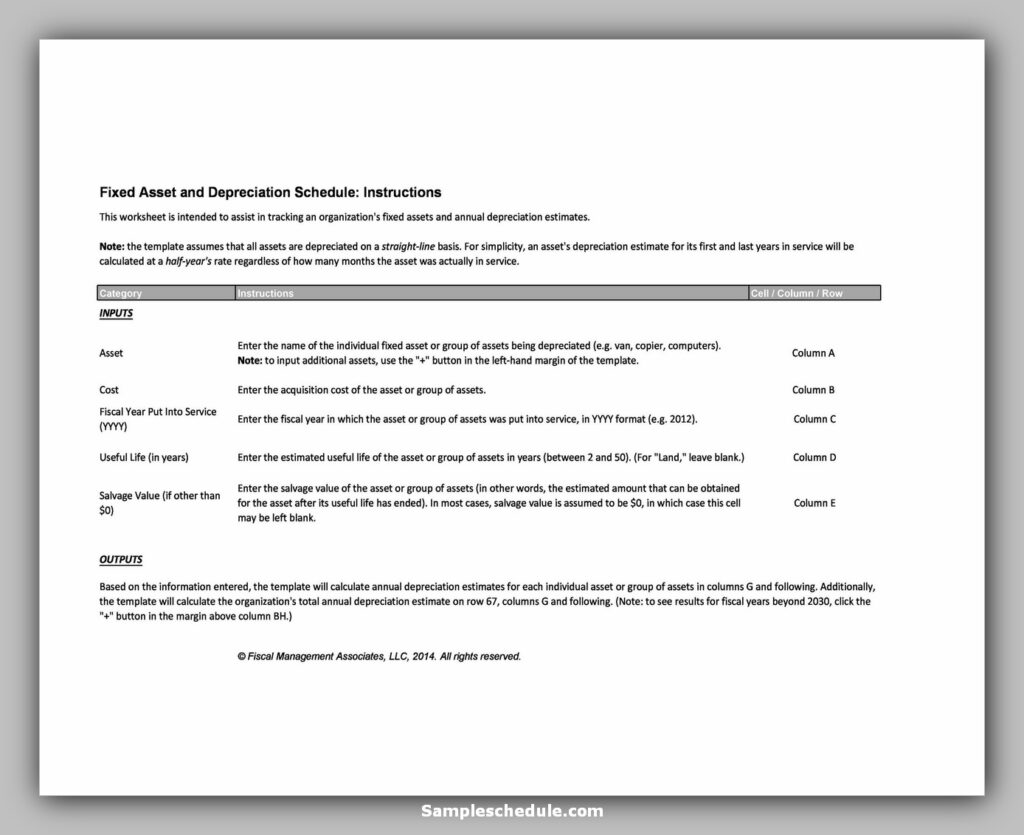

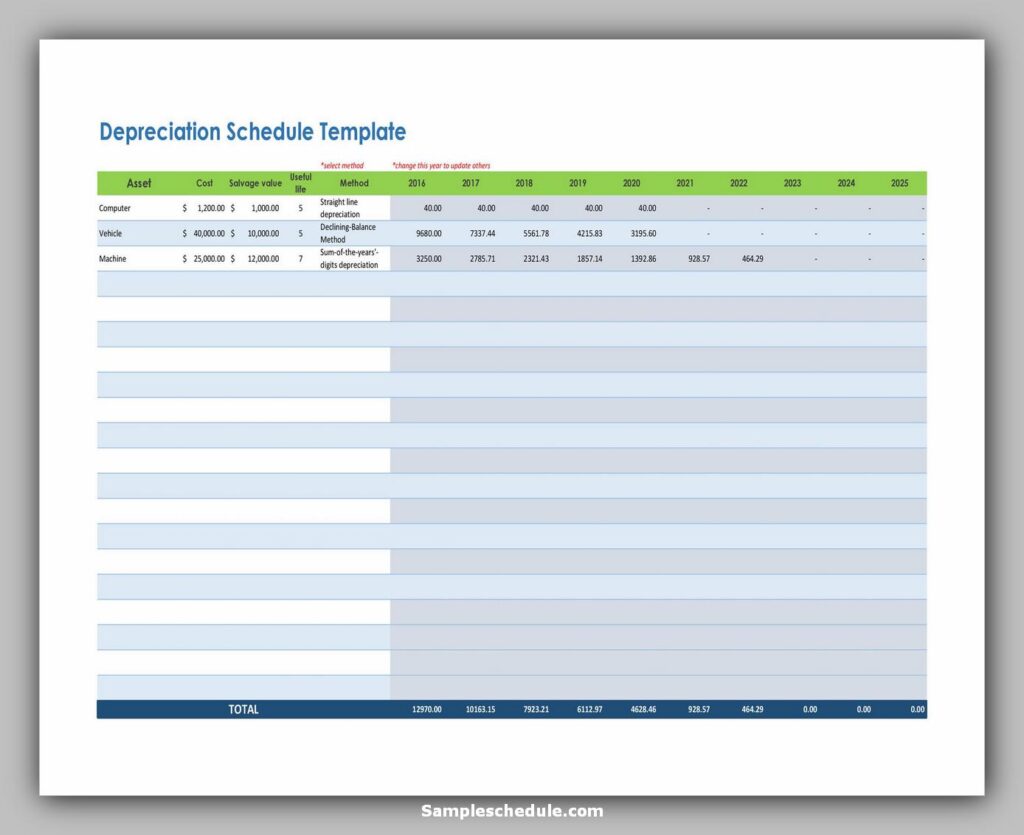

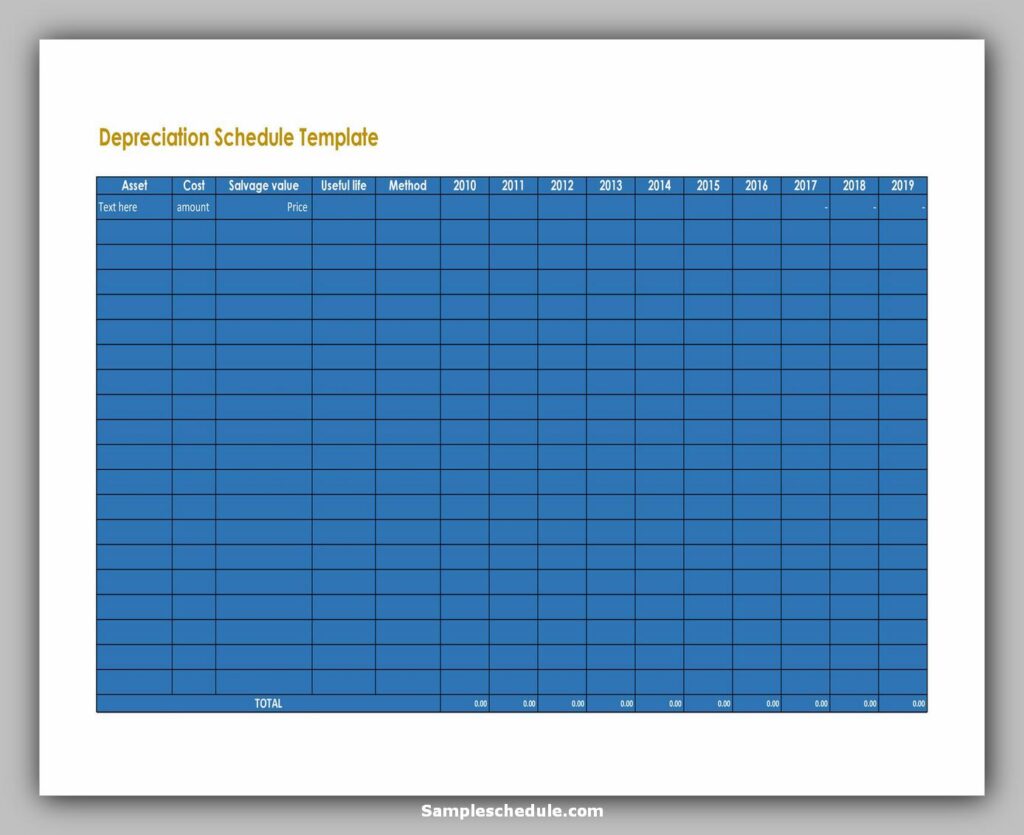

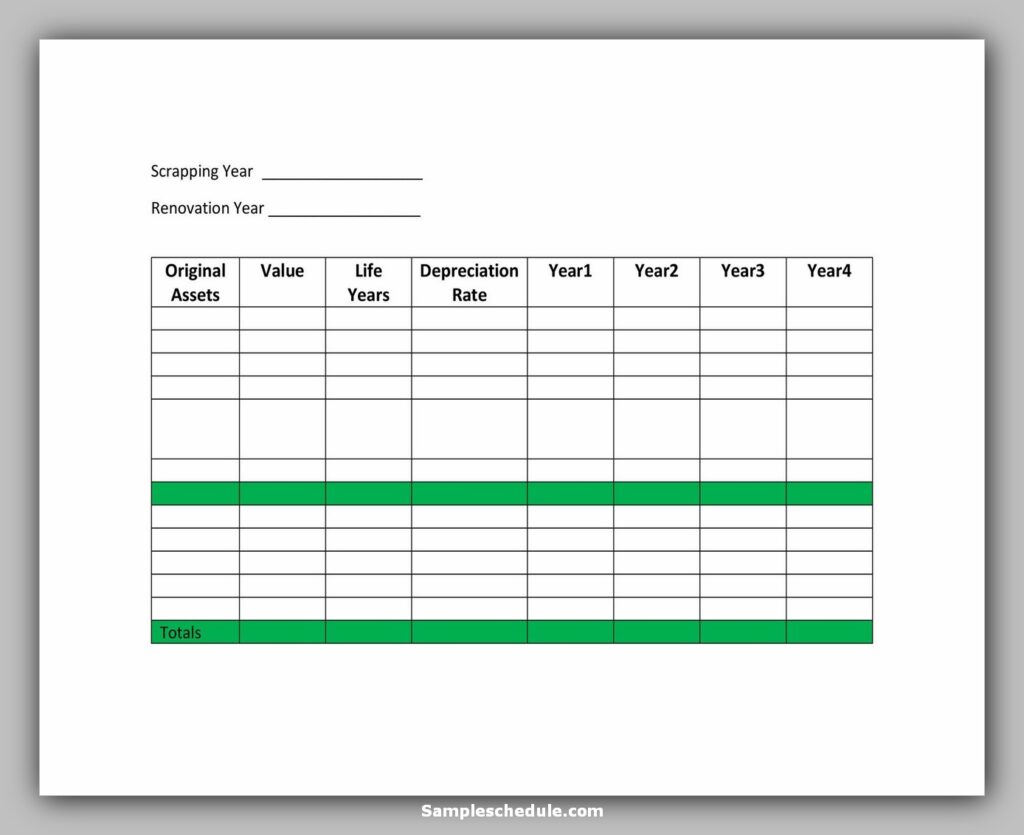

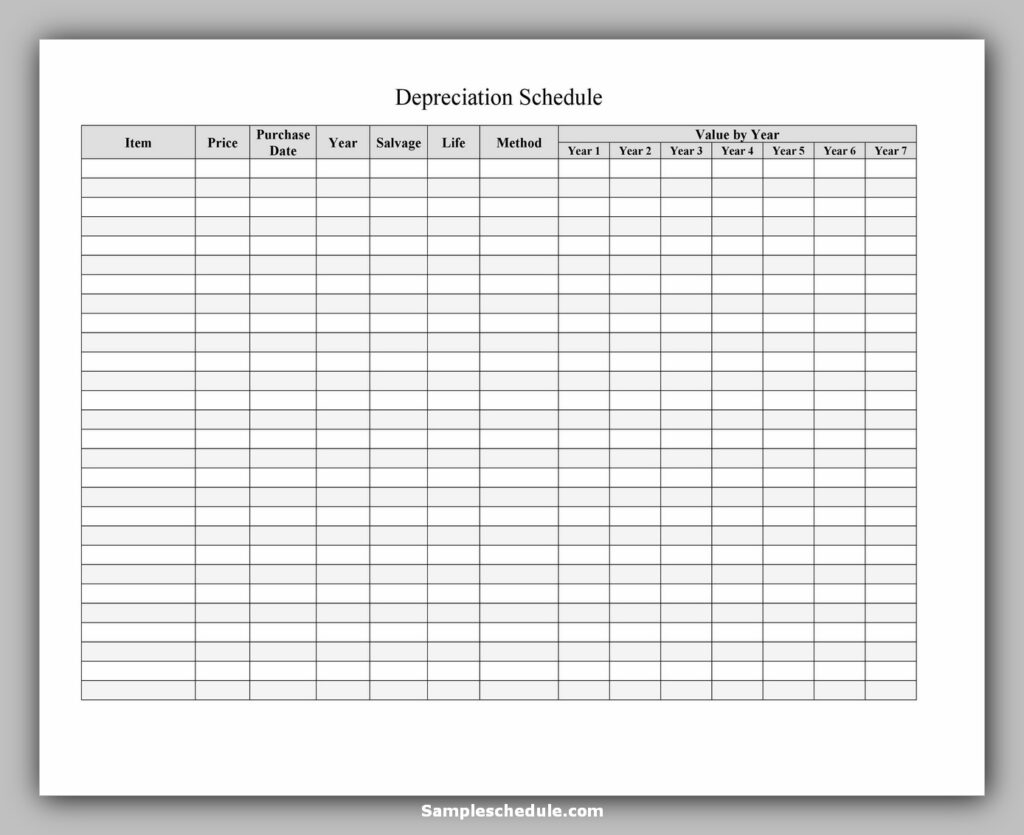

Depreciation schedules are perfect for offering multiple assets while allowing various depreciation methods to be selected for this purpose. These models are particularly suitable for creating monetary reporting for small and medium enterprises.

A sample depreciation schedule is a table that shows the depreciation amount over the entire life of an asset. For accounting and tax purposes, the depreciation cost is calculated and used to “write off” the cost of buying assets over time.

Companies typically want to write off assets (i.e. make costs) as soon as possible to increase the present value after-tax or asset profitability. For these and other reasons, governments often regulate the different depreciation methods used by eligible companies.

What is the important Element Depreciation Schedule?

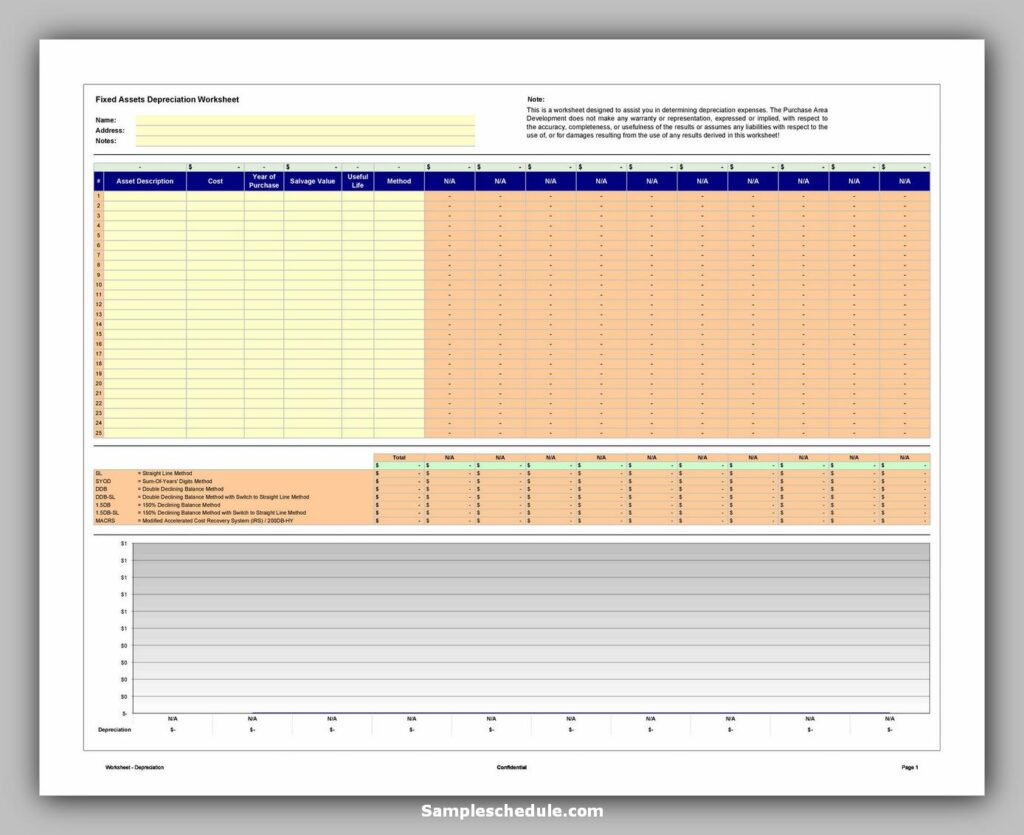

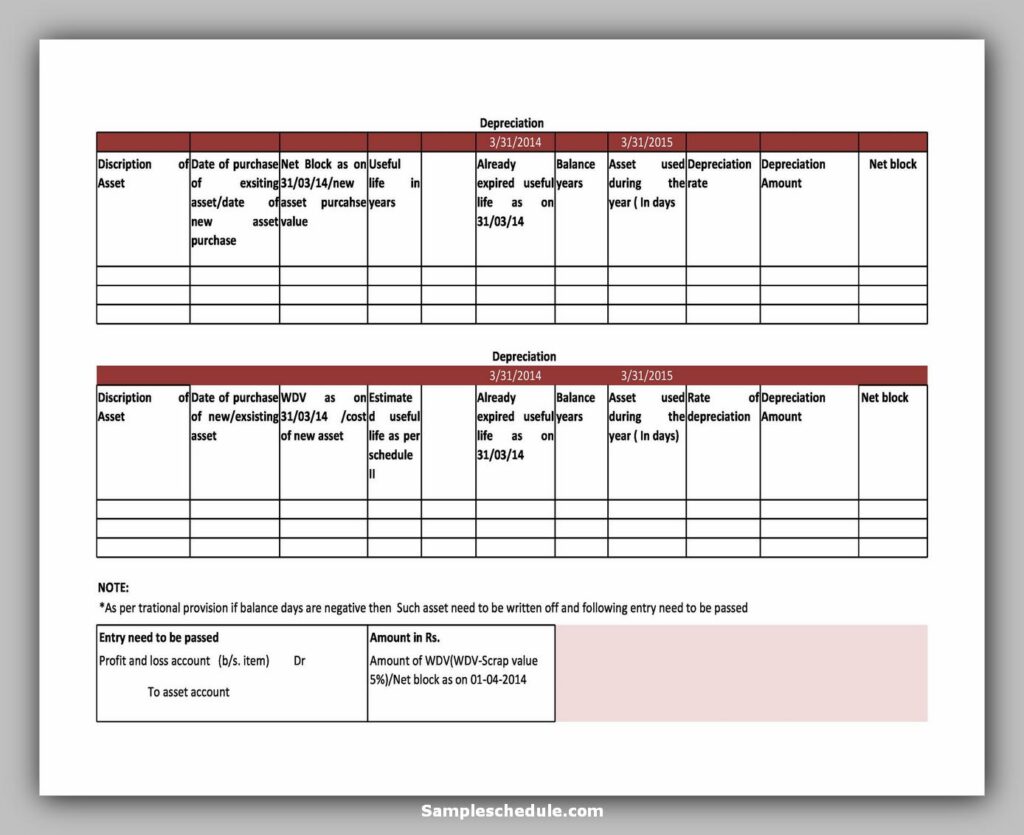

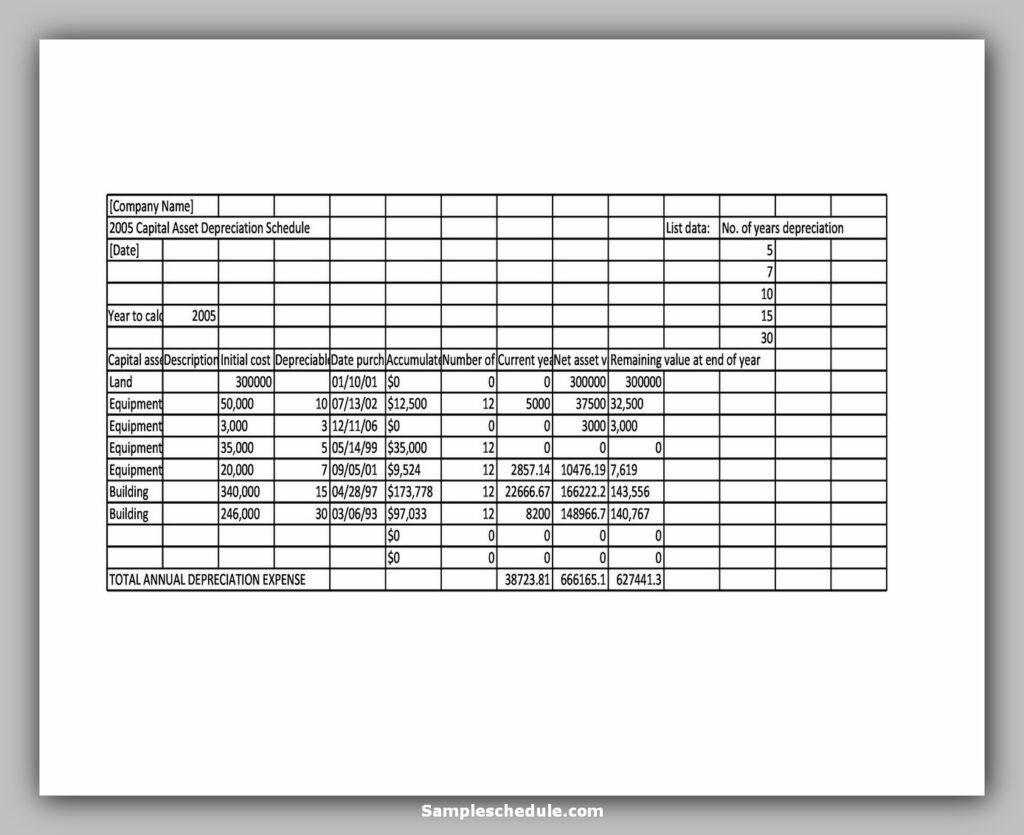

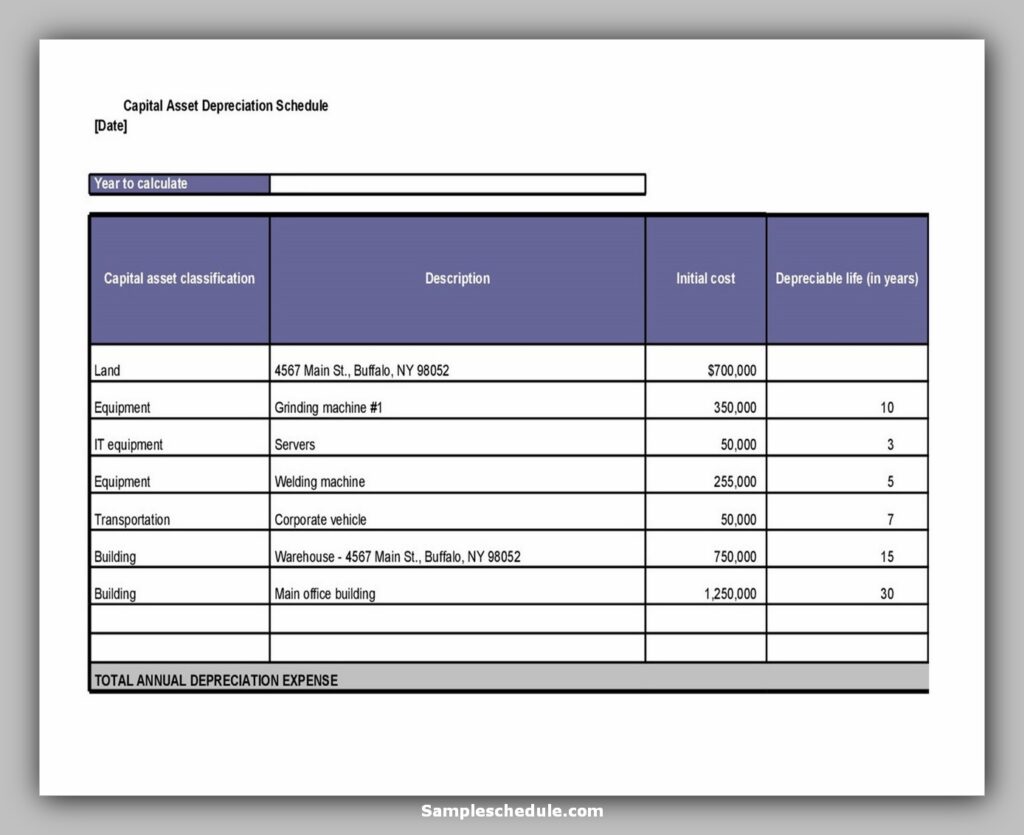

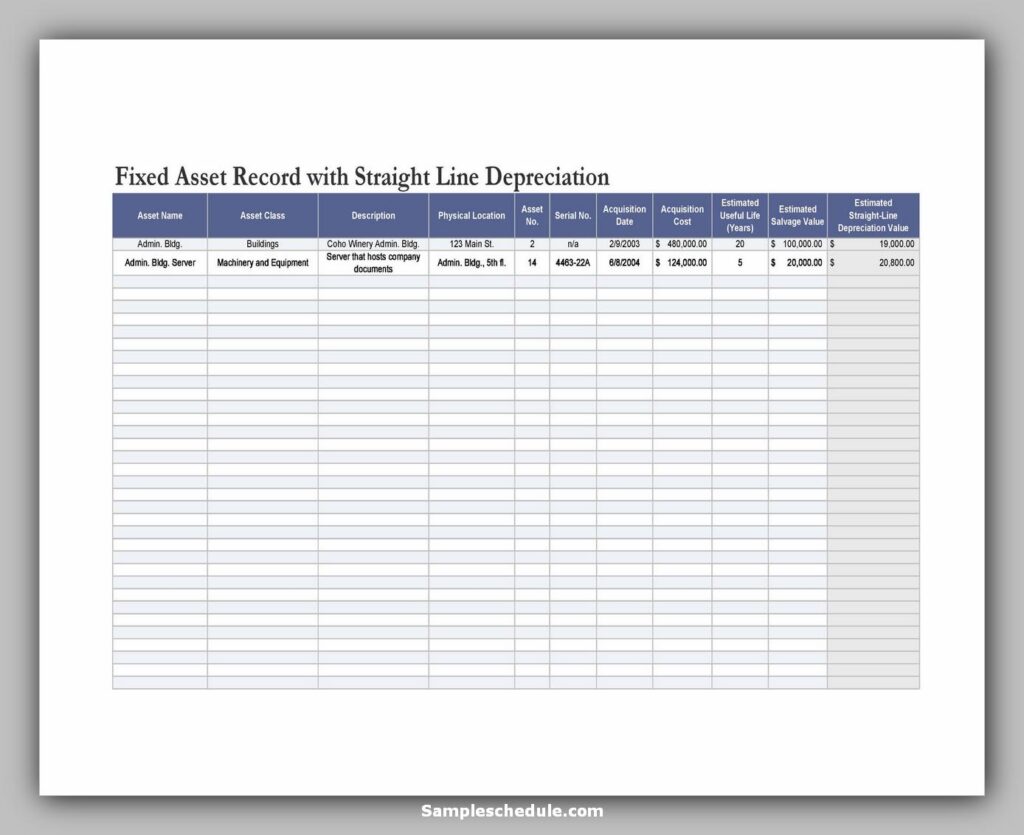

It usually contains the following information:

- A description of the asset

- Date of purchase

- The total price you paid for the asset

- Expected lifespan

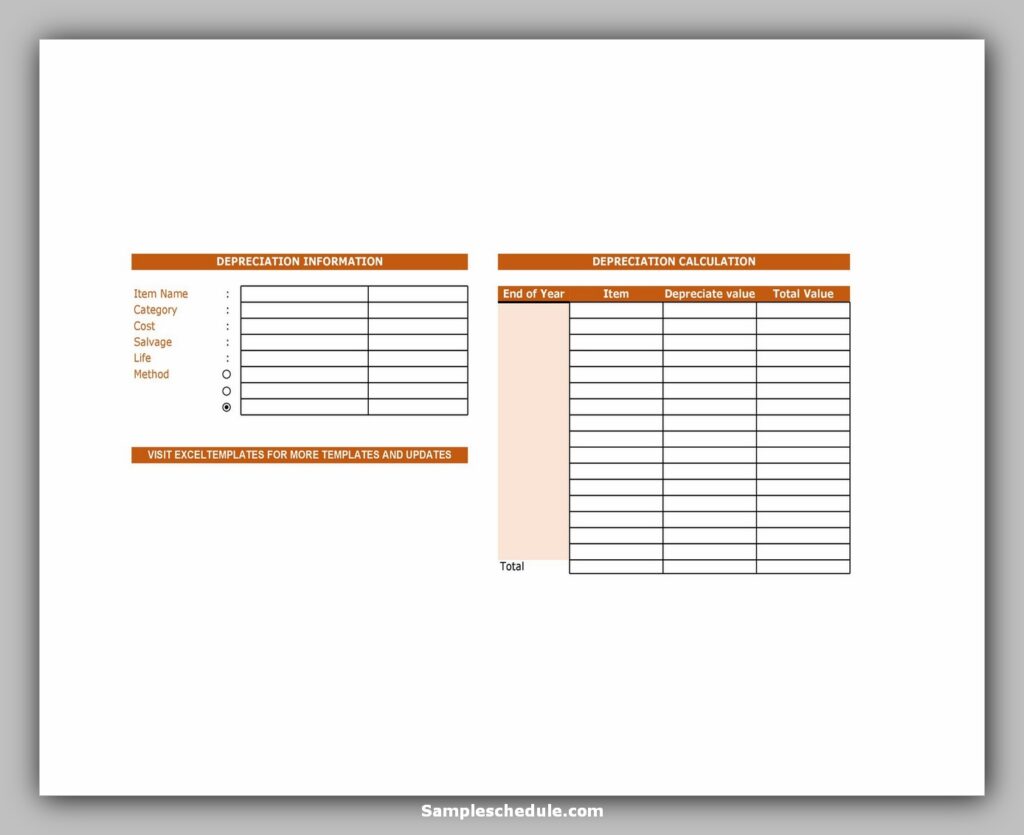

- Depreciation method used

Resale value- how much you sell for once has passed its longevity (for example, how much a scrap yard would pay for your old work truck)

How to Create a Depreciation Schedule

If you become familiar with the subjects of the previous two sections, you are familiar with the different methods of calculating straight-line depreciation rather than reducing the balance sheet. A depreciation schedule template the loss of value of an asset during the period you have designated as a useful life using the chosen accounting method.

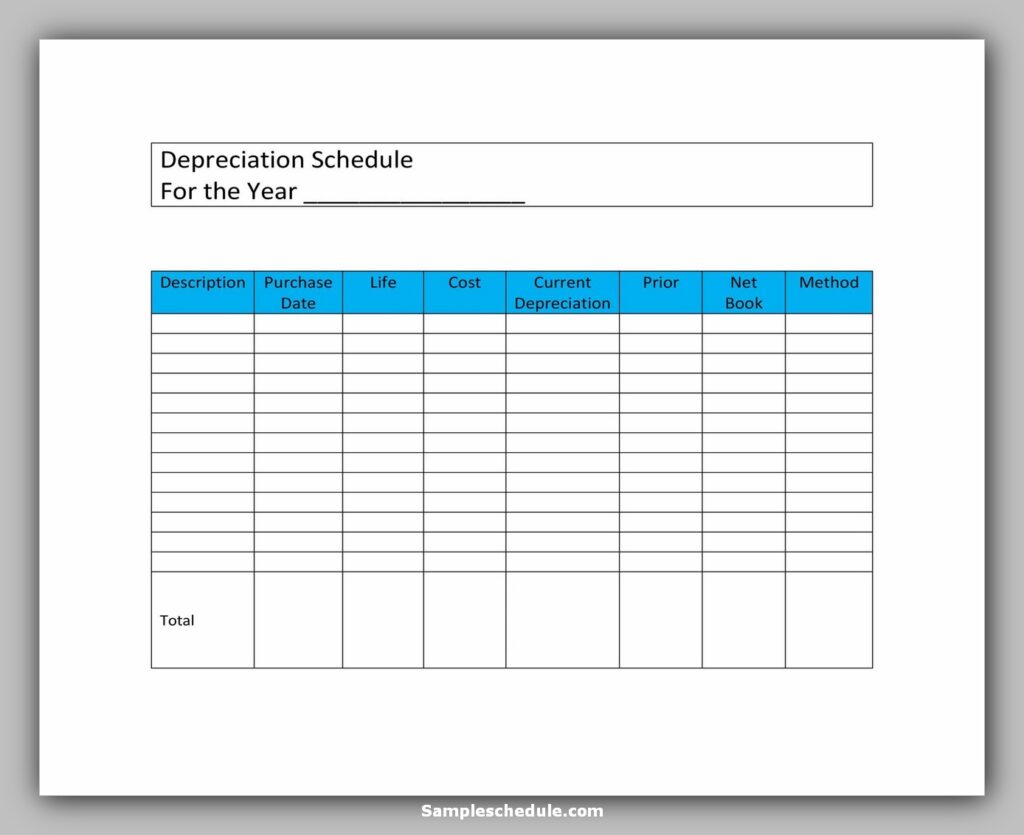

The purpose of having a depreciation schedule is to give you the opportunity to keep track of what you have already deducted and to stay informed about the process. Here is an easy way to do it.

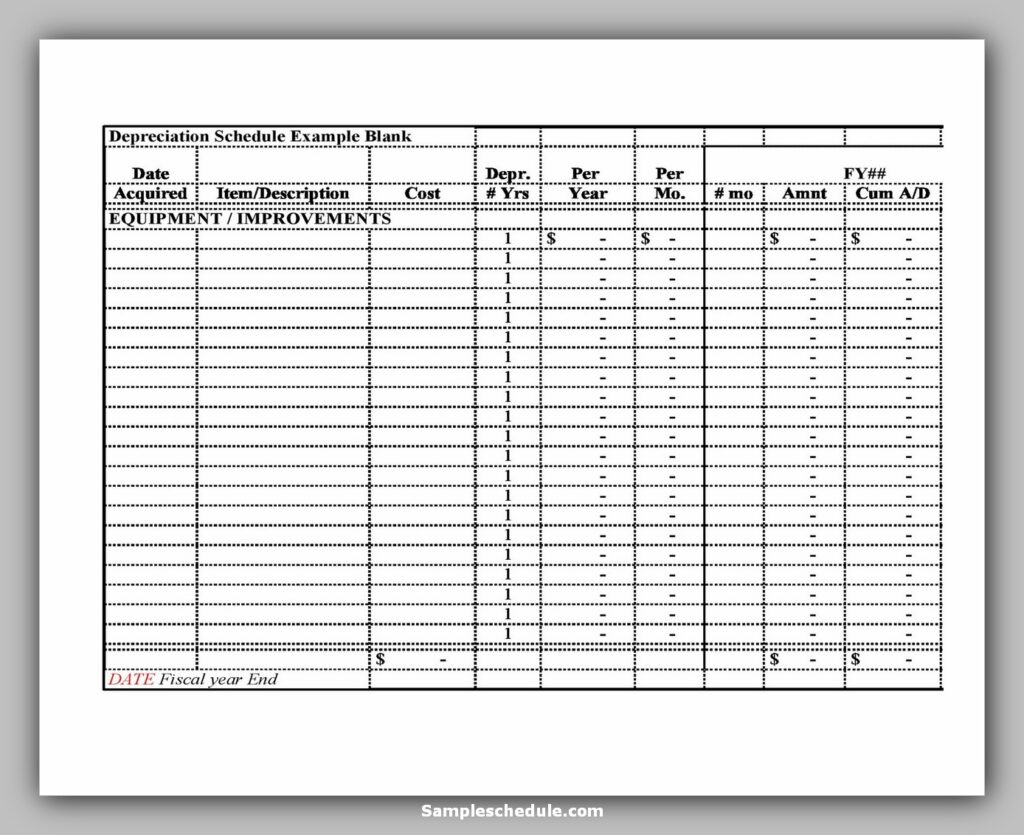

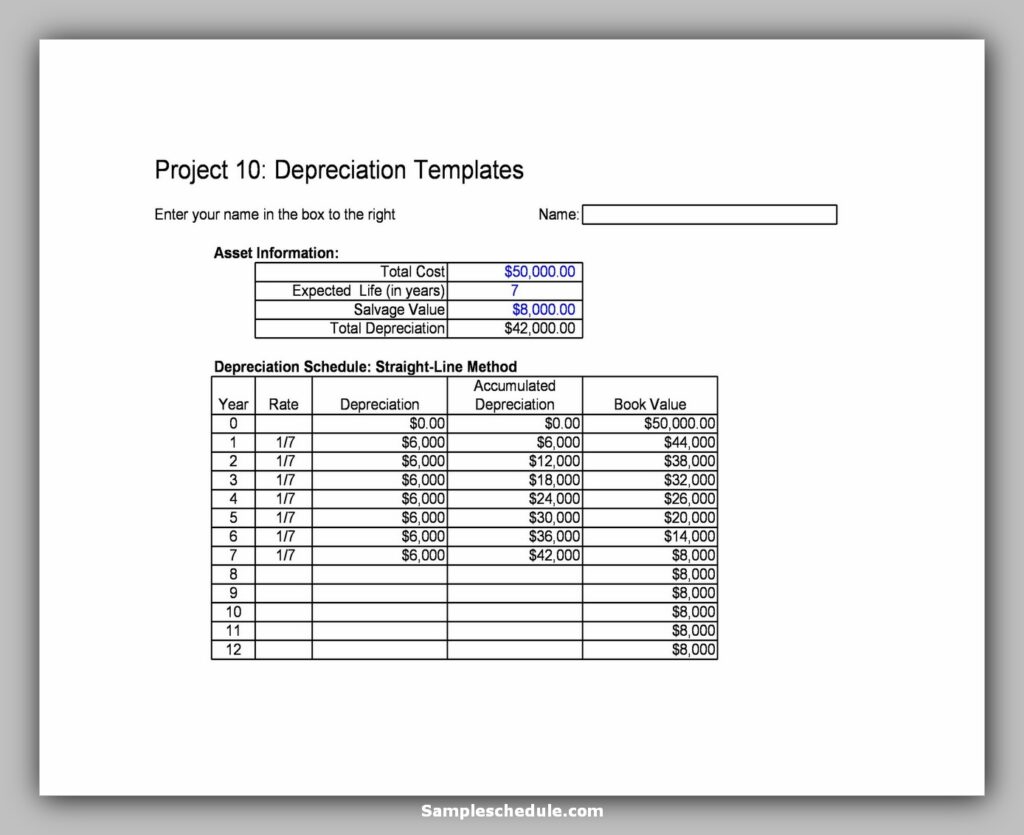

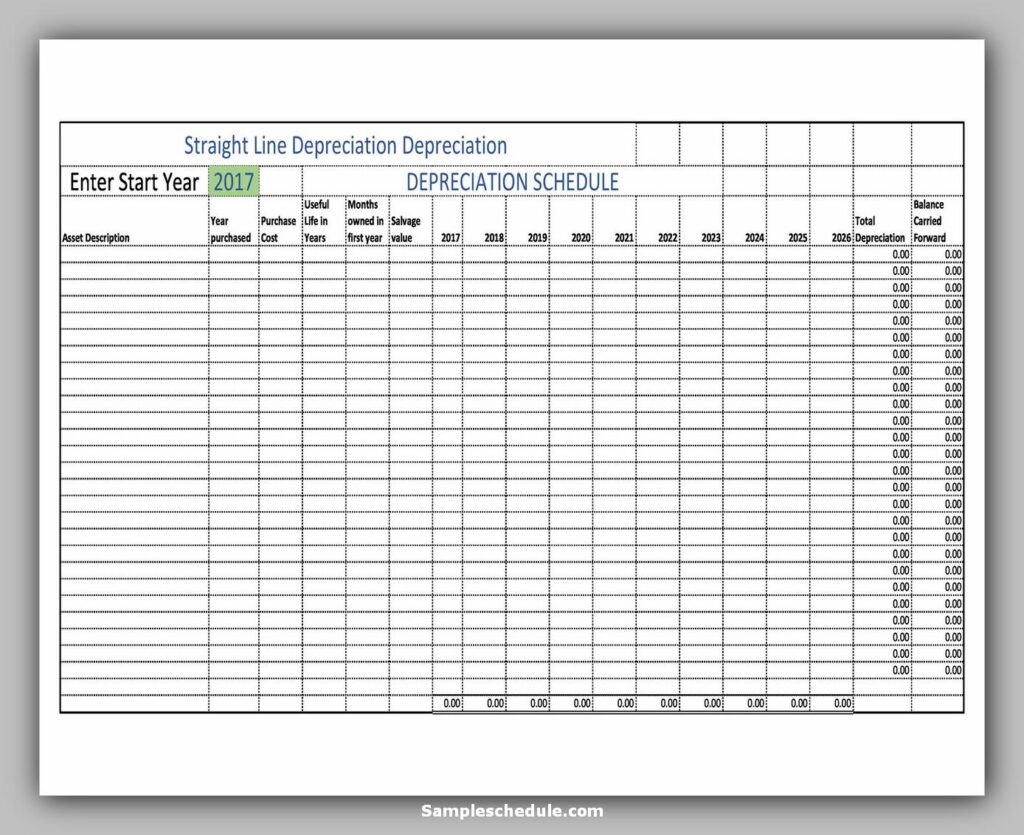

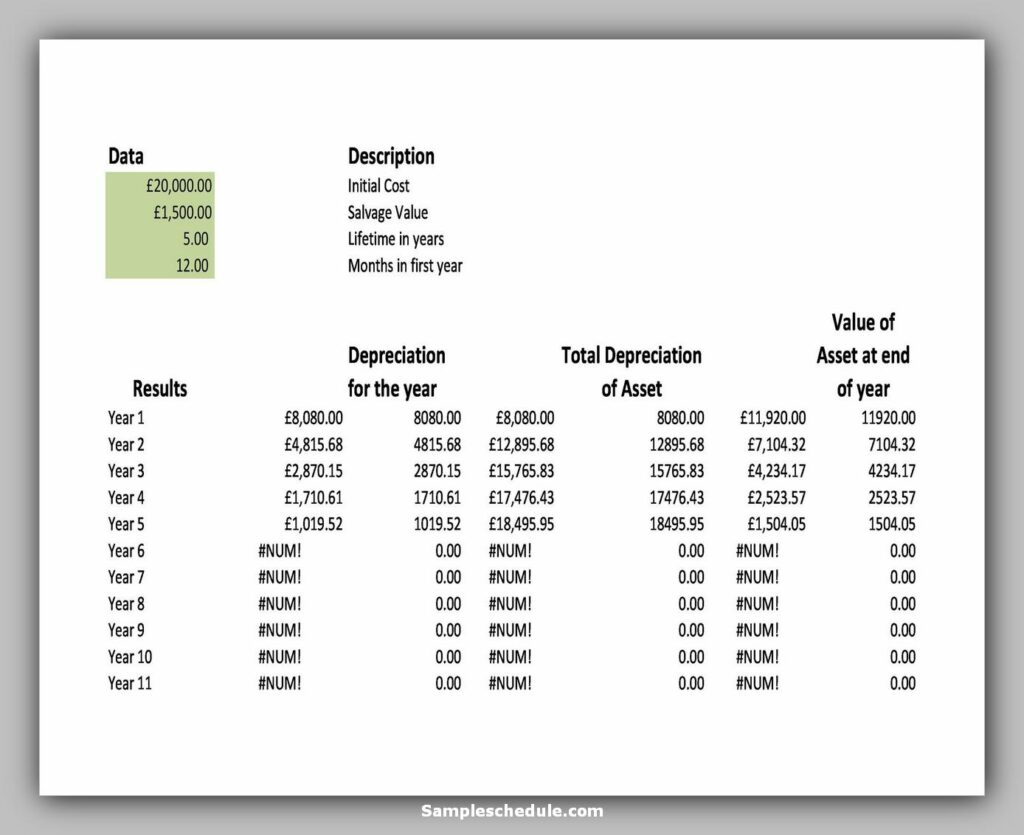

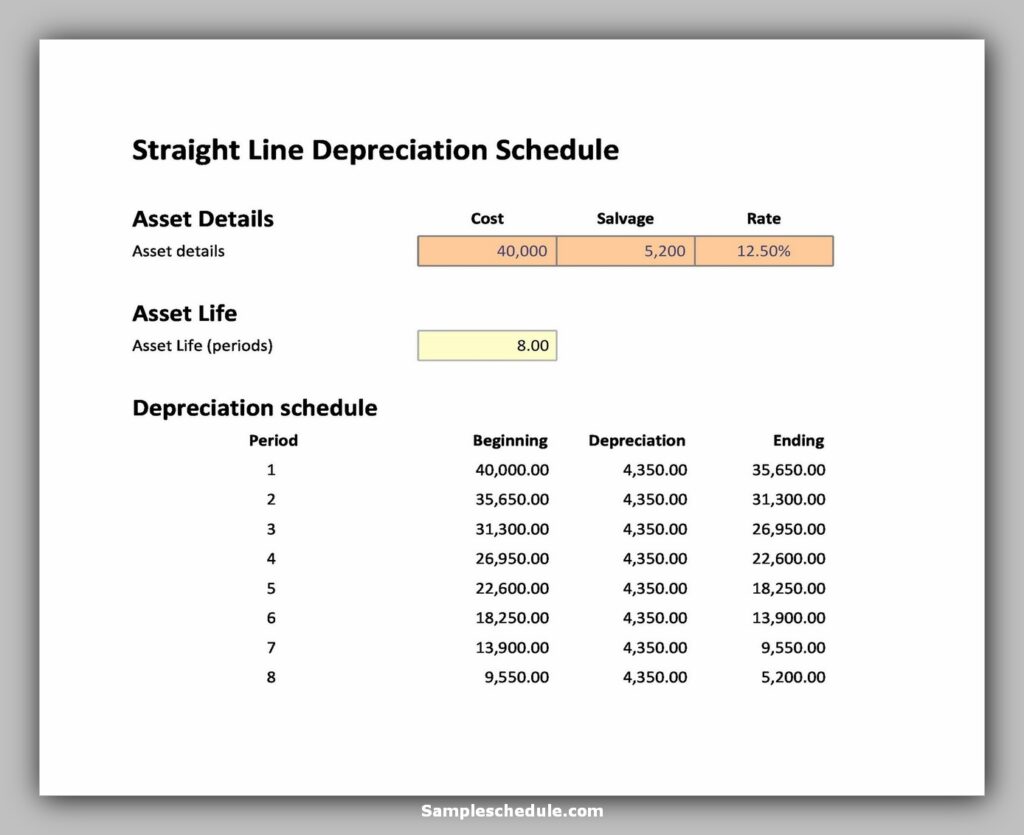

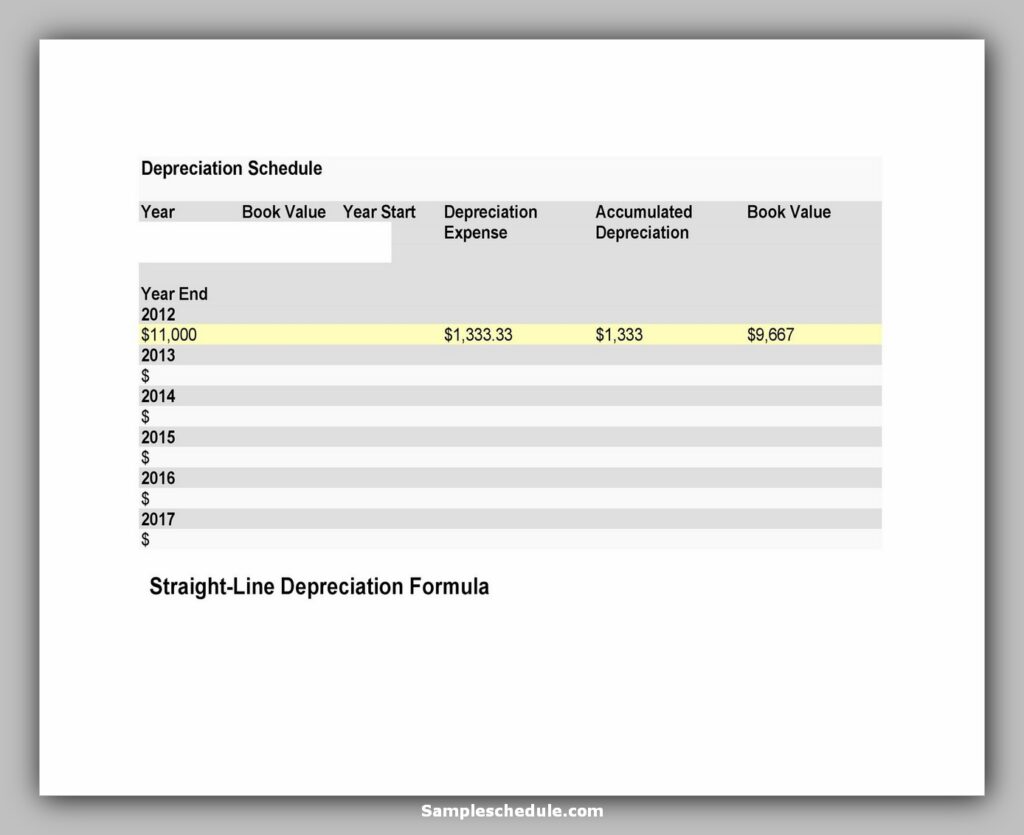

Use the Straight-Line Method

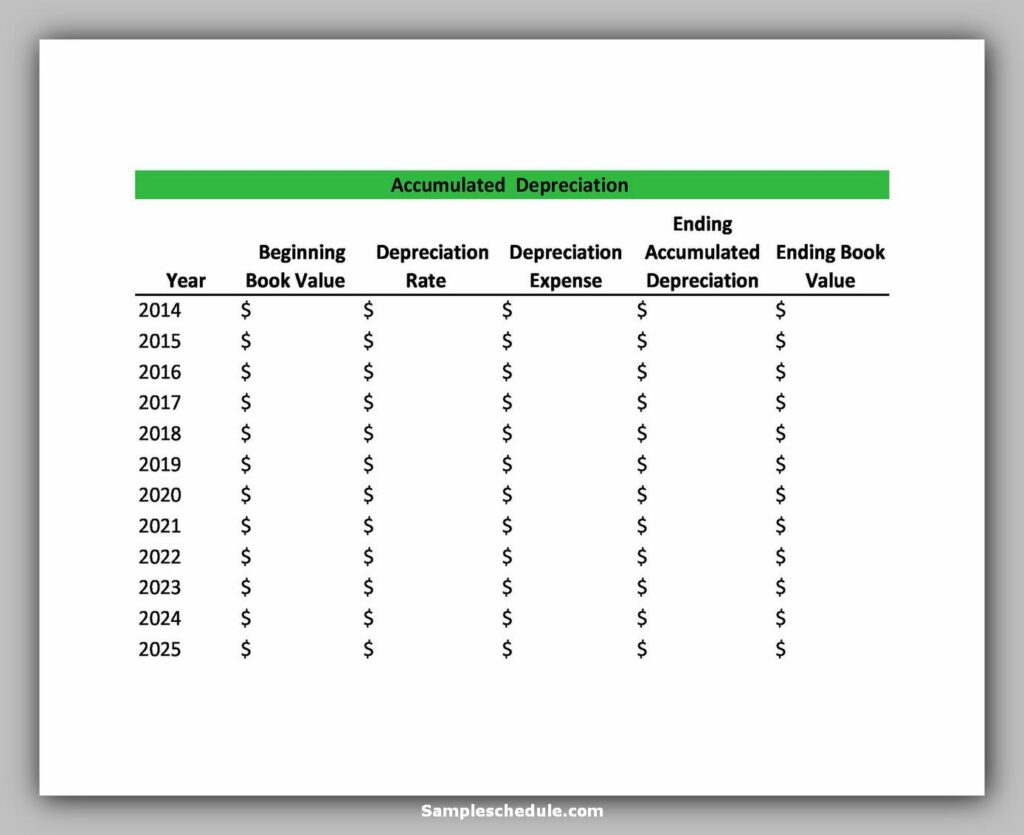

You need three columns:

- The first column records the depreciation deduction (also known as depreciation costs) that you want to take each year. The number in this column remains the same in each line because you deduct the same amount each year.

- The second column shows the depreciation accumulated at the end of each year.

- In the third column, the book value of the asset is displayed at the end of each year.

Use the Reducing-Balance Method

The only difference that exists here is that the first column (depreciation reduction) will vary by year as the accelerated value decreases at the beginning of the asset’s useful life.

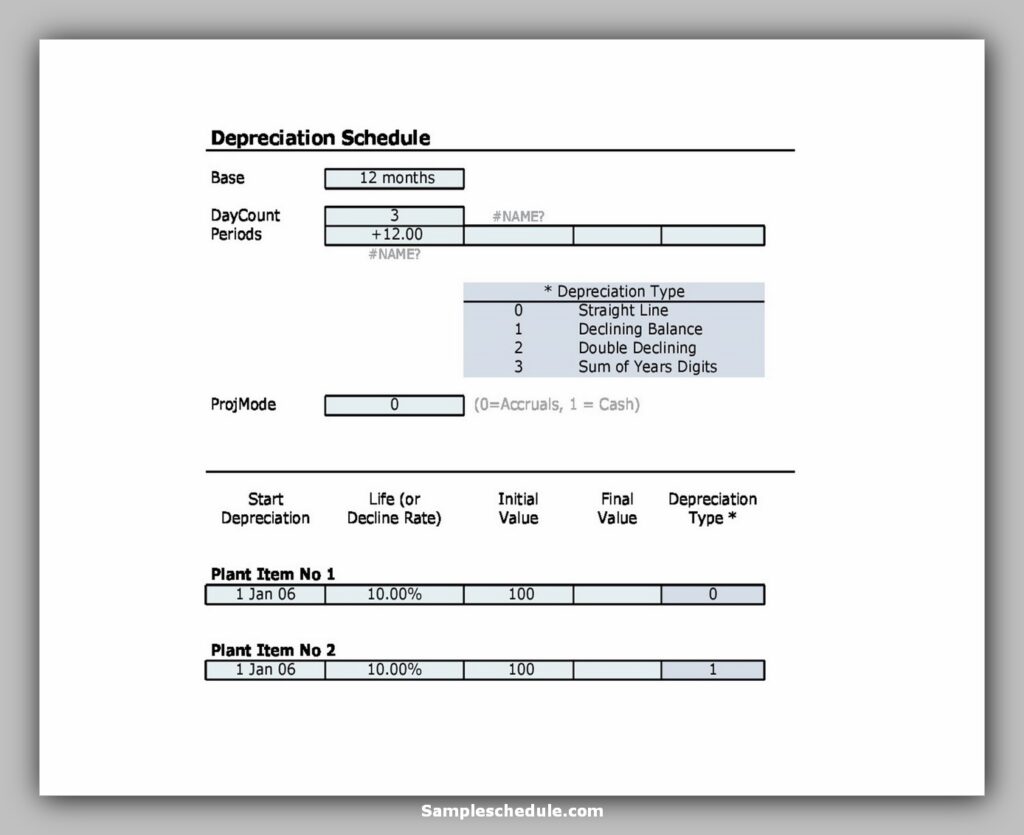

Types of depreciation

There are many ways to write off assets for your books or financial statements, but the IRS allows only one method to take write-offs on your tax return. As a result, some small businesses use one method for their books and another for taxes, while others choose to keep things simple by using the tax depreciation method for their books.

Let’s look at the options available for the book and the tax.

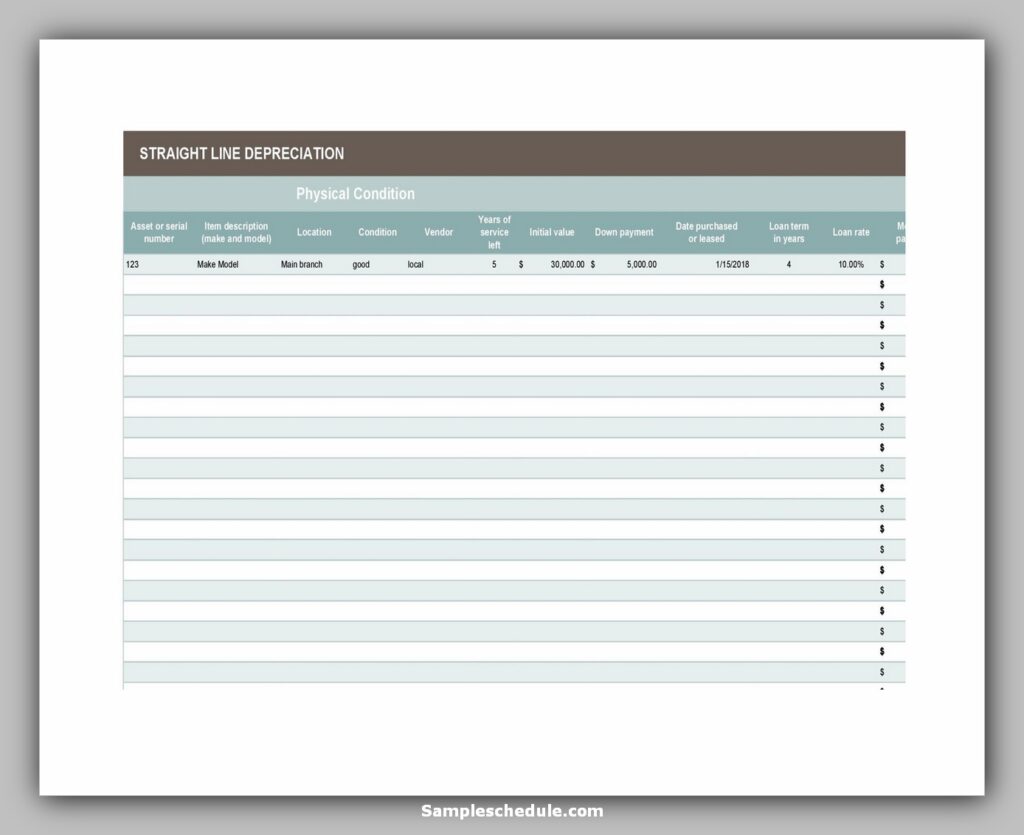

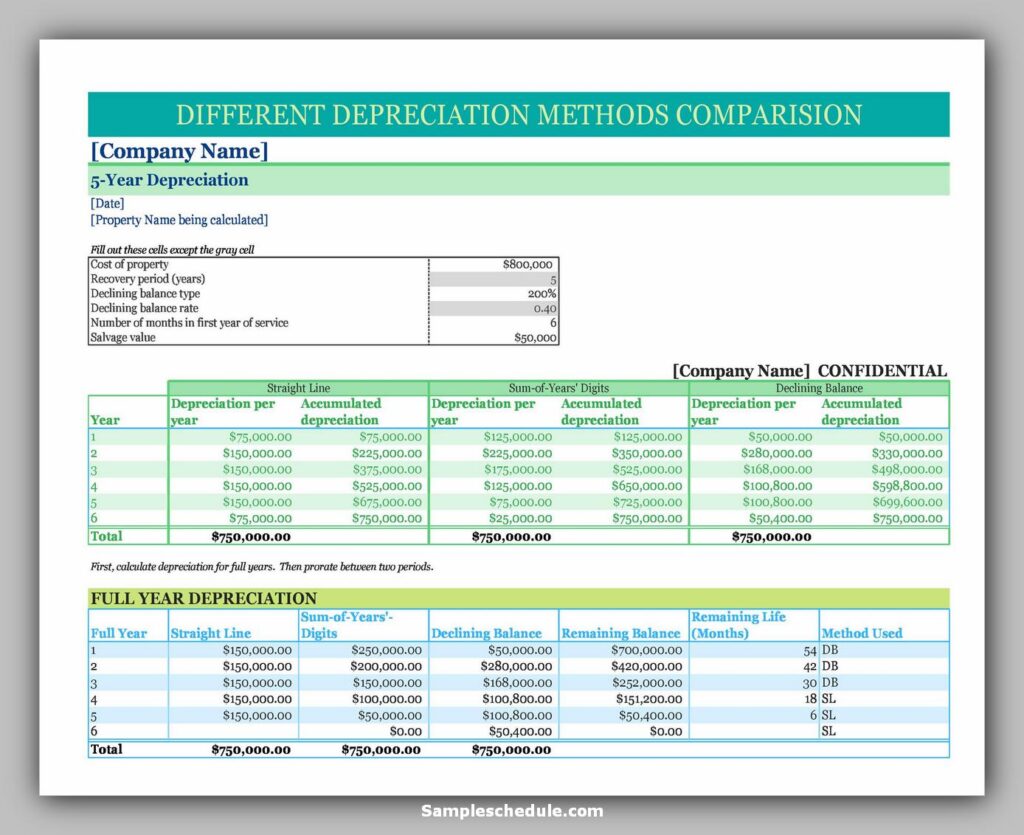

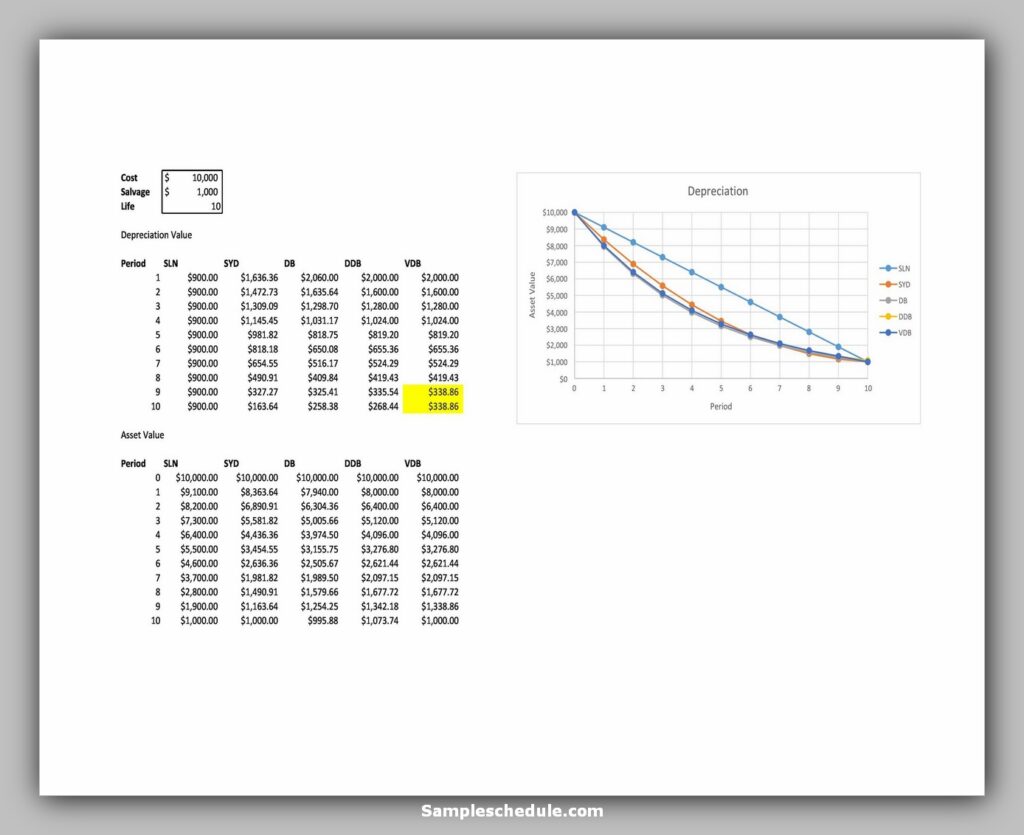

Depreciation in a straight line

The most common (and simplest) way to write off an immobilization is by the line method. This divides the value evenly over the life of the asset.

Depreciation and depreciation at double decrease

The dual-decreasing balance method is a slightly more complicated way to write off an asset. Allows you to clear more of the value of an asset in the days that are addressed immediately after the purchase and less later.

Depreciation of annual results

Depreciation of SYD depreciation (Year Sum) is another method by which you charge more than one asset in the first years of its useful life and less in subsequent years.

Depreciation units for production

The units of the production method are an easy way to erase a piece of equipment depending on the amount of work it does. “Production unit” can refer to something the equipment creates like widgets or the times it is in service.

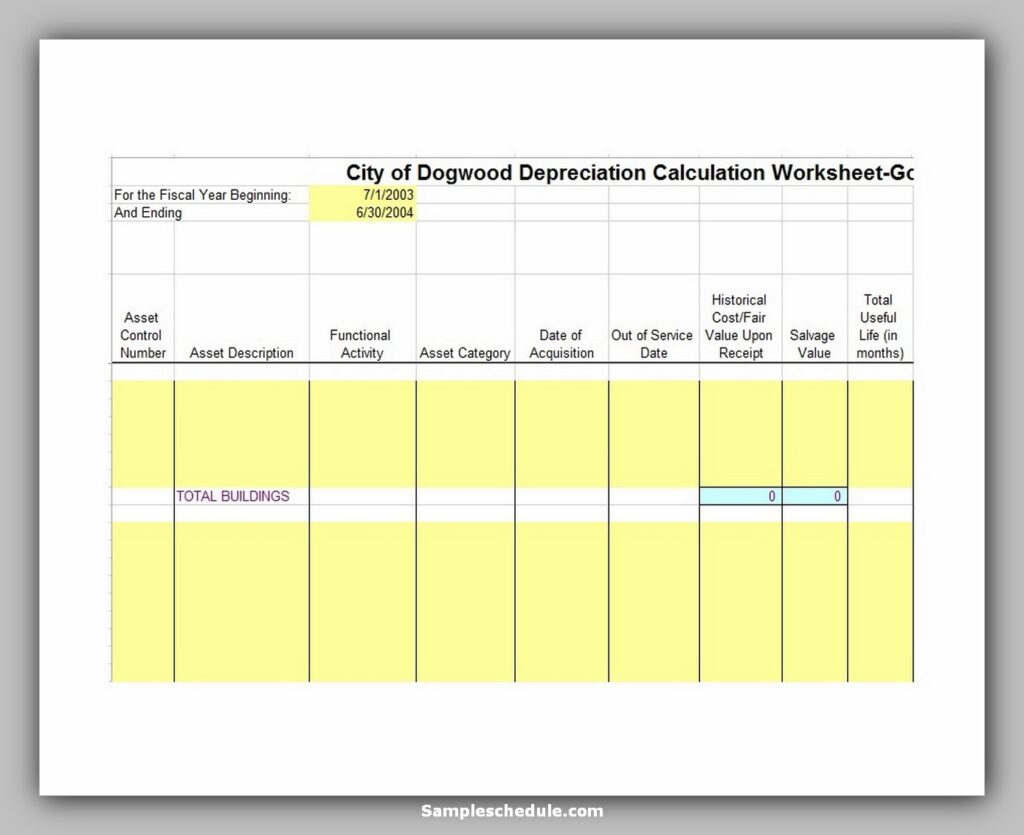

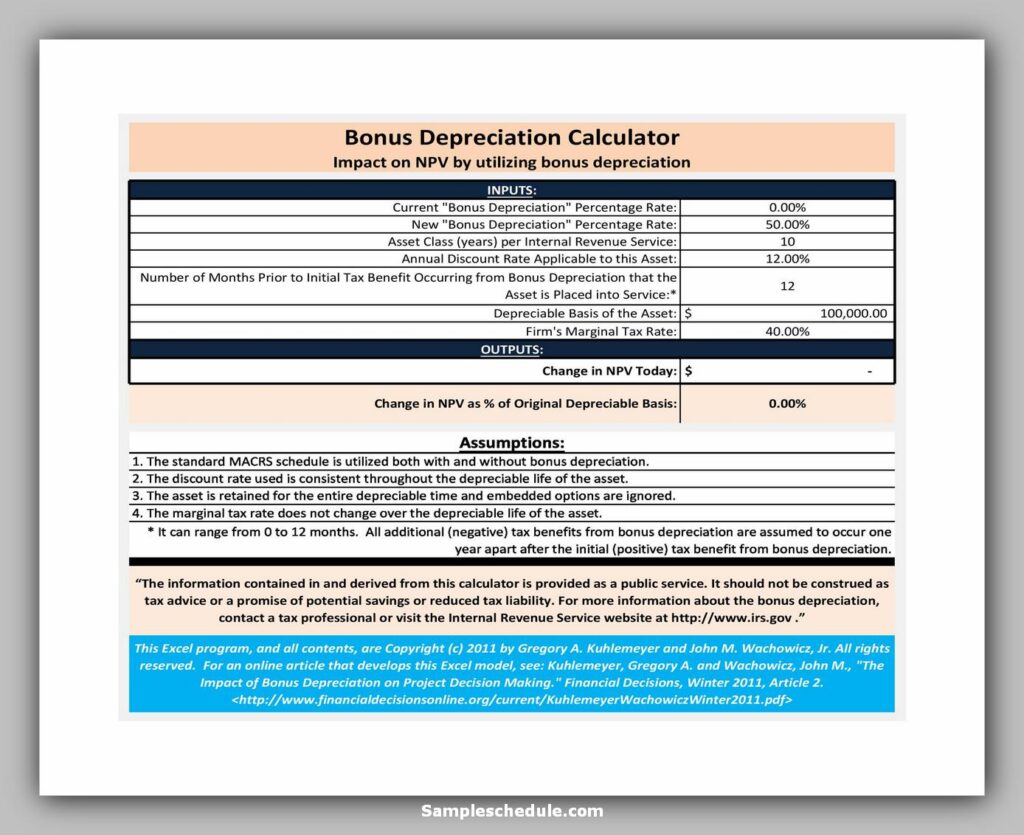

Modified Accelerated Cost Coverage System

You can find a detailed asset class table in IRS publication 946, Appendix B.

The Modified Accelerated Cost Recovery System (MACRS) is the method of depreciation that is generally required on a tax return. Under MACRS, assets are allocated to a specific asset class, and this category determines the life of the asset.

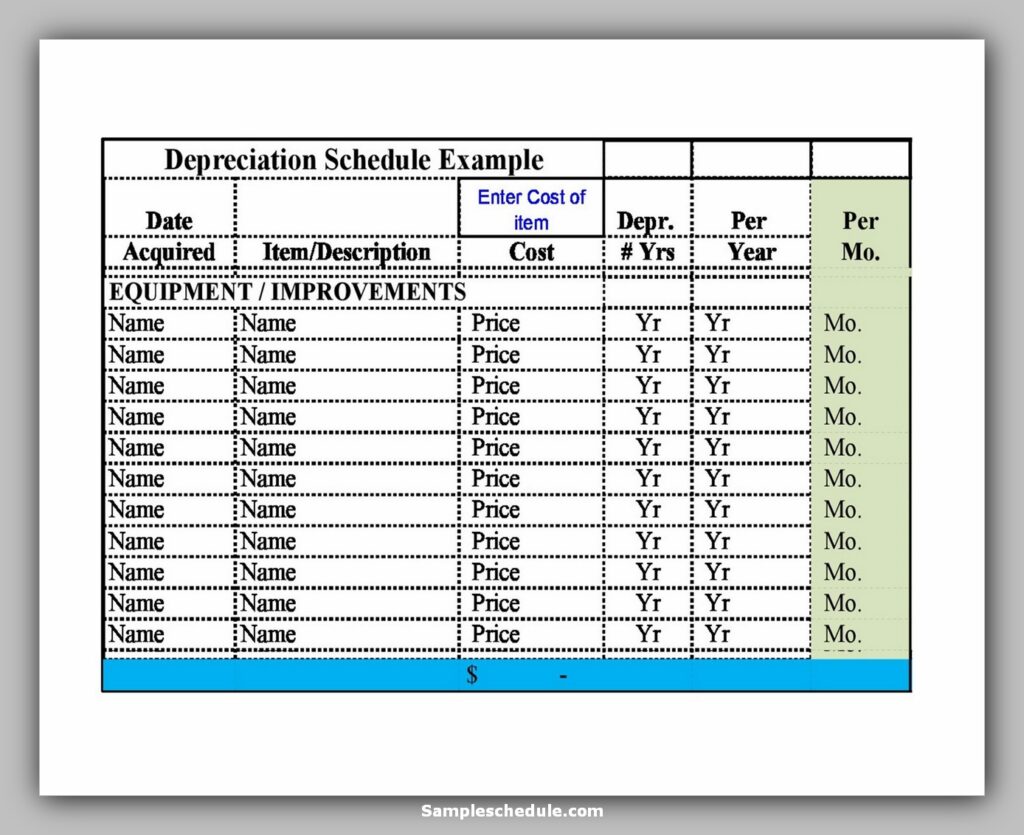

Sample Depreciation Schedule & Template