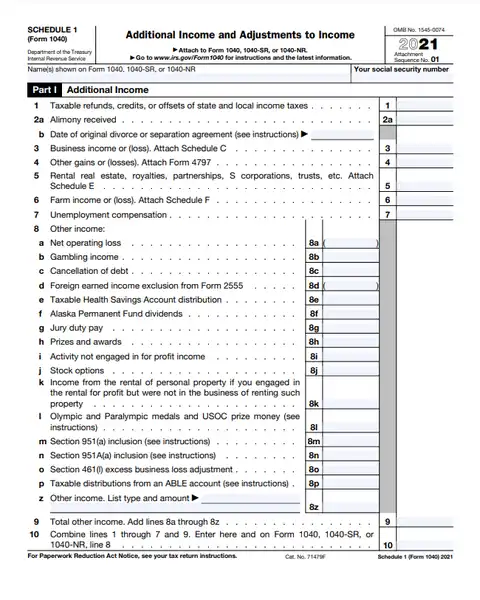

Schedule 1 Form 1040 that you can use to claim deductions and credits for your income tax return. You may wonder what it is, why you should use it, and how to get started. This blog post will discuss each of these questions in more detail.

What Is Schedule 1 Form 1040?

Schedule 1 Form 1040 is a form used by taxpayers to declare their income, deductions, and credits on their federal income tax return. It consists of one page and can be downloaded from the IRS website. The table below provides an overview of some common items that are listed on Schedule 1:

Schedule 1 Form 1040 – irs.gov

What is included on the Schedule 1 Form 1040?

The schedule 1 form can also help you save money on taxes. Some examples of items are The amount of your mortgage interest, the value of your home and your charitable contributions can be claimed as deductions or credits.

Schedule 1 is a long and varied list of items taxpayers may be suitable for deductions and credits. This forum covers many tax deductions and credits you may be suitable for. Some of the items contained on the Schedule 1 Form 1040 are:

- Itemized deductions

- The mortgage interest deduction

- The state and local tax deduction

- The charitable contributions deduction

- The medical expenses deduction

- The casualty loss deduction

- The unemployment compensation deduction

What can examples of items be claimed as deductions or credits?

There are many different types of deductions and credits that are claimed. The most common examples are rent, mortgage interest, and car taxes. Here are rare, more examples:

- You can claim deductions for things like your rent, your mortgage interest, and your car taxes.

- You can also claim credit for expenses like your mortgage, child’s tuition, and gas bills. There are many different types of deductions and credits, so it is important to do some research to find the ones that are best for you.

- You can claim deductions and credits on your schedule 1 form, which can help lower your taxes. However, claiming deductions and credits has some drawbacks, so it is important to weigh the pros and cons before filing.

Read Also : The Schedule C Form 1040 and 5 Best Tips on How to File It

Why Use schedule 1 form 1040?

As mentioned earlier, Schedule 1 Form 1040 serves as a way for taxpayers to declare all the various deductions and credits they are entitled to on their federal income tax return. This includes things like:

- exemptions (which reduce taxable income)

- capital gains (if any were realized during the year)

- moving expenses (paid when relocating within the U.S.)

- health expenses (including premiums paid for health insurance ),

- and miscellaneous itemized deductions.

By completing Schedules 2-9 correctly, you can prove that you met all your eligibility requirements so that relevant taxes may be reduced or eliminated!

How do I Claim Deductions on Schedule 1?

You must follow the correct steps to claim deductions on Schedule 1. The most common type of deduction is the self-employed business deduction.

The process of claiming deductions and credits on Schedule 1 Form 1040 is not difficult.

However, you can claim many different types of deductions and credits, so it’s important to know all about them. Let’s take a look at some examples:

- The self-employed business deduction. This is one of the most commonly claimed deductions on Schedule 1 and allows small businesses with no employees to deduct their share of expenses from their income. To take this deduction, your business must be registered for GST/HST as a sole proprietorship or corporation without shareholders.

- The expense ratio rule. You may also be able to claim certain expenses related to your investing activities as part of your eligible investments under the expense ratio rule. You may only use this rule if you meet all three following conditions:

Your investment objective has been consistent throughout the year.

Each purchase was made in good faith.

You have reasonable documentation showing how much money went towards supporting your investment objectives over the year. - Repairs, maintenance, and improvements.

You may generally treat these costs as capital expenditures if they meet two criteria: first, they are required for you to

operate effectively; second, they are unusual or excessive compared to similar properties

How do I Claim Credits On Schedule 1?

Claiming Credits On schedule 1 form 1040 is Easy! The IRS has made claiming credits on schedule 1 extremely easy. All you need to do is gather your documentation and file an application. Here are a few things you can claim:

- You can claim deductions for business expenses such as travel, marketing, office supplies, and software licenses.

- You may be able to take a tax deduction for contributions to the charitable organization.

- You could deduct the interest paid on your mortgage or loan.

- Finally, there are many other small business-related deductions that you may be able to take advantage

How do you file a schedule 1 form 1040?

To file your taxes correctly, you must choose the right filing method.

There are three main methods: paper, electronic, and tax preparation software.

- If you are filing on paper, you must print out your schedule 1 form and fill it out. You must keep records of your deductions and credits to substantiate them when you file your taxes.

- If you are Filing electronically, you must complete and submit your Schedule 1 form through the IRS’s e-file system. This system is safe, easy to use, and allows you to file your taxes quickly and securely.

- Lastly, scan and upload your schedule 1 form into the program if you use tax preparation software. This will permit you to file your taxes quickly and easily.

Whichever filing method you choose, ensure to follow the instructions provided by the IRS. And don’t forget to keep all your records so you can prove your deductions and credits when you file!t.

FAQs about scheduling a form

Here are some common questions that taxpayers have about filing a schedule 1 tax form:

1. What information is included on the schedule 1 form?

2. How do I find out if I need to file a schedule 1 form?

3. What are the benefits of filing a schedule 1 form?

4. What are the drawbacks of filing a schedule 1 form?

5. What should I do if I am unsure whether I need to file a schedule 1 form?

6. How can I avoid errors when filing my schedule 1 tax form?

7. What are some tips for filling out my schedule 1 tax form?

8. Can I claim any deductions or credits not mentioned on the schedule 1 form?

9. What should I do if the IRS contacts me regarding my schedule 1 tax form?

10. Is it possible to amend my schedule 1 tax form after filing it?

11. What should I do if I am audited because of my Schedule 1 tax form?

12. What should I do if I cannot find my Schedule 1 form?

Conclusion

Deductions and credits can help you lower your taxes. Claiming deductions and credits can provide significant savings and can be critical in reducing your overall tax liability. The schedule 1 form 1040 includes a list of all the deductions and credits available to taxpayers.

It is important to ensure that you claim all the deductions and credits available to you, as this can significantly reduce your tax liability. In addition, it is important to file your schedule 1 form correctly, as errors on this form can lead to penalties and potential tax penalties and interest