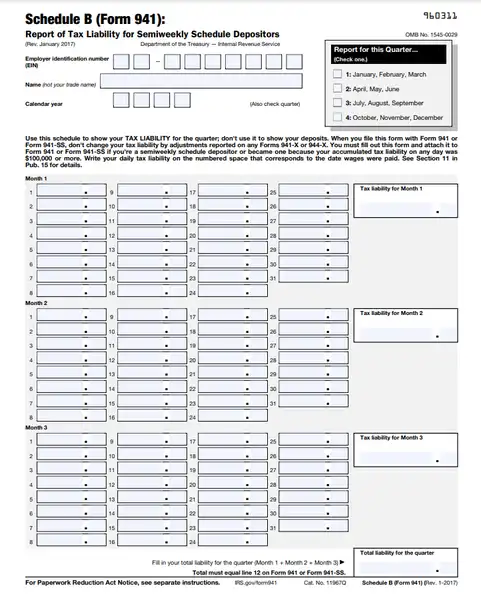

If you’re like most small business owners, you likely file your taxes annually with the IRS. But even if you’re familiar with the 941 Schedule B form, you can do a few things to ensure your filings are accurate and compliant. This post will outline some of the most important tips for accurately filing your 941 Schedule B form on time.

What is the 941 Schedule B form?

The 941 Schedule B form is a document to inform your company’s income and expenses. The form is important because it helps the IRS track your tax payments. The 941 Schedule B form must be filed annually, no later than May 15th, following the tax year in which the income was earned.

What is included on the 941 Schedule B form?

The form reports your company’s revenue and expenses. The form includes information about your company revenue and expenses, including the amount of gross income, the number of expenses, and the dates of the transactions. Additionally, the form includes information about your business ownership, including the business owner’s name and the ownership percentage.

What should you do if you find an error on the 941 Schedule B form?

When you file your 941 Schedule B form, it’s important to ensure that all information is accurate and up-to-date. If you discover an error on the form, take action to correct it as soon as possible. If you have questions about the form or your tax liability, don’t hesitate to contact your tax advisor or the IRS.

Read Also: 60+ Best Practices Hourly Schedule Template Excel & Word

How is the 941 Schedule B form used?

The 941 Schedule B form reports your company’s revenue and expenses. The form is designed to assist you in keeping track of your finances, and it must be accurate and complete to be accepted by the IRS. Anything on the form that does not pertain to your company, such as personal expenses, can be left off the form.

To prepare the form, you must first gather all the information you need to report your income and expenses. This contains details about your company, such as the type of business, the name of the owner, and the amount of revenue generated during the year. Additionally, you will require to record the expenses associated with operating your business, such as rent, salaries, and supplies.

If you find an error on the form, report it to the IRS. An incorrect or incomplete form can lead to penalties or additional taxes.

How do you prepare the 941 Schedule B form?

The 941 Schedule B form can be challenging, but it can be done easily with the right tools and techniques. Preparation begins by gathering all of the necessary information. This includes gathering your income and expenses and any deductions you may be eligible for. You should also keep track of your business receipts and bank statements. Once you have gathered all the necessary information, you can begin preparing the form.

The 941 Schedule B form is a long document and can be daunting to complete independently. If you are having trouble completing it, you should seek help from a tax professional or online resource. Online resources can be especially helpful when preparing large tax forms, such as the 941 Schedule B form.

Following the instructions provided with the 941 Schedule B form will ensure that your form is accurate and meets the IRS’s standards. If you find an error on your form, you should immediately contact a tax professional to rectify the situation.

Conclusion

- The form reports your business income and expenses.

- The form is an important document for tax filers.

- The form tracks your business income and expenses.

- The form includes important information such as business name, address, etc.

- If you find an error on the form, you should correct it and fill out the form accordingly.