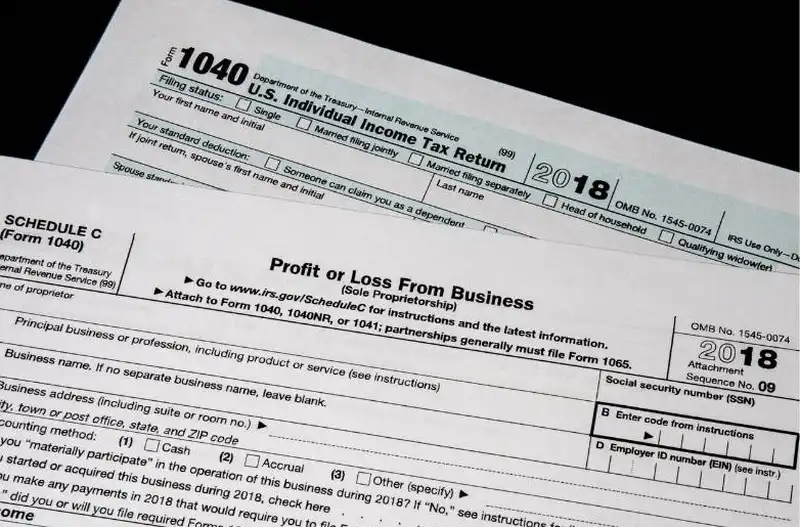

Are you feeling pressure to file your income tax return by the deadline? Don’t worry; plenty of ways to increase your revenue on Schedule C and maximize your tax refund. This article will outline some of The Schedule C Form 1040 used by sole proprietors to report their business revenue and costs. This article provides a detailed overview of the form and offers tips on how to file it.

What is the Schedule C Form 1040?

The Schedule C form 1040 is used to report earnings from a company or other activity. It can be utilized to report earnings from your regular job, extra employment or activities, associations, businesses, and other entities.

schedule c form 1040 pdf

Who Needs to File the Schedule C Form 1040?

If you are personal and have made more than $100,000 from your company activities in the past year, you must file the Schedule C form. This form is utilized to calculate your earnings and deductions. The report required on the form includes your business’s revenue, costs, and assets. If you are filing a joint return with your partner, you must also file the Schedule C form if either of you made more than $100,000 from your company activities. If you are filing as a single taxpayer, you are not required to file the Schedule C form. However, consulting with a tax professional can be helpful if you have questions about filing the form properly.

When is the Schedule C Form 1040 Due?

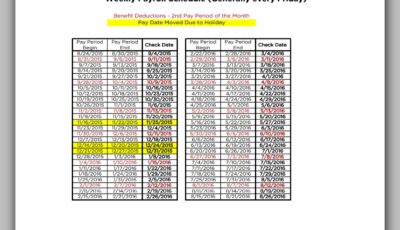

The Schedule C Form 1040 is generally due on or about the 15th day of the fourth month after the end of the tax year. Nevertheless, the deadline may be later if you file an amended return. For example, if your return is due on April 15th, but you filed an amended return on May 15th, the deadline would be June 15th. If you are needed to file a fiscal year return, the deadline is October 15th.

If you are needed to file a return and do not file on time, you may be subject to a late filing punishment of $135 per month (or part of a month), up to $1,000. If you are subject to the late filing penalty, you should contact the IRS immediately to discuss potential remedies.

You may be subject to fines if you file an income tax return that does not contain all the information needed on the form. The punishments for filing a false return can include imprisonment for up to five years or a fine of up to $250,000. Additionally, you may be subject to interest and administrative costs.

Remember: They are important and should not be ignored. Don’t wait until the last minute to file your return – it could result in late fees and damages you may be unfit to afford.

What Information is Required on the Schedule C Form 1040?

The Schedule C Form 1040 needs to be accurately filled out. The form must include all income and expenses that occurred during the tax year in question. Each line on the form must be checked off for the information to be accurate. Some of the information that is required on Schedule C Form 1040 include:

- – Name

- – Address

- – Phone Number

- – Email Address

- – Occupation

- – Business or Professional Activity

- – Total Income from all Sources During the Tax Year

- – Business Expenses Paid During the Tax Year

- – Net Profit or Loss from Business or Professional Activity

- – Social Security Number

- – Spouse’s Social Security Number

- – Dependents Include : Name, Relationship to Spouse, Date of Birth, and Estimated Taxable Income for the Year

The Schedule C Form 1040 also requires you to provide a statement of estimated taxes. This statement will give you an idea of how much income you may owe in federal taxes for the upcoming year. This statement should be updated at least once every six months. Failure to do so may result in penalties and interest.

How to File the Schedule C Form 1040

If you are an individual earning income from a business or profession, you must file Schedule C Form 1040. The Schedule C Form 1040 is a helpful tool for individuals who want to increase their income. The Schedule C Form 1040 is required if your income from your business or profession exceeds $600 in any year. Remember to accurately record your income and expenses to file Schedule C Form 1040. If you have questions about how to file Schedule C Form 1040, don’t hesitate to contact a tax professional.

Tips for Filing the Schedule C Form 1040

When preparing your Schedule C, it is important to keep the following tips in mind:

1. Understand your income and deductions.

If you have been working hard to earn an income, you may be eligible to claim many deductions on your 2018 Schedule C tax return. This article will briefly overview the most common Schedule C deductions and how to claim them on your 2018 tax form.

There are five main categories of deductions that can be claimed on Schedule C: itemized deductions, qualifying medical expenses, casualty losses, business expenses, and miscellaneous deductions. Each category has rules and criteria that must be met for the deduction to be allowed.

Some common Schedule C deductions include mortgage interest and property taxes, state and local taxes, charitable contributions, IRA contributions, and self-employment taxes. It is important to consult with a tax professional to determine which deductions are available to you and how much credit you may be eligible for. There are many complex rules surrounding the deduction of expenses, and over-claiming can lead to serious financial penalties. In addition, claiming too many personal exemptions can also result in a large tax bill at tax time.

It is important to keep track of your income and expenses throughout the year to determine whether any changes to your Schedule C deductions should be made. By following the instructions on your tax form carefully, you can minimize your tax burden and ensure that you take all of the deductions available to you. Read Also : The Truth About Schedule A of IRS Form 1040: You’ll Be Surprised

2. Review your expenses.

Reviewing your expenses and seeing where you can cut back is important when composing your tax return. Reviewing your expenses can save money on taxes and get more benefits from your spending.

You are looking closely at your expenses to see which ones are necessary and which can be eliminated or reduced. You may be surprised at how much money you can save by making these changes.

You may also be entitled to unreported income or deductions you were unaware of. Review your expenses to ensure you claim all the deductions you are entitled to.

Some common expenses to review on the Schedule C form include:

- Employee benefits

- Medical expenses

- Mortgage interest

- Property taxes

- Charitable contributions

- Time spent commuting

To maximize your refund, it is important to file correctly on your tax return. Review your income, deductions, and credits to report everything correctly. If you have any questions about the information required on the form, consult a tax professional.

3. Diversify your income.

There are a few ways to diversify your income:

- Changing your job

- Starting a side business

- Investing in certain types of assets

Keeping tabs on your expenses is essential to diversify your income. If something you want isn’t affordable, don’t buy it! Consider ways to bring in new sources of income, like starting a side business or investing in assets. Consult with a tax professional to make sure you’re taking advantage of all your income opportunities.

4. Manage your tax obligations.

It’s important to carefully review your income and deductions to maximize your tax refunds. Make sure you are submitting all the necessary tax forms and paperwork. Get help from a tax professional if you have any questions about your taxes, but be certain to stay on top of changing tax laws so you don’t pay more tax than you require.

Also, keep track of your finances to make sound financial decisions. Review your expenses, and diversify your income if you can. And lastly, manage your tax obligations by getting help from a tax professional when needed.

5. Get help from a tax professional.

If you are not sure how to file your taxes, Seeking Tax Help can assist. Tax preparers can offer expert assistance with filling out Schedule C. If you have any questions about the tax law, speak with a tax professional. You may be able to decrease your tax liability by handling the advantage of deductions and credits.

Conclusion

There are many ways to earn money on your IRS Form 1040, such as changing your job or starting a side business. Here are some tips on maximizing your income from Schedule C.

FAQs about the Schedule C Form 1040

What is Schedule C form 1040?

Who needs to file the Schedule C form 1040?

When is the Schedule C form 1040 due?

What information is required on the Schedule C form 1040?

How to file the Schedule C form 1040?

Tips for filing the Schedule C form 1040