Many people are unaware of all the deductions available on their IRS Form 1040 Schedule A. This article discusses some of the more common deductions and what you should expect when filing your taxes.

Overview of Schedule A of the IRS Form 1040

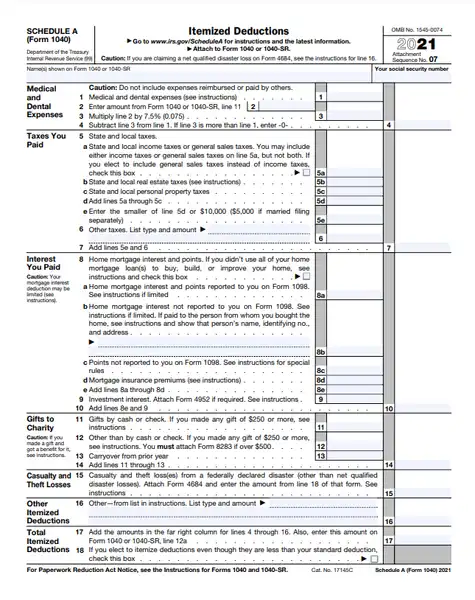

When filing your taxes, you may be familiar with Schedule A of the IRS Form 1040. This is where you can deduct various items that directly impact your financial situation. This article will discuss some of the more common Schedule A deductions and what you should expect when filing taxes.

Schedule A of the IRS Form 1040 is divided into three sections: Item 1, Item 2, and Item 3.

- Item 1 is deductions related to your finances, such as mortgage interest and taxes paid on personal income.

- Item 2 is for deductions related to your business finances, such as depreciation and amortization.

- And finally, Item 3 is for miscellaneous deductions, such as charitable contributions and casualty losses.

When filing your taxes, reviewing each form section is important to determine which deductions are eligible. Some deductions, like casualty losses, may only apply to certain businesses. Additionally, you may be able to claim different items in different sections of the form. For example, you may be able to claim mortgage interest in Item 1 but not in Item 3.

The benefits of scheduling a form include several advantages. For example, you may be able to claim more deductions on Schedule A than you would if you filed without scheduling a form. Additionally, filing a form can help you better track your finances and understand your tax situation. Finally, taking the time to schedule a form can also simplify tax prep tasks down the road.

Schedule A Form 1040 PDF

Who should schedule a form?

There is no one-size-fits-all answer to this question. However, if you are unsure whether or not a particular deduction applies to your situation, filing a form is generally best to ensure maximal accuracy is generally best. Additionally, if you anticipate having additional income or expenses in the future, scheduling a form in advance is helpful to account for these changes accurately. Lastly, if you have any questions about eligibility or how to file a form, please do not hesitate to reach out to an accountant or tax professional.

Common Schedule A deductions

When you file your taxes, you will likely be asked to list deductions on Schedule A. This list includes deductions for which you can claim a tax deduction on your income tax return.

Many different types of expenses qualify as deductions on Schedule A. Most common include mortgage interest, state and local taxes, and charitable contributions.

You can deduct a wide range of expenses, including medical, automobile, and educational expenses.

Make sure to list your deductions on Schedule A if you want to claim them on your tax return. If you have any changes or updates to your deductions, note them down so that you can take full advantage of your allowable deductions.

If you file a tax return in which you are claiming more than the standard deduction, you may need to itemize your deductions. The IRS has detailed instructions about how to do this on Schedule A properly. Read Also: 941 Schedule B Form: How to Stay Ahead of the IRS When Filing It

What to expect when filing taxes

When filing taxes, you will need to schedule a form called Schedule A. Schedule A of the IRS Form 1040 is for deductions. You can deduct some of your expenses on Schedule A of the IRS Form 1040. There are benefits to scheduling a form and certain problems that can happen when filing taxes using Schedule A. Who should schedule a form? Most people would recommend scheduling a form if you can use its deductions.

How Schedule A works

Schedule A of the IRS Form 1040 is mostly used for deductions. It allows you to claim a variety of expenses that are related to your business or income. These deductions can be valuable in reducing your tax burden.

When filing taxes, you will first need to determine your business income. This can be done by taking your business’s Profit & Loss (P&L) statement or using other methods, such as consulting services. Once you know your business income, you can start to fill out Schedule A.

Schedule A consists of six columns.

- The first column is your business name.

- The next column is the type of business.

- The third column is the activity that you are conducting.

- The fourth column is the expenses that you incurred in conducting that activity.

- The fifth column is the income that you generated from conducting that activity.

- The sixth and final column is the deduction that you are claiming.

Some of the more common deductions that can be claimed on Schedule A include:

- Rent and utilities

- Professional fees

- Employee wages and salaries

- Interest

- Dividends

- Non-business taxable events

What are the benefits of scheduling a form?

When you schedule a form with the IRS, you can expect some benefits. For example, scheduling a form can make the tax process easier. By filling out your information on a pre-printed form, you can avoid some of the hassles and delays that come with filing taxes manually. Additionally, scheduling your form early in the year can ensure you get as many deductions as possible. And last but not least, filing your taxes early can help you save money on your taxes.

With all of these benefits, it’s clear why taxpayers often recommend scheduling a form. If you’re unsure whether or not to schedule a form, look at the list of common Schedule A deductions and see if any of them apply to your situation. If so, Schedule A is a great way to save money and get the most out of your tax return.

Tips for successfully scheduling a form

If you’re like most people, you probably don’t have a lot of experience with scheduling taxes. That’s okay – the IRS is happy to help. This article will discuss some of the main considerations you need to take when scheduling your forms.

- First, ensure you have all the information you need to file your taxes. You’ll need your tax return information, including your filing status and income. If you’ve made any changes to your tax return since you filed last year, include that information too.

- Next, determine when you want to file your taxes. The earlier you file, the sooner your refund will arrive. However, be aware that there are late penalties for filing after the due date.

- Finally, consider what form you should file. You may be eligible to file either the 1040 or the 1040A Form. The 1040A is designed for individuals with additional expenses that they can deduct.

Once you’ve determined which form to file, schedule your forms promptly. The sooner you submit them, the sooner your refund will arrive.

Remember to factor in all the information you need before scheduling your taxes and submitting them on time – that way, you won’t have to worry about those late penalties.

Troubleshooting scheduling a form

If you experience issues filing your taxes, don’t hesitate to contact the IRS for assistance. They are here to help you get through this process as smoothly as possible. However, if you run into any difficulties, do not hesitate to contact our office for assistance. They are experts at resolving these issues as quickly as possible.

Don’t hesitate to call Them if you experience any technical difficulties when filing your taxes- even if you have already filed them. The team is available 24/7 to help you get through these problems.

Conclusion

So, if you’re looking to deduct some items on Schedule A of the IRS Form 1040, check out the various items that are allowed. There are many benefits to scheduling a form, and making sure your deductions are accurate can save you time and money in the long run. As long as you have the right information, filing taxes shouldn’t be too difficult – though it can sometimes be a little bit confusing. If you have any questions or concerns about scheduling a form, don’t hesitate to contact your accountant or the IRS website.

Schedule A of the IRS Form 1040 is a list of deductions you can claim on your tax return. This form is important because it allows you to reduce your taxable income. This article discusses some of the more common Schedule A deductions. We also explain what you should expect when filing your taxes and review the benefits of scheduling a form. Finally, we provide tips for scheduling a form and answering frequently asked questions.

FAQs about scheduling a form

- What are the most common questions about Schedule A of the IRS Form 1040?

- How do I know if my deduction is allowable?

- How do I calculate the amount of my deduction?

- What should I include in my Schedule A declaration?

- What are the benefits of scheduling a form?

- Is it possible to neglect to include certain items on my Schedule A?

- What happens if I don’t schedule my form?

- Can I schedule my form more than once?

- How do I correct any mistakes I may have made in preparing my form?

- Conclusion