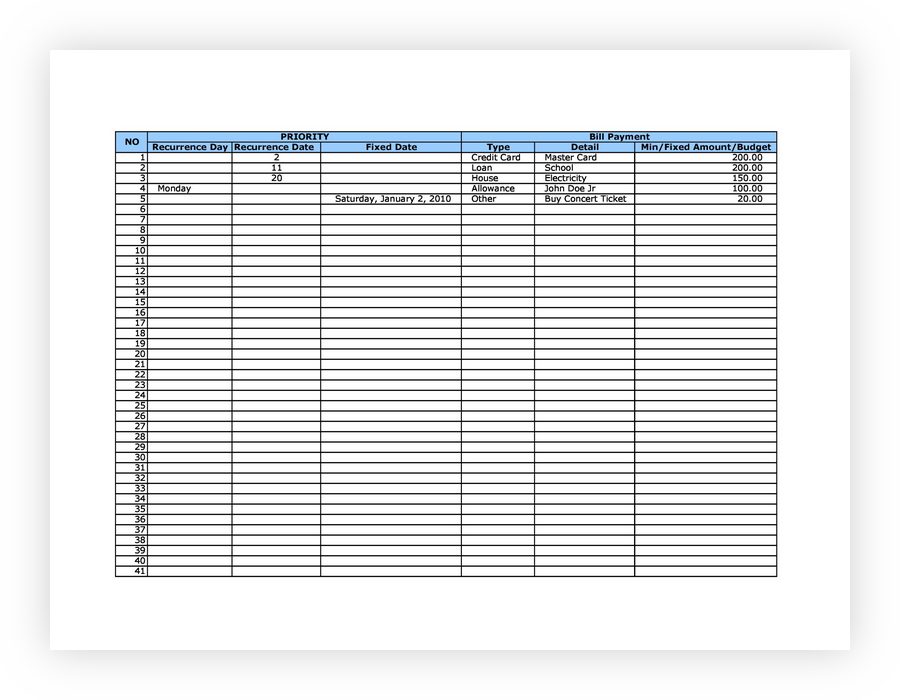

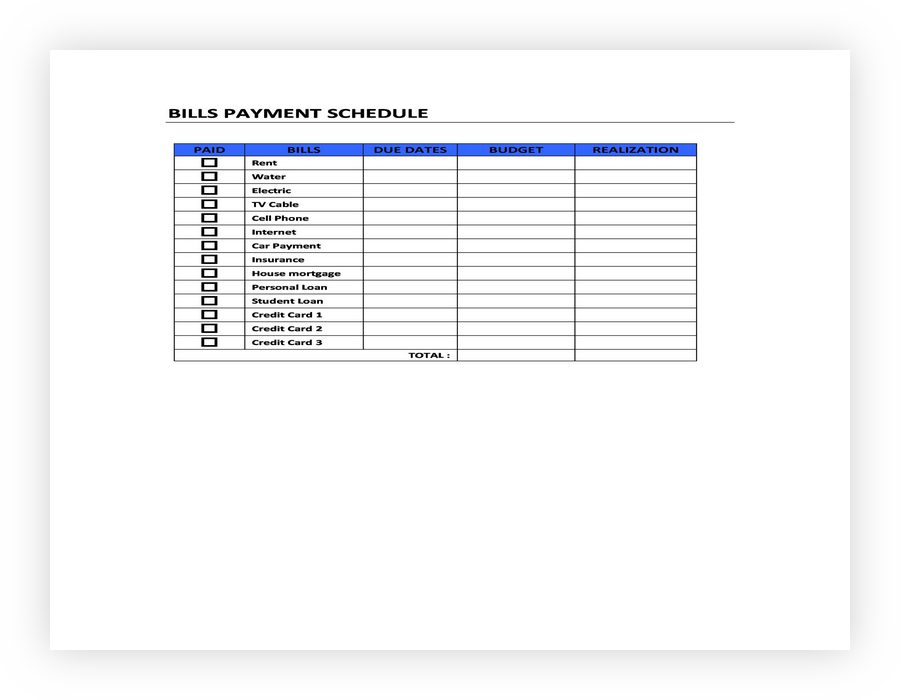

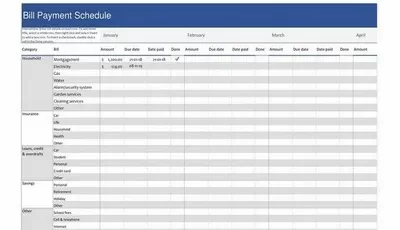

Bill Payment Schedule Template

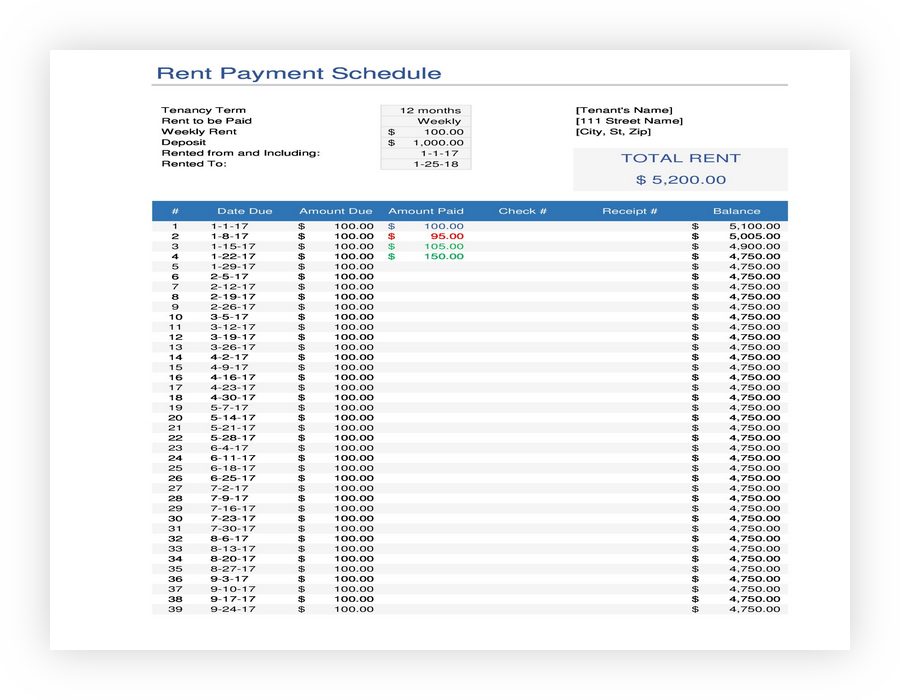

One of the important things in managing finances is to plan monthly schedule expenses.

A monthly expenditure plan lets you easily track your expenses and spend wisely. Especially if you are managing a company, planning monthly expenses is very important because it is related to cash flow and the company’s sustainability.

- Bill Payment Schedule Template – Simple Payment Schedule Template 02

- Bill Payment Schedule Template – Simple Payment Schedule Template 03

- Bill Payment Schedule Template – Simple Payment Schedule Template 04

- Bill Payment Schedule Template – Simple Payment Schedule Template 06

- Bill Payment Schedule Template – Simple Payment Schedule Template 12

- Bill Payment Schedule Template – Simple Payment Schedule Template 21

- Bill Payment Schedule Template – Simple Payment Schedule Template 23

- Bill Payment Schedule Template – Simple Payment Schedule Template 26

- Bill Payment Schedule Template – Simple Payment Schedule Template 27

- Bill Payment Schedule Template – Simple Payment Schedule Template 28

- Monthly Bill Payment Schedule Template – Simple Payment Schedule Template 29

- Bill Payment Schedule Template – Simple Payment Schedule Template 32

- Bill Payment Schedule Template – Simple Payment Schedule Template 42

You can plan monthly expenses using a bill payment schedule template. Your monthly bills can be marked and result in an annual review. The annual review will inform where and when bills will be paid. So, you will also be able to see how your money is spent.

Bill Pay Checklist Template

If you want to manage bill payments more easily, you can use the bill pay checklist template. This template allows you to provide reminders when bills are due to be paid. In addition, by using this template, you will see what bills you have paid.

A schedule of payments template is very easy to use. The way to use a schedule template is that you only give a checklist of the type of bill you have paid. A neat and organized sample schedule display can make it easier to use and see in more detail.

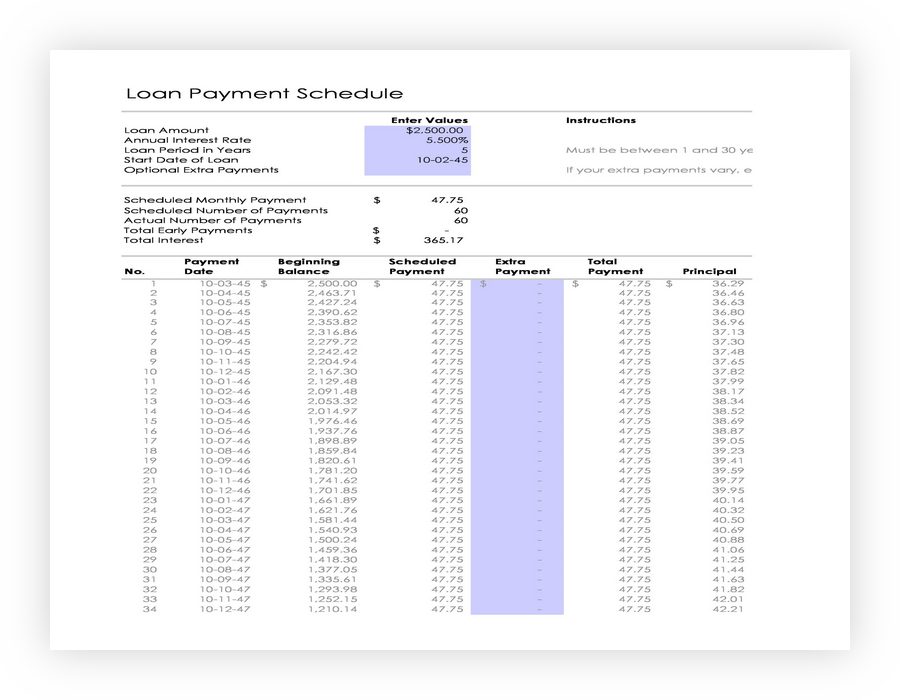

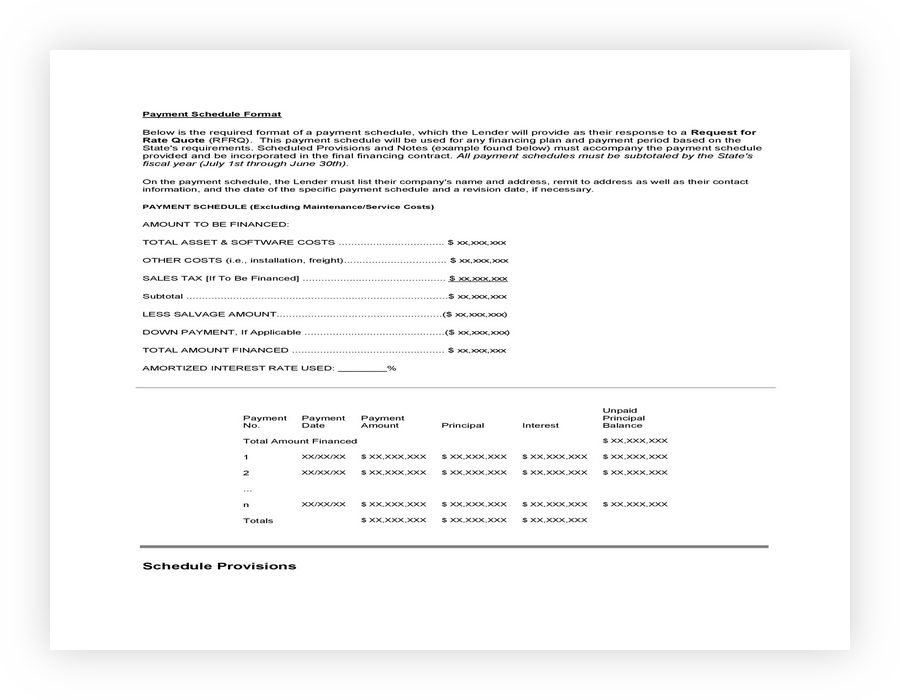

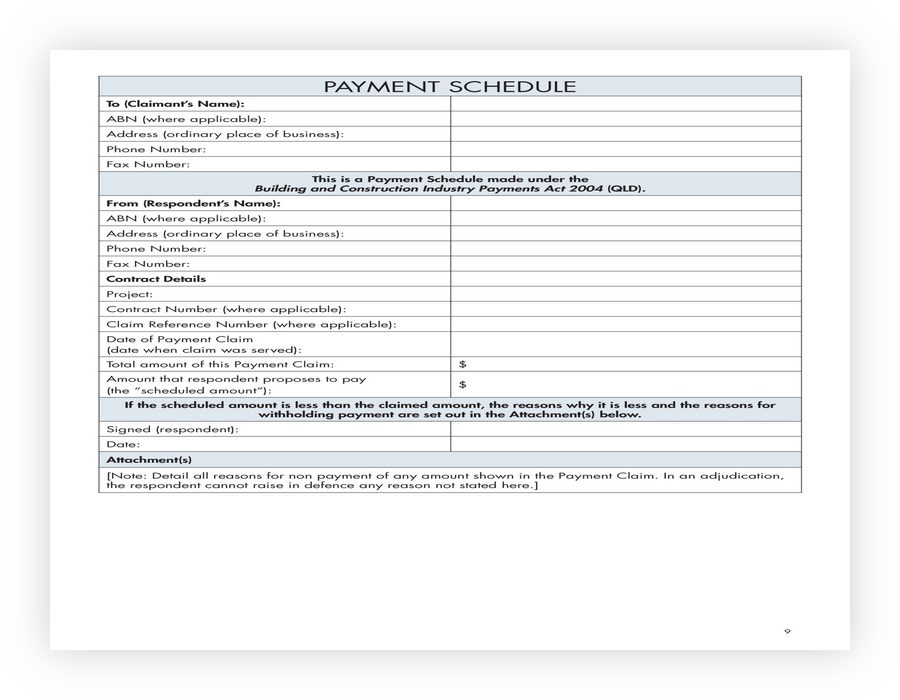

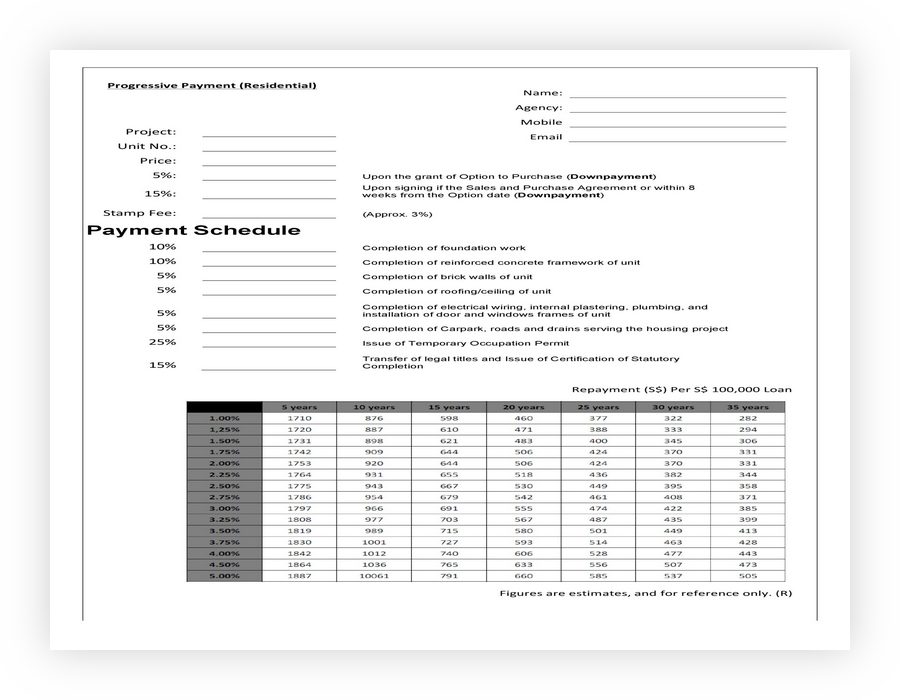

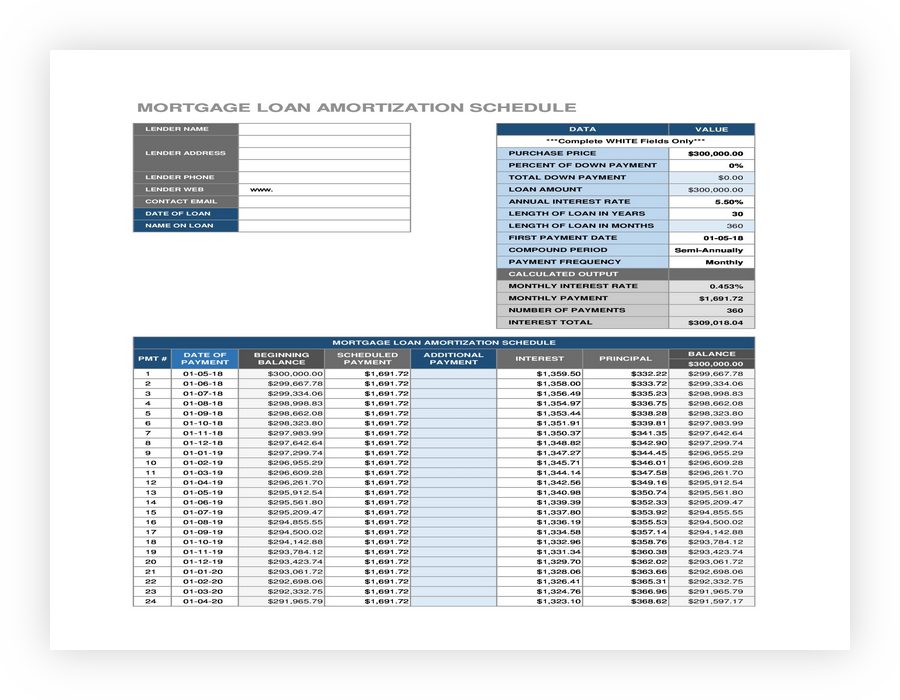

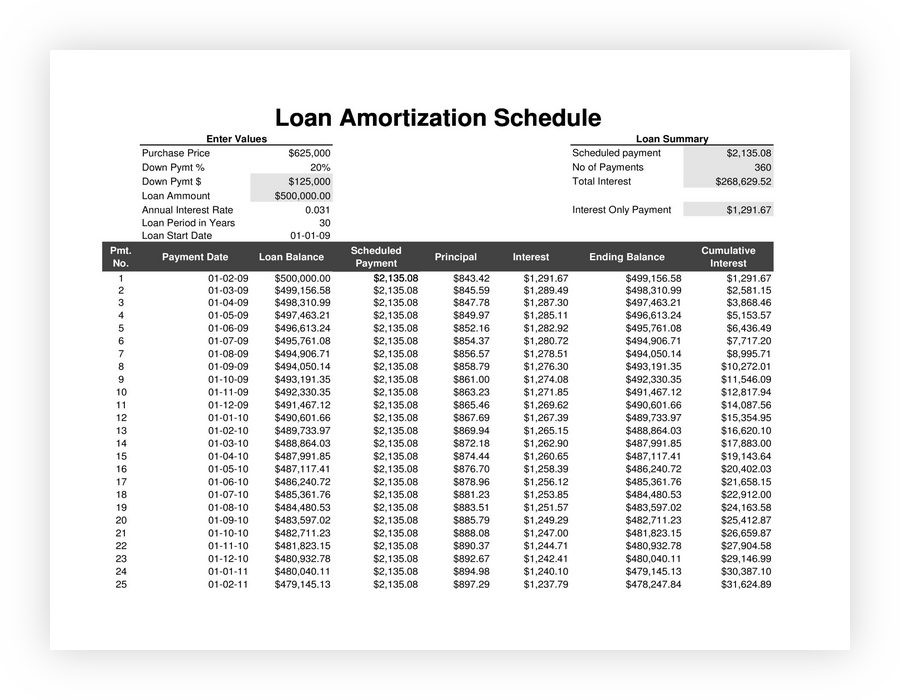

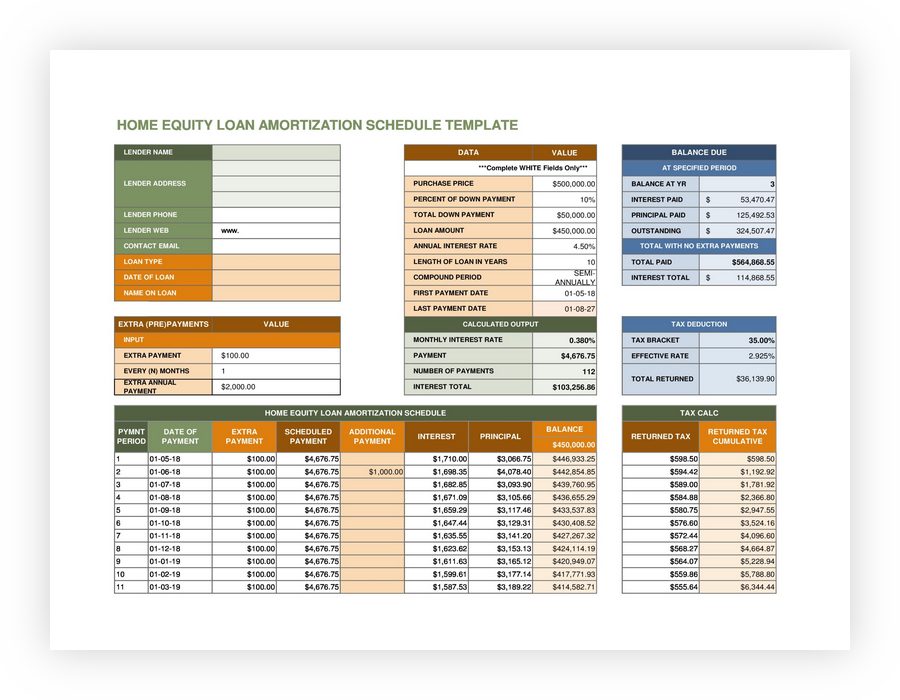

Mortgage Loan Payment Schedule Template

When you have a mortgage loan, you can use a mortgage loan payment schedule template to plan and track loan payments. In addition, you can also track interest, principal payments, and the remaining balance you must pay. In this template, you will see loan details at the top, such as creditor information, interest rates, loan duration, etc.

A detailed and rigid schedule can help you stay on the right path when making loan payments. If you can see more clearly by using this schedule, you can pay it off faster. You can see the exact change in total costs if you pay more monthly loans.

- Simple Payment Schedule Template 19

- Simple Payment Schedule Template 15

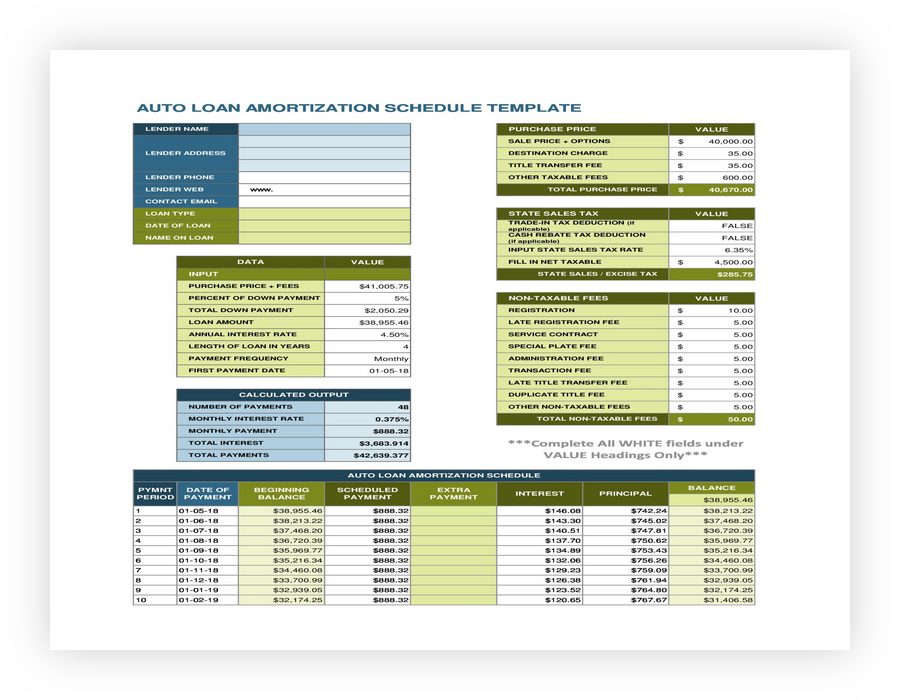

Auto Loan Schedule Template

If you experience difficulties paying your bills, you can use a schedule of payments template. This schedule can help you pay bills on time and see how many bills you will have paid.

You can add payment columns to this template to see what additional costs you need to pay off the loan. Of course, you will save even more because you do not have much interest to pay. You can enter all the detailed information about your automatic loan in the template. This template will automatically do the exact calculation specifically for you.

- Simple Payment Schedule Template 18

Pension Payment Schedule

You cannot forget about pension payments because they are an employee’s right—a retirement payment schedule you can use to facilitate your work. Using a retirement payment schedule, you can see the expenses you must pay specifically for retired employees.

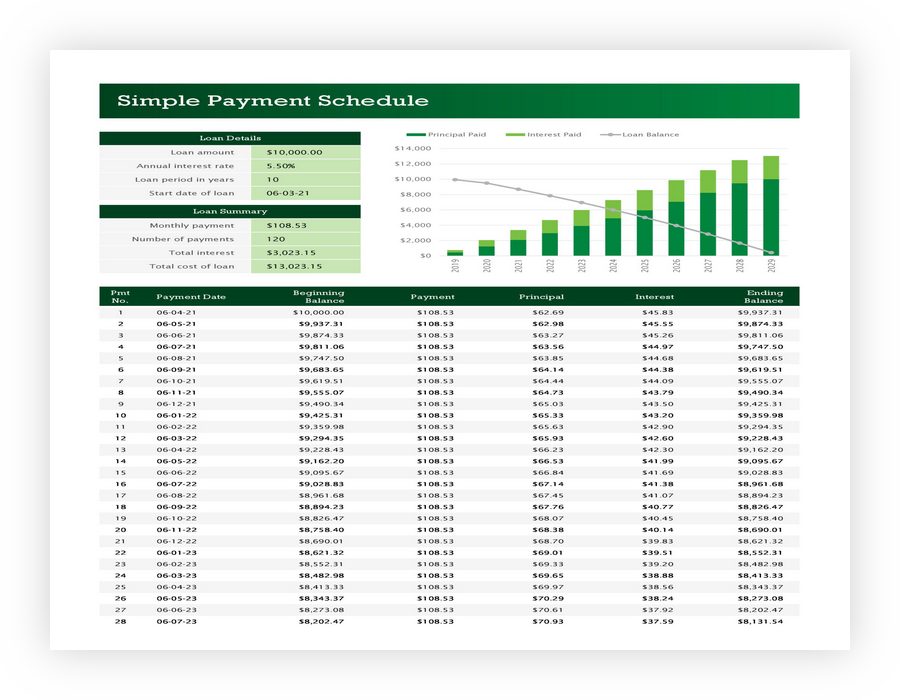

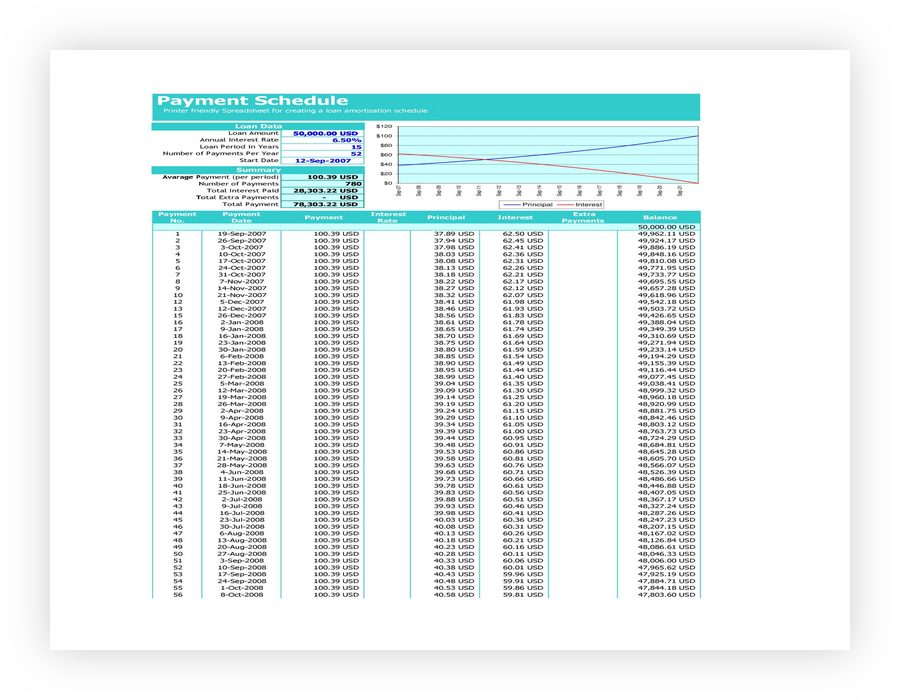

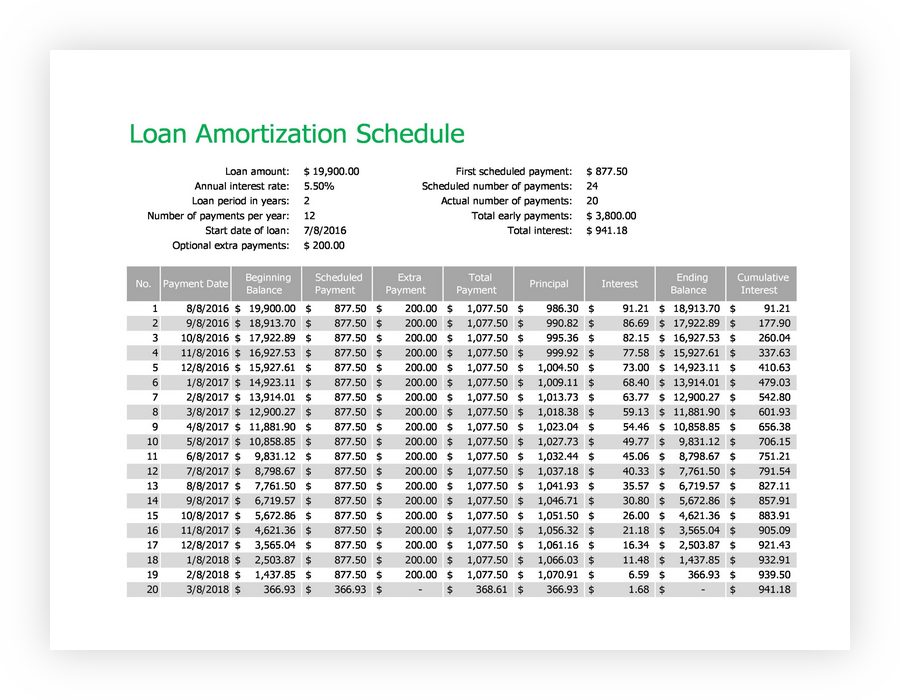

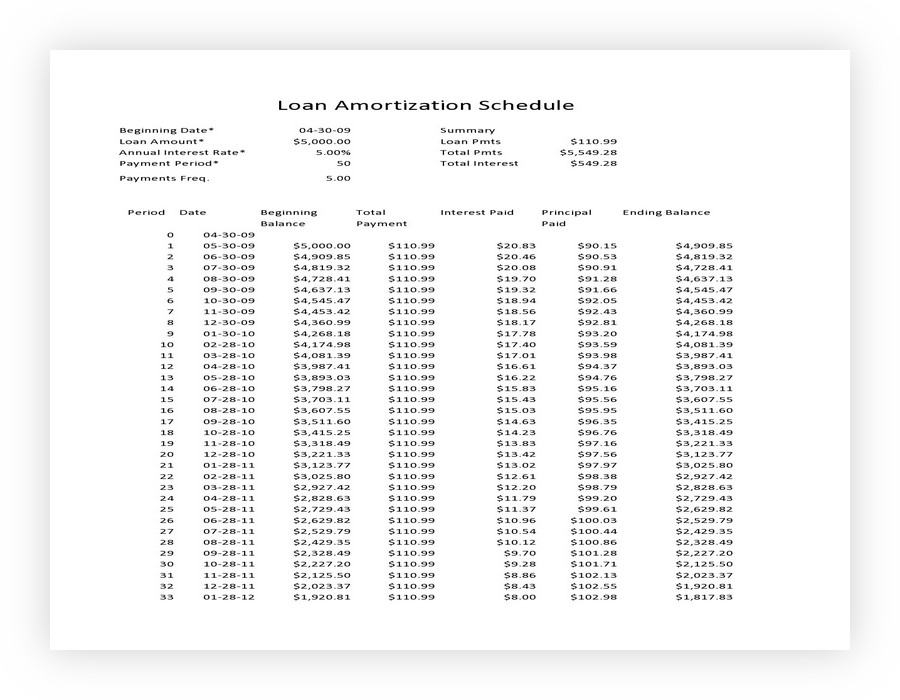

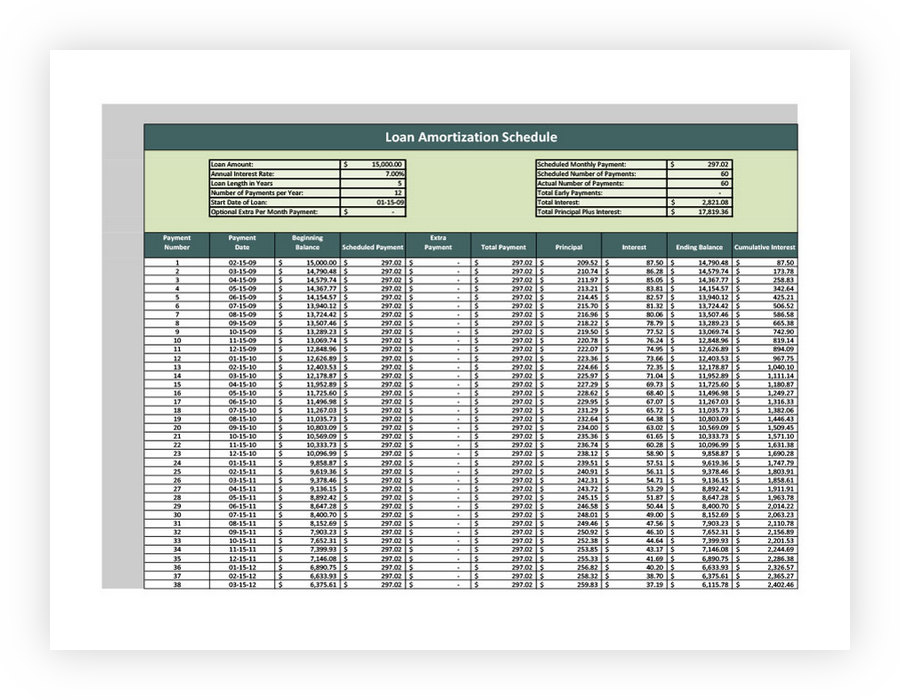

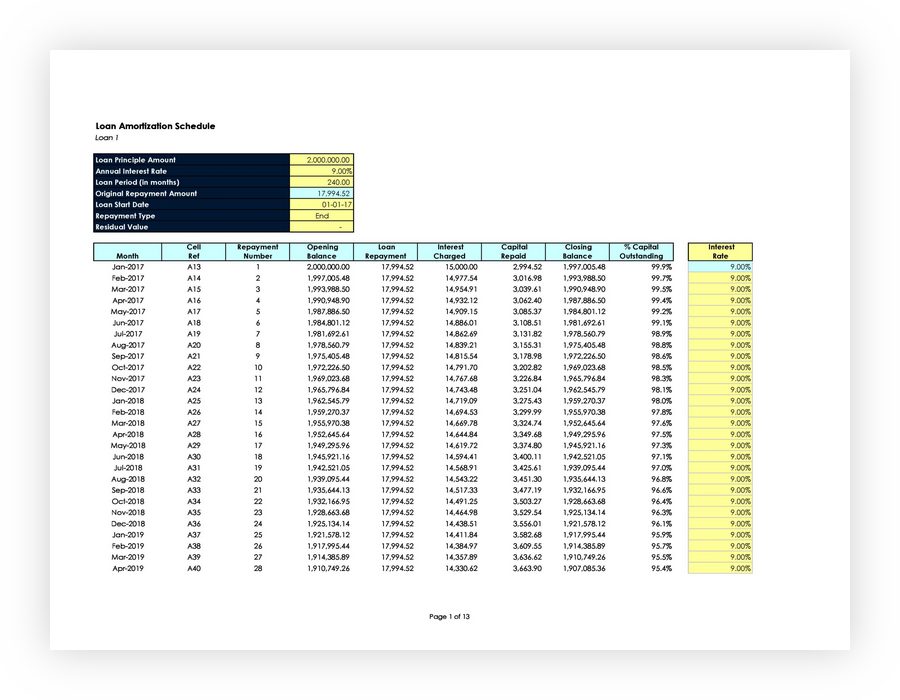

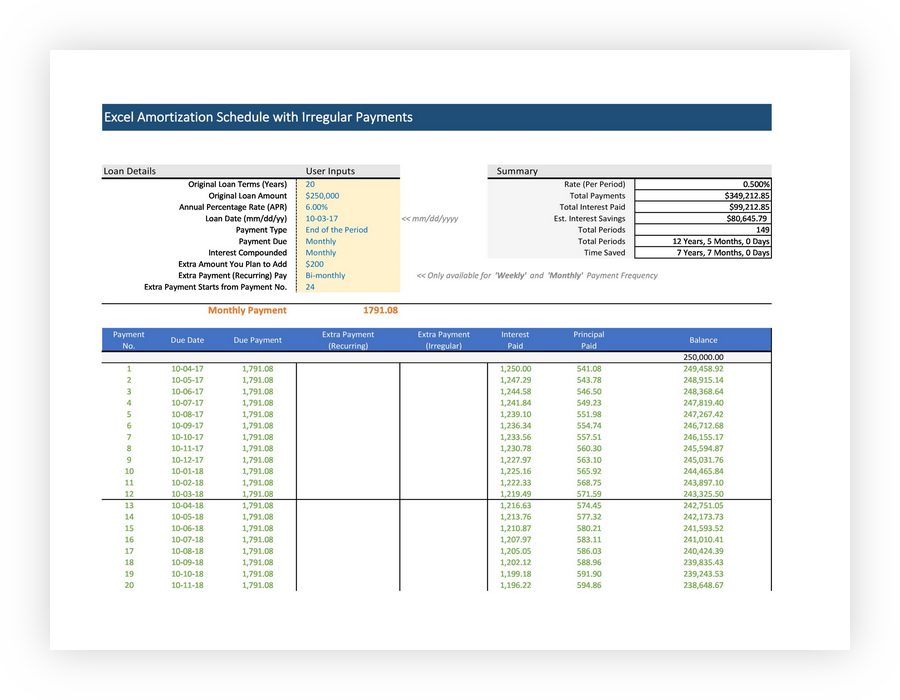

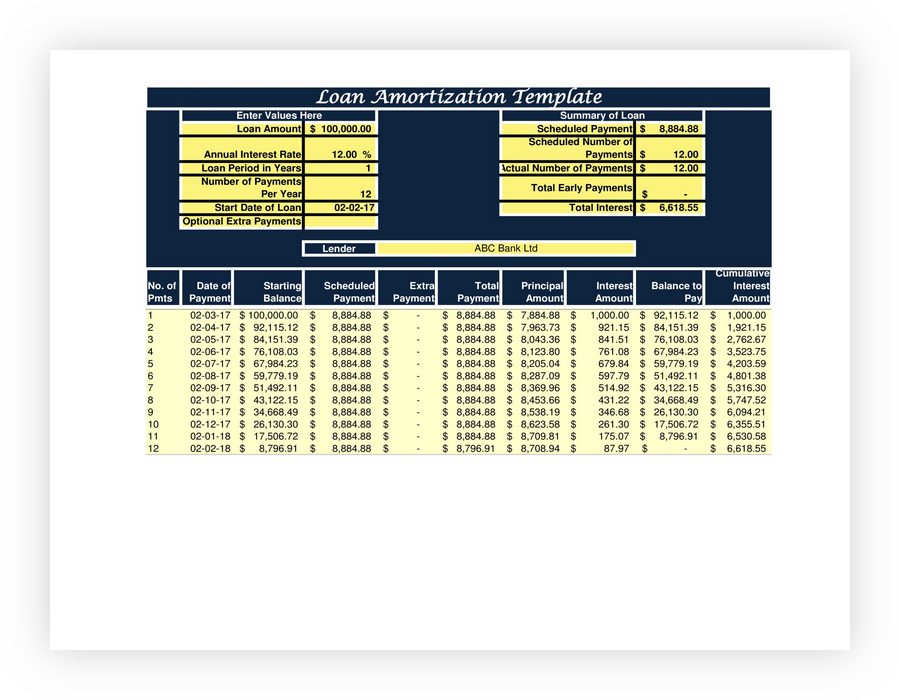

Loan Amortization Schedule

This is a plan for paying back a loan, like when you borrow money to buy a house or a car. It shows how much money you must pay each time and how long. The cool part? It also shows how much of your payment goes to the interest (the extra cost of borrowing money) and how much goes to paying off the loan.

- Payment Schedule Template 10

- Payment Schedule Template 13

- Payment Schedule Template 17

- Payment Schedule Template 20

- Payment Schedule Template 22

- Payment Schedule Template 31

- Payment Schedule Template 34

- Payment Schedule Template 36

- Payment Schedule Template 37

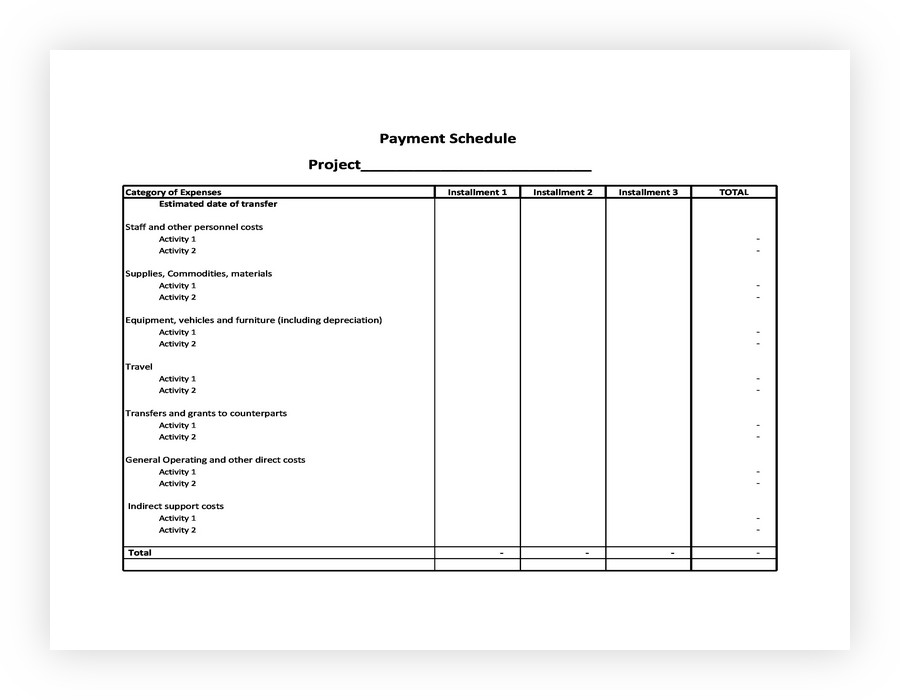

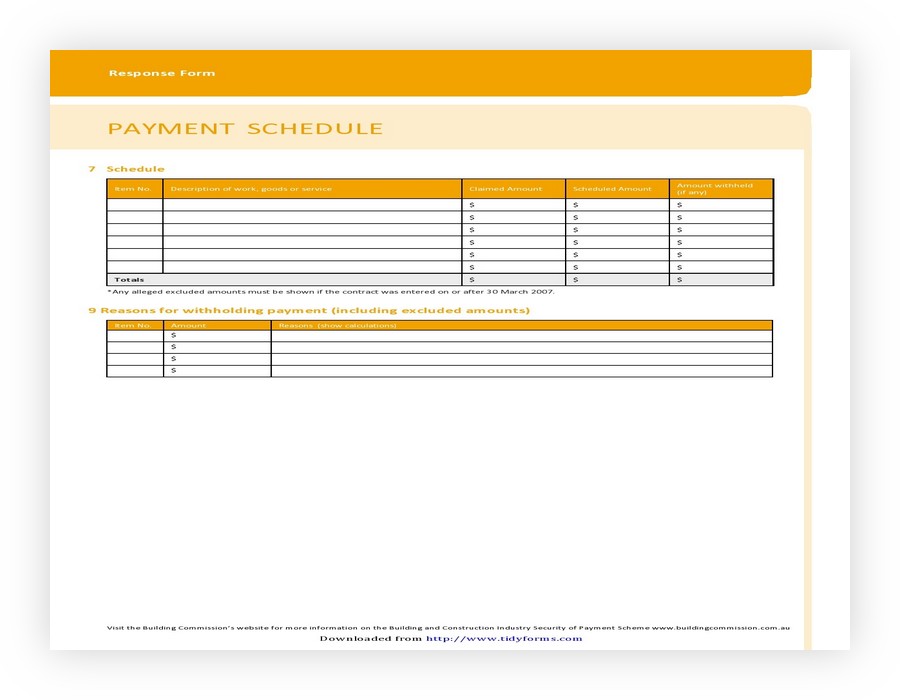

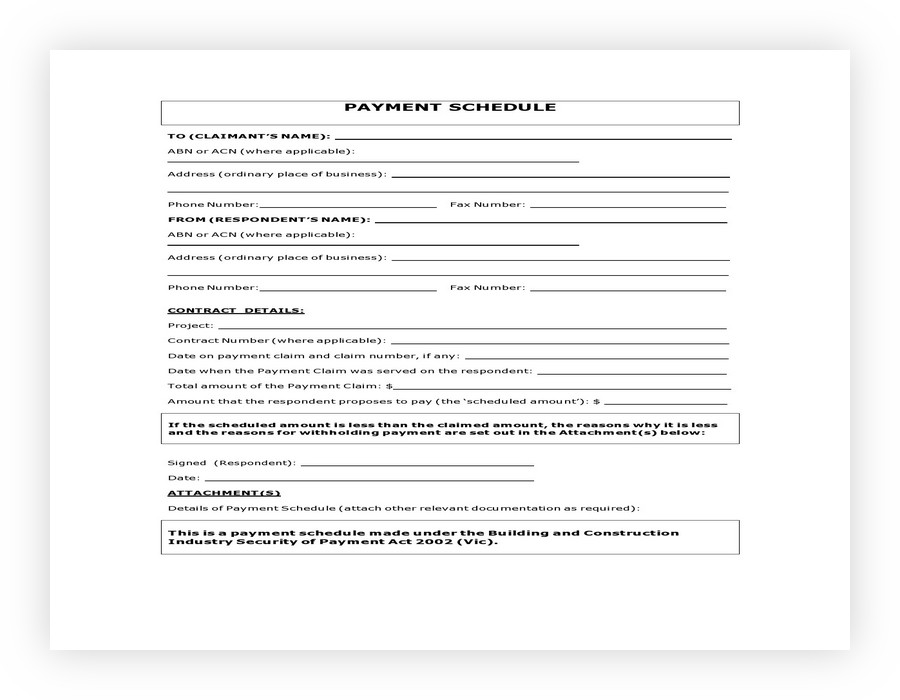

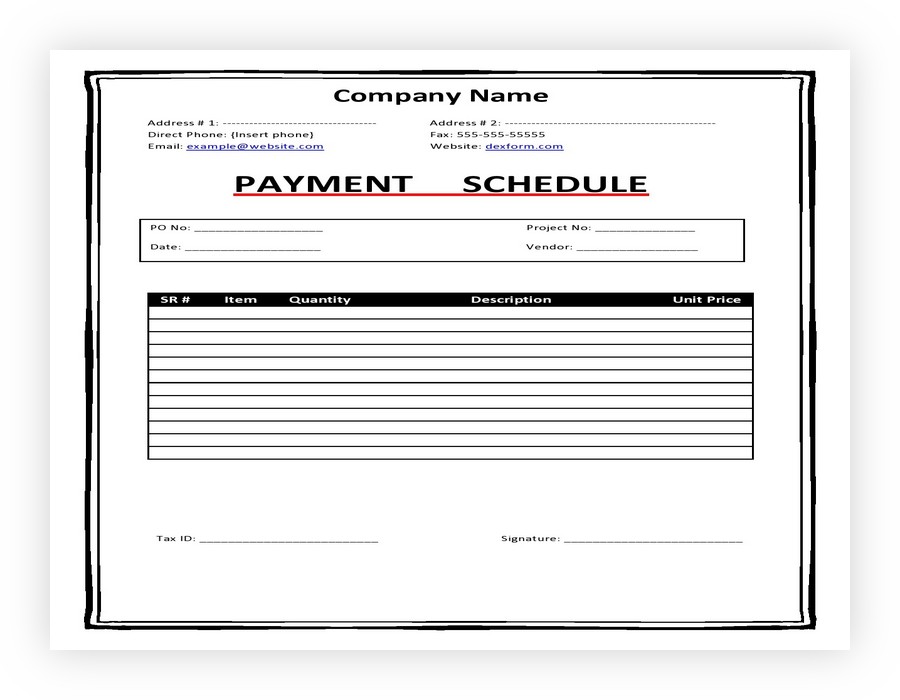

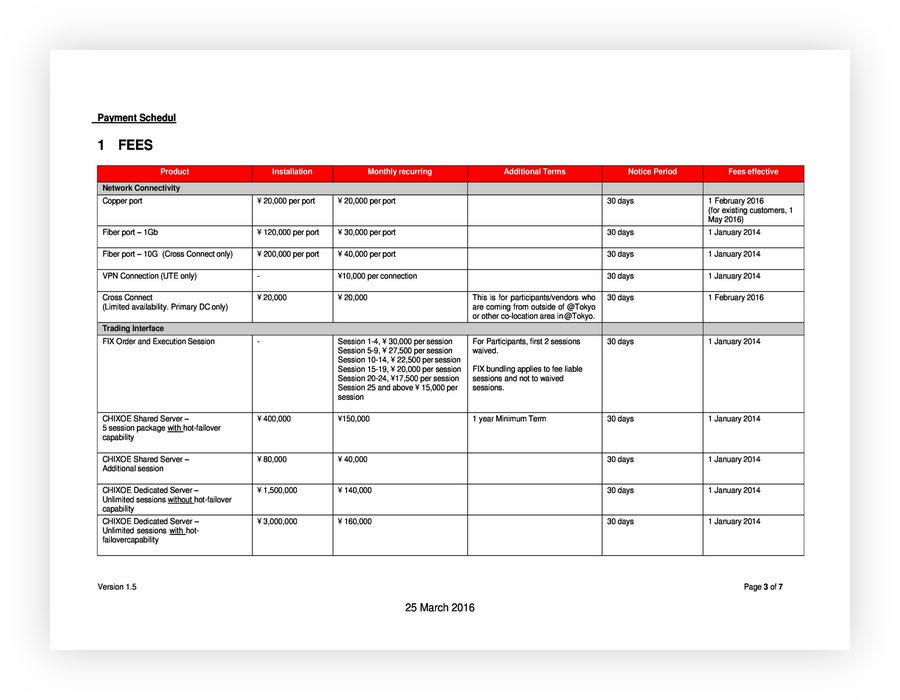

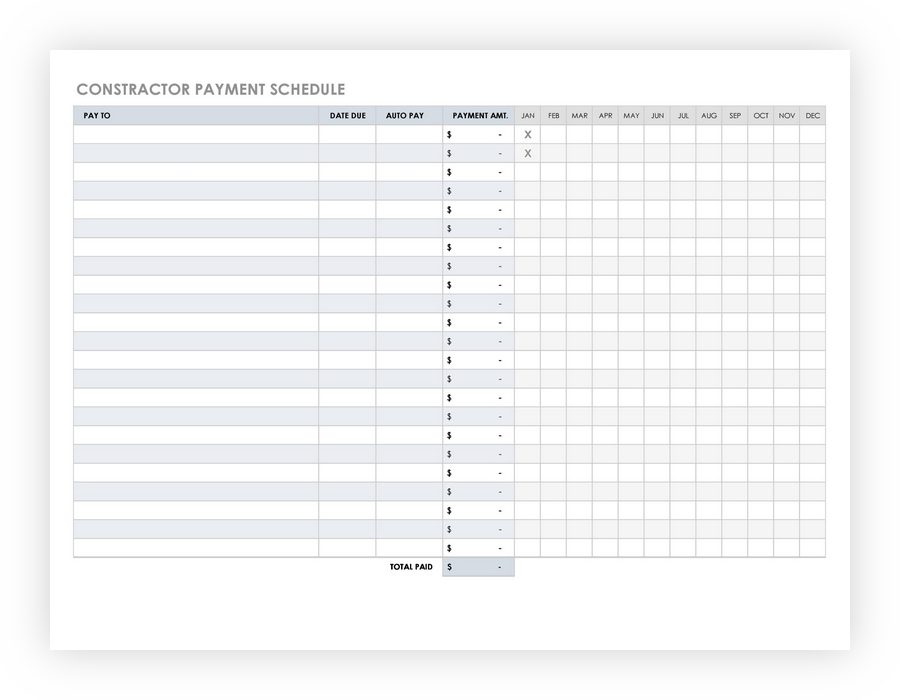

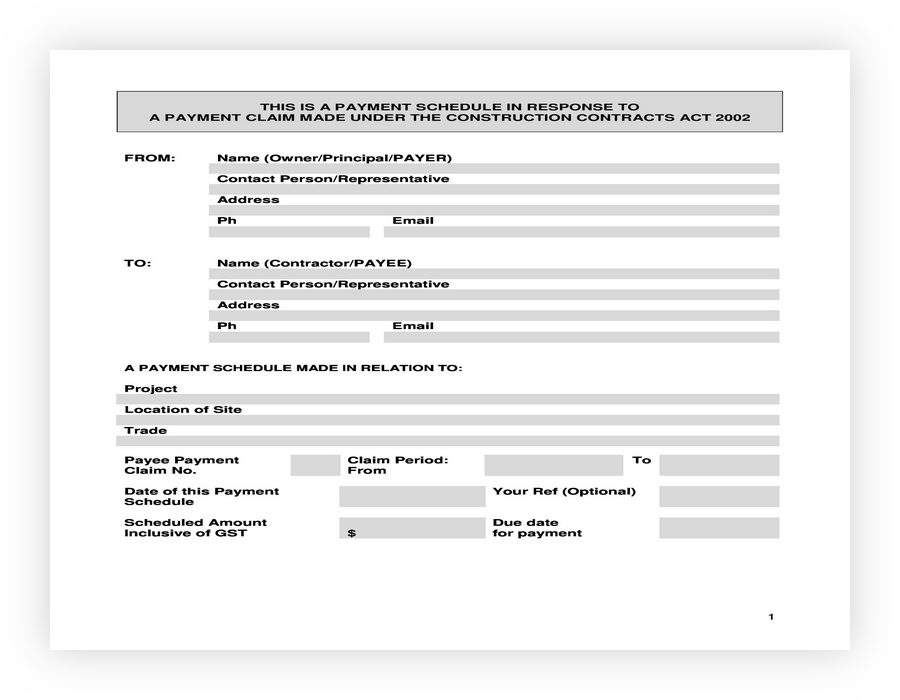

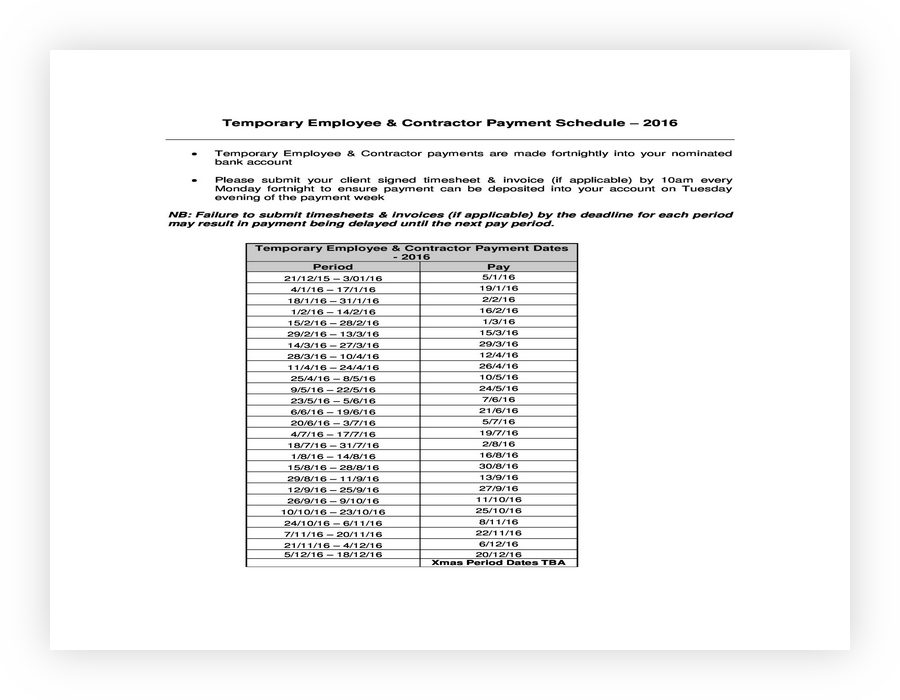

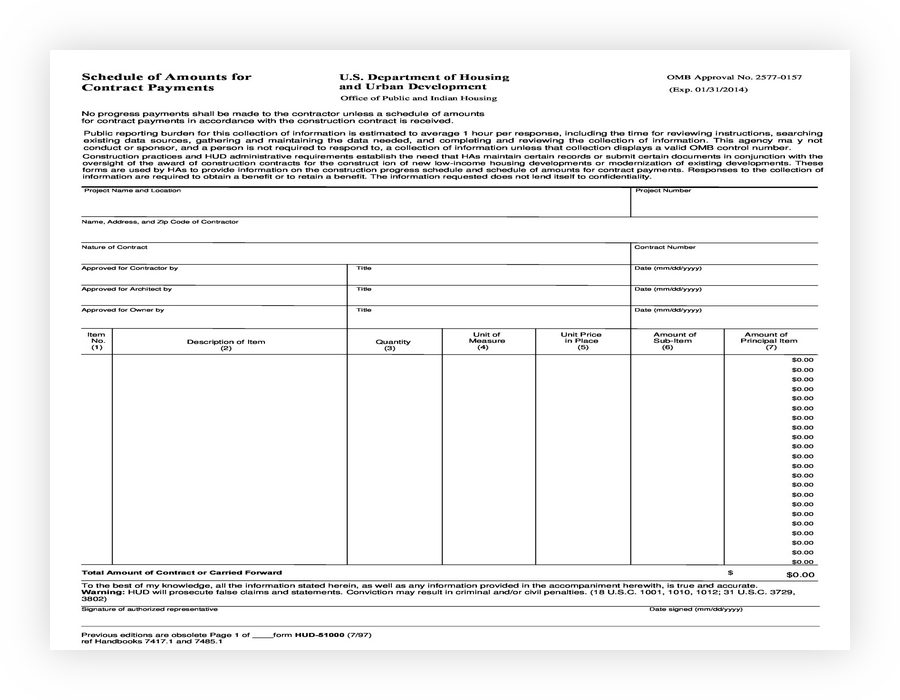

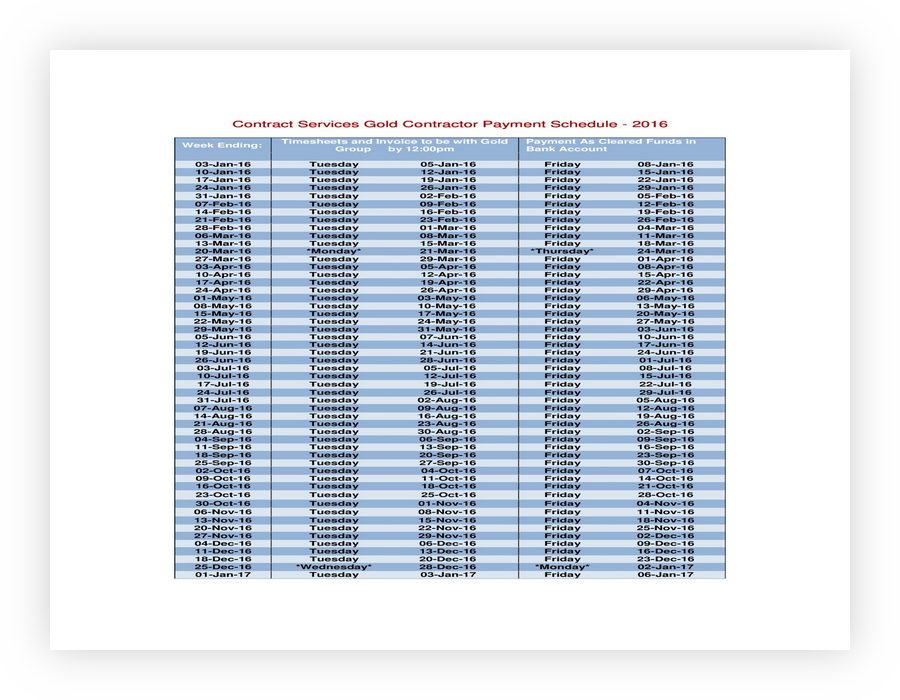

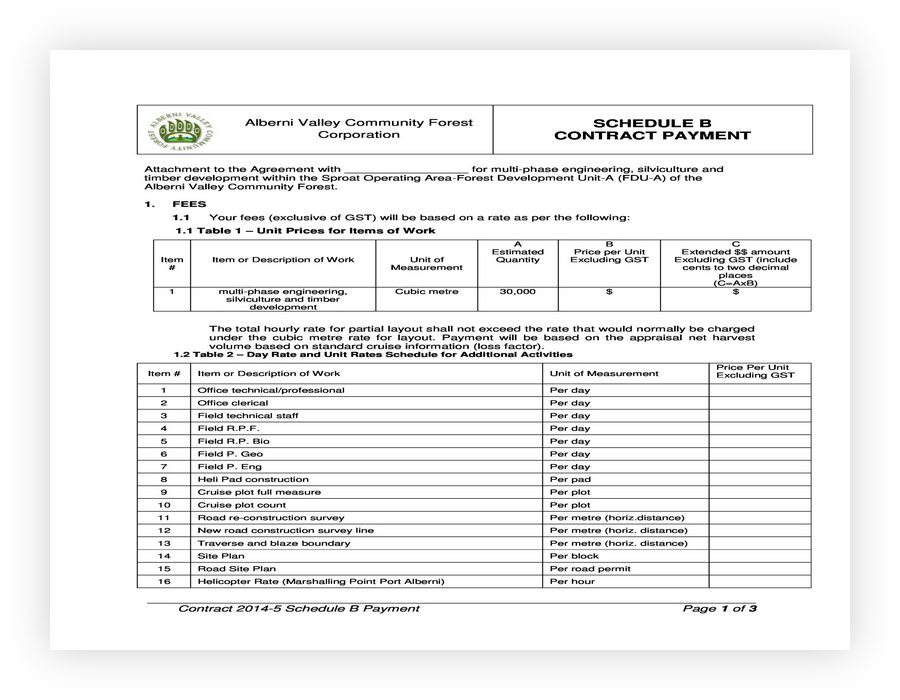

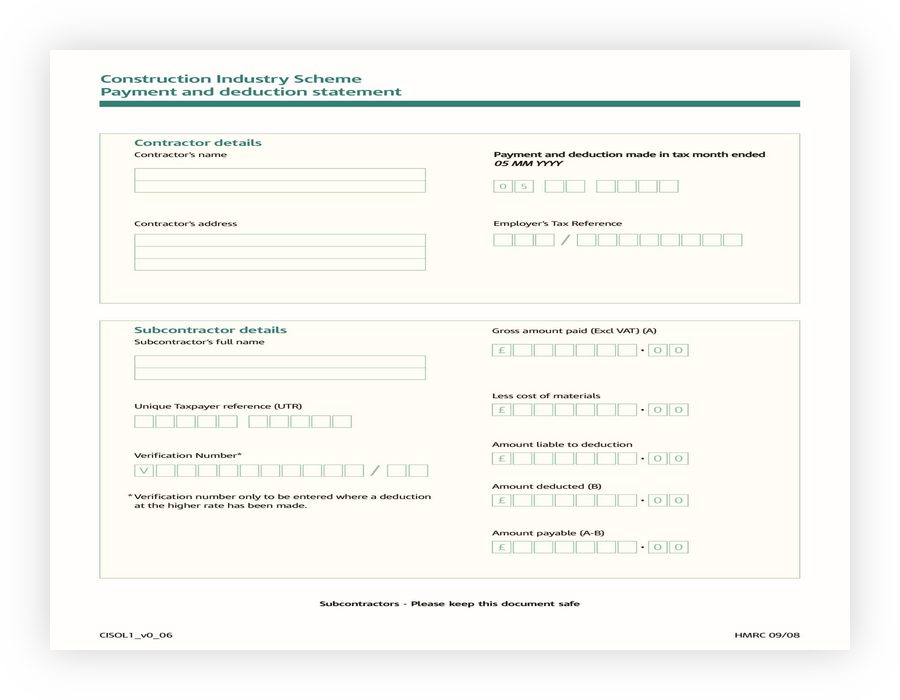

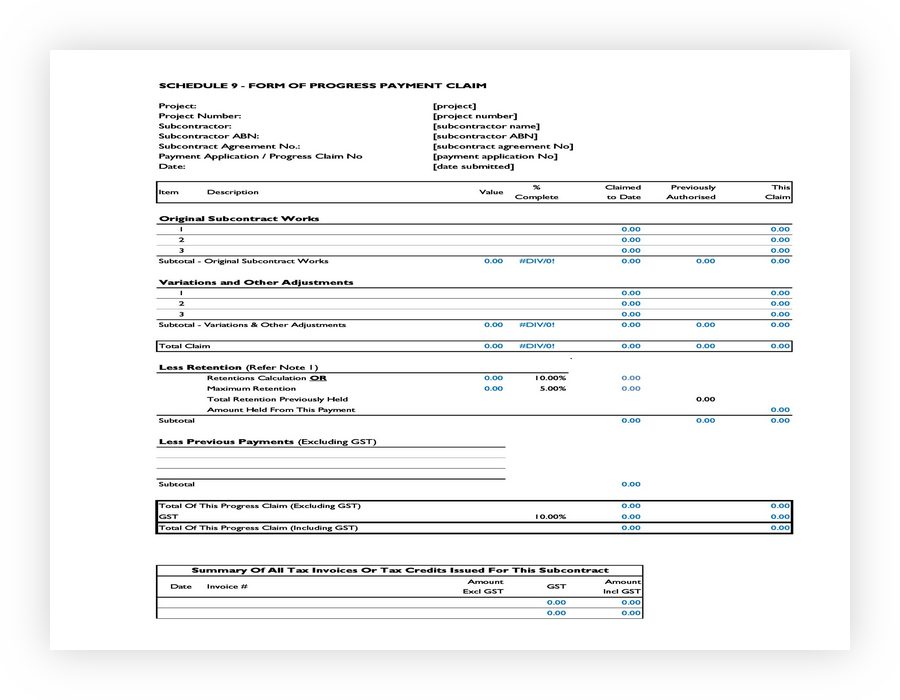

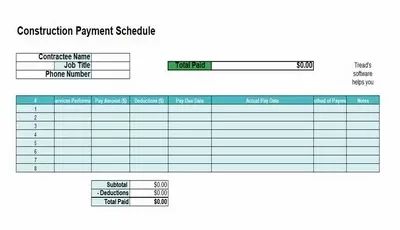

Contractor Payment Schedule

This is used when you hire someone to do a big job, like building a house or fixing something. It shows how much you need to pay the contractor and when. Payments are often tied to how much work is done. For example, after the contractor finishes half the job, they get half the money.

- Contractor Payment Schedule – Payment Schedule Template 40

- Contractor Payment Schedule – Payment Schedule Template 41

- Contractor Payment Schedule – Payment Schedule Template 45

- Contractor Payment Schedule – Payment Schedule Template 46

- Contractor Payment Schedule – Payment Schedule Template 47

- Contractor Payment Schedule – Payment Schedule Template 48

- Contractor Payment Schedule – Payment Schedule Template 49

- Contractor Payment Schedule – Payment Schedule Template 44

Why is the Payment Schedule Template Important?

Think of a payment schedule template like a special planner for your money. Here’s why it’s super important:

- Keeps You Organized: It’s like having a neat backpack with everything in place.

- Helps with Budgeting: Imagine you’re saving up for a new toy. The template shows you when to pay for things so you can plan how to spend the rest of your money smartly.

- Avoids Late Payments: It’s like having a reminder for an important school project. The template reminds you of due dates so you can pay on time and avoid late fees.

- Reduces Stress: Knowing what’s coming up regarding money can make you worry less. It’s like checking the weather before a picnic, so you’re not worried about it raining.

- Good for Business: If you have a business, this template ensures you pay your bills on time and get paid by others on time. It’s like making sure everyone in a game plays by the rules.

- Clear Communication: If you share your money matters with someone, like your family or business partners, this template clarifies when payments are due. It’s like a schedule on a refrigerator that everyone can see.

How is the Payment Schedule Calculated?

Here’s how you do it for payments:

- Total Amount Due: First, find out the amount of money that must be paid. This is like knowing how big the pizza is.

- Divide by Payment Periods: Next, decide how often payments should be made. It could be every month, every two weeks, or another time. Then, divide the total amount by the number of payment periods. It’s like cutting the pizza into equal pieces, depending on how often you want to eat it.

- Add Interest, If Any: Sometimes, you must pay extra money called ‘interest.’ Add this to each payment if it’s required. It’s like adding a little extra topping to each slice of pizza.

- Consider Due Dates: Mark the calendar for when each payment should be made. This is like setting reminders for when it’s time to eat each slice of pizza.

- Adjust for Final Payment: The last payment might be slightly different if the numbers aren’t evenly divided. It’s like having a slightly bigger or smaller last slice of pizza.

- Review and Adjust: Finally, check if the schedule works for you. You can make changes if needed. It’s like rearranging the slices if someone wants a bigger or smaller piece.

Common Mistakes and How to Avoid

A payment schedule template is like how and when to pay money, so it’s important to get it right. Here we go:

- Forgetting to Update It: It’s like forgetting to erase old things on your to-do list. Always update your payment schedule when things change, like if a bill amount changes or if you pay something off.

- Making It Too Complicated: If your payment schedule is as hard to understand as a tricky puzzle, it’s not helpful. Keep it simple to see what and when you need to pay easily.

- Not Checking for Mistakes: It’s like not checking your homework for errors. Look over your payment schedule carefully to ensure everything is correct, like the amounts and dates.

- Ignoring Due Dates: This is like forgetting when your homework is due. Always pay attention to when payments are due to avoid late fees.

- Forgetting to Include All Payments: That’s like leaving ingredients out of a recipe. Make sure to include all your big and small payments in the schedule.

- Not Planning for the Unexpected: Sometimes, surprise expenses come up, like a sudden trip to the doctor. Having a plan for these unexpected costs in your schedule is good.

- Not Keeping It Secure: Your payment schedule has important information. Keep it safe like a secret treasure map so only you and trusted people can see it.

By avoiding these mistakes, your payment schedule will work much better.

In addition, you can also see the timeline when you have to pay it to employees who are entitled to receive it. If you have fulfilled the payment schedule contract template on time, your former employees will have a good view of the company, and the quality of the company will increase.

The explanations above are various simple payment schedule templates. You can use it according to payment needs. This template is very easy to use. You can print it at home and on your desk or save it as a digital document.