There’s a reason why corporate managers closely watch schedule variance. It can significantly impact a company’s financial health. When unexpected changes in customer demand, mergers, acquisitions, or employee turnover cause a company’s earnings to differ from expected, this is called schedule variance.

What is schedule variance?

The impact of schedule variance on project budget and timeline, with clear labels and a simple design

Schedule variance is a term used in accounting that refers to the difference between actual earnings and what the company expects to earn. Various factors, including unexpected changes in customer demand, mergers and acquisitions, and employee turnover, can cause this. When schedule variance is significant, it can impact a company’s financial health.

When companies are looking to calculate their schedule variance, they use an index known as the schedule variance index (SVI). The SVI is a numerical indicator that shows the degree to which actual earnings fall short of what was expected. It ranges from 0 (no variance) to 100 (maximum deviation).

When calculating the SVI, companies consider both positive and negative schedule variances. Positive schedule variance occurs when actual earnings are higher than expected, while negative schedule variance occurs when real earnings are lower than expected.

It can be a challenging problem to manage, as it can impact a company’s bottom line in many ways. To minimize the risk of schedule variance, companies must ensure that all potential contributors to variance are accounted for. This includes unexpected changes in customer demand, employee turnover, and mergers and acquisitions.

What are some factors that can cause schedule variance?

factors that can cause schedule variance

Many factors can cause a company’s earnings to differ from what was initially expected. Sometimes, these changes are due to changes in customer demand, while other times, they may result from external factors like mergers and acquisitions or employee turnover. When it is significant, it can greatly impact a company’s financial stability.

- One of the most common reasons to find schedule variance is changes in customer demand. For example, if sales volumes unexpectedly decline, this can lead to a shortfall in earnings. Other factors that can cause customer demand changes include inflation, currency fluctuations, and geopolitical events. Companies need to monitor these sorts of things to adjust their expectations accordingly.

- Mergers and acquisitions are also known to cause significant. When two companies join forces, their operations become intertwined, creating unexpected challenges. For example, one company might take on responsibility for another company’s legacy product lines. As such, there can be a lot of overlap between the two teams, leading to production disruptions.

- Similarly, if one company acquires another, the former employees may suddenly find themselves with new responsibilities. This can throw both departments into disarray and disrupt workflow. Because of this, it’s important to do extensive due diligence to ascertain any acquisition’s true value.

- Employee turnover can also have a big impact. Employees must transfer their skills and knowledge to someone else when they leave the company. This process usually requires some training or a learning period, which can lead to delays in production. In some cases, this delay may even exceed the original schedule. In other cases, new team members may need to be up to speed on the existing processes and procedures. This can lead to further disruptions.

- Finally, unforeseen technological changes can cause as well. Rapid technological advancements often bring new challenges that weren’t anticipated when the original plans were made. For example, one company might rely heavily on a certain software application, but that application might suddenly become obsolete. As such, the company would need to find a way to transition to a new system without causing too much disruption.

Various factors can cause schedule variance, and companies need to be aware of them to plan for potential disruptions by taking proactive steps.

What are the consequences?

The differences between planned schedule and actual schedule in a project

Schedule variance can have serious consequences for a company’s financial health. Significant can lead to revenue and profits losses, IRS penalties, and increased credit ratings. Companies must regularly monitor key performance indicators (KPIs) and adjust as needed to reduce the risk.

To understand how schedule variance affects a company, it is important to understand what it is. It is the difference between actual earnings and the company’s expectations. Various factors, including unexpected changes in customer demand, mergers and acquisitions, and employee turnover, can cause it. When it is significant, it can impact a company’s financial health in many ways.

For example, high costs may cause a company to miss sales goals or exceed budgeted costs. This can result in decreased shareholder value and increased vulnerability to external forces. Moreover, missed earnings milestones and increased costs can trigger costly penalties from the IRS. In extreme cases, it can lead to bankruptcy.

Companies should regularly monitor and adjust KPIs to mitigate the risk schedule variance. This includes ensuring that expectations are reasonable in the first place and not assuming that any changes will be minor. Additionally, companies should develop clear accountability structures and maintain tight controls over employee turnover. By taking these steps, companies can reduce the risk of experiencing significant schedule variance and ensure long-term financial stability.

What can companies do to reduce the risk?

The concept of schedule variance in project management

There are many different strategies that companies can use to reduce risk. These strategies include monitoring demand, adjusting staffing levels, renegotiating supplier contracts, and monitoring customer demand.

Monitoring demand is one of the most important strategies that companies can use to reduce risk. By understanding how customers spend their money, companies can be proactive in predicting future demand and adjust their production accordingly.

By negotiating better terms with suppliers, companies can reduce their experience. Suppliers often provide products or materials at a lower cost and schedule variance if companies are willing to negotiate beforehand.

Adjusting staffing levels is also a viable strategy for reducing the. Companies can better meet customer demand by adding or removing employees from production without incurring significant schedule variance.

However, none of these strategies can reduce the risk to zero. Some of them may even increase it slightly. Ultimately, companies must weigh each option’s pros and cons before deciding.

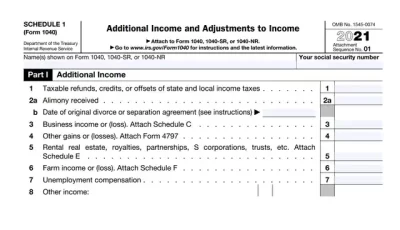

Schedule variance index

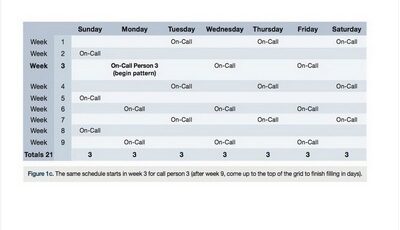

Basic project schedule with tasks, start and end dates, and progress bars

An index of schedule variance is a tool a company can use to measure the risk of schedule variance. It can help determine whether or not the company is experiencing significant levels of variance from its expectations. The index can be created using a variety of factors, including customer demand, employee turnover, and company performance.

When creating an index of schedule variance, companies should take into account a variety of factors. These include things like customer demand, employee turnover, and company performance. By considering these factors, companies can ensure that their index accurately reflects the risk of schedule variance.

It can help companies assess the risk of schedule variance. By understanding the risk level, companies can decide how to reduce it. Reducing the risk of schedule variance may require changing the company’s structure or processes.

The benefits include improved decision-making and quicker identification of risks. By knowing the risks associated with schedule variance, companies can take appropriate steps to mitigate those risks.

Companies must have an index of schedule variance to ensure they adequately protect themselves from the risk. By taking into account various factors, companies can create an index that accurately reflects the level of risk associated with variances from expectations.

Schedule variance positive

A project manager adjusting the schedule on a large calendar, with symbolic icons representing different project

When it is positive, it means that the company’s actual earnings are higher than what was expected. This can be a good thing, as it can help a company improve its performance. However, negative schedule variance can also occur, meaning the company’s earnings are lower than expected. When this happens, it can hurt a company’s financial health.

Several factors can cause unexpected changes in customer demand, mergers and acquisitions, and employee turnover. Management should use schedule variance to their advantage by taking advantage of opportunities that arise from these events.

The consequences depend on the size and significance of the discrepancy between actual and expected earnings. When it is small, it typically has little impact on a company’s financial health. However, it can impact a company’s performance and stock price when it becomes significant.

To limit the risk, companies should improve their forecasting abilities. By understanding customer demand better, companies can avoid making costly mistakes. Additionally, companies can gain new customers and market share by making acquisitions and partnering with other companies.

It is a good thing insofar as it can help companies improve their performance. However, companies should be careful not to allow schedule variance to become negative, which can significantly impact their financial health.

Schedule variance calculator

It can determine the magnitude of schedule variance for a given period. This information can help assess the impact of schedule variance on asset value and profitability, as well as manage risks and optimize performance.

Schedule variance percentage

When schedule variance exists, it can impact a company’s financial health. To reduce the risk, companies must understand the factors that can cause it and take steps to prevent them from happening.

Several factors can cause schedule variance. These include unexpected changes in customer demand, mergers and acquisitions, and employee turnover. When these events occur, the company may be unable to meet its earnings targets.

One way to measure it is by calculating the percent difference between actual earnings and the company’s expected earnings. This percentage is known as the schedule variance index (SVI).

The consequences of high schedule variance can be serious. If the SVI exceeds 3%, it can lead to a loss of shareholder value. Additionally, if the SVI exceeds 5%, it can trigger a review from the SEC.

Companies must understand their customers and their business environment to minimize the risk. They should also have a process to monitor and adjust their plans.

Negative schedule variance means

A company’s actual earnings are lower than expected, known as negative schedule variance.

There are various reasons why this can happen, including unexpected changes in customer demand or employee turnover.

The consequences of negative can be significant for a company. If it’s substantial enough, it can lead to financial trouble. To prevent this, companies must vigilantly monitor their customer and employee demand. They can use tools like budgeting or forecasting to adjust their plans accordingly if necessary.

As businesses become more complex, managing them becomes even more important. With the right tools and strategies, companies can keep their financial health intact while executing their plans.

Schedule variance example

When things don’t go as planned, schedule can result. Many factors can cause this discrepancy, but understanding them is key to preventing it from harming your business.

We’ll look at what it is and some common causes. We’ll also cover the consequences of significant variance and give tips on minimizing its negative impact.

Additionally, we’ll provide an index that measures it and a calculator to help you calculate it. Finally, we’ll discuss agile and how its approach to variability can help mitigate risk.

Schedule variance percentage formula

When schedule is significant, it can impact a company’s financial health. The percentage formula can help you calculate the percentage of the variance between actual earnings and what the company expected to earn.

This can be useful for calculating the severity and identifying areas where improvement is needed.

The variance percentage formula is easy to use and can be used in Excel or other spreadsheet software.

The schedule variance formula pump is also helpful for comparing companies with different levels. By understanding the percentage of the variance between actual earnings and what was expected, you can make informed decisions about improving your company’s operations.

Schedule variance in agile

Agile methodologies can be extremely beneficial when reducing the risk of schedule variance. By encouraging collaboration and communication, agile allows teams to adapt quickly to changes in the environment. Additionally, agile processes often rely on quick decisions and actions. As a result, agile projects usually take advantage of opportunities that others might miss.

However, despite the advantages of agile, It can still occur. Despite the best efforts of teams and project managers, unexpected changes can occur, which can cause schedule variance. When this happens, it can seriously affect a company’s financial health.

Fortunately, there are many ways that companies can reduce the risk. For example, by using detailed diagrams and status reports, managers can keep track of progress and ensure that changes are made as soon as necessary. Additionally, agile processes often encourage communication between team members. When all parties know the changes, they are more likely to make appropriate adjustments.

Overall, agile methodology is an excellent tool for managing risk. Organizations can use these techniques to ensure their projects are completed on time and within budget.

Read Also: 30+ Free Employee Shift Schedule Template Excel.

Conclusion

In Summary, schedule variance is a term used in accounting that refers to the difference between actual earnings and what the company expects to earn. When it is significant, it can impact a company’s financial health. Companies can reduce the risk by tracking actual earnings against expected earnings and implementing measures to prevent unexpected changes in customer demand from causing significant.

When managing, companies must be willing to make sacrifices. Often, this means sacrificing profits. However, by planning and budgeting carefully, companies can minimize the impact on their financial health. Despite the risks, it is an inevitable part of the business. And while it can be difficult to manage, there are steps that companies can take to minimize its impact.