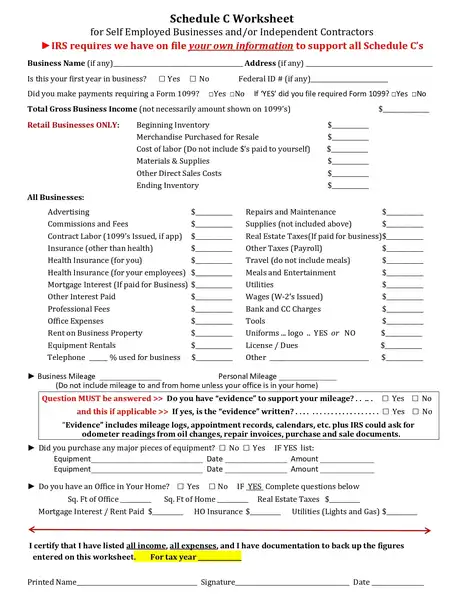

The Schedule C Expenses Worksheet is for people with a small business. It’s a paper where they write down all the money they spend on their business.

This includes what they buy for work, money for ads, or paying helpers. This worksheet helps them with their taxes to see if their business made money. Their business needs to write down every cost. For more help, they can talk to someone who knows about taxes or look at the IRS website.

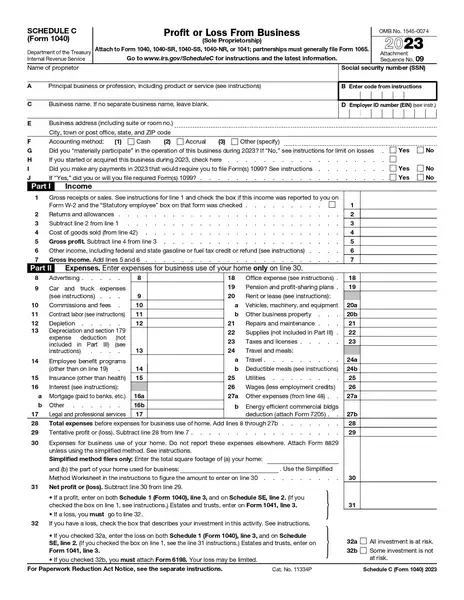

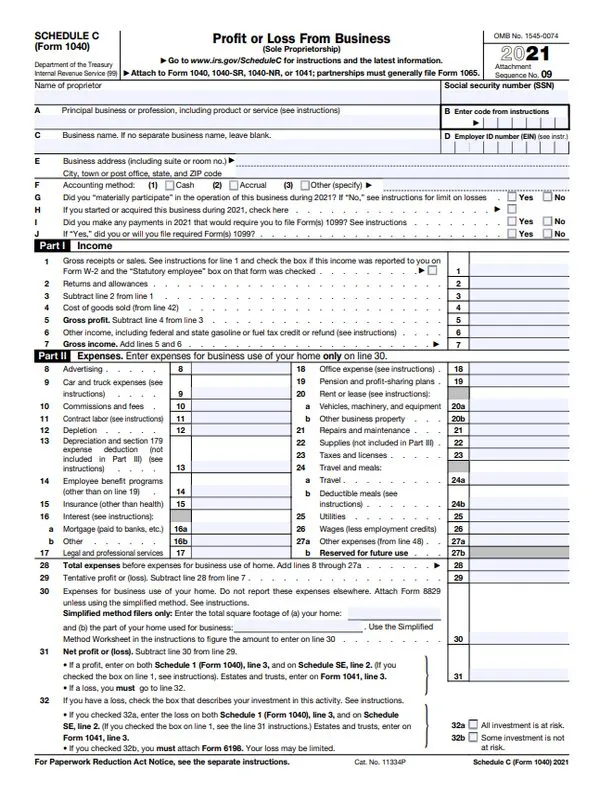

Schedule C template is a special form you use when you do your taxes. It’s for people who own their own business by themselves. This form helps you tell the IRS (the tax people) about the money your business made and spent.

Importance

It’s really important to write down all the money your business makes and its spending. This helps you fill out Schedule C the right way. Doing this enables you to follow the rules and even saves you money on taxes. You must be careful and accurate when reporting your business money on Schedule C.

Getting Started with Schedule C

Updates for 2023

For 2023, there are some changes to Schedule C that you should know about:

- Standard Mileage Rate: This is the amount you can claim for each mile you drive for your business. In 2023, it’s gone up to 65.5 cents per mile. This is more than it was in 2022.

- Business Meals Deduction: Now, you can deduct 100% of your business meals. This is a special rate that will last until 2025.

Choosing Accounting Methods

When you fill out Schedule C, you must pick how to track your money. There are two main ways:

- Cash Method: This is when you only count money when it comes in or goes out. For example, you only write down income when you get paid, not when you do the work.

- Accrual Method: This one is a bit different. You count income when you earn it, even if you have not been paid. And you count expenses when you get the bill, not when you spend it.

Which method you choose can affect how much tax you pay. The cash method is usually simpler, especially for small businesses.

Identifying and Reporting Business Income

Calculating Gross Income

When you have a business, the first thing you need to figure out for Schedule C is your gross income. Gross income is all your business makes before you take out any expenses. Here’s how you can calculate it:

- Add Up Sales: Add everything you sold or the services you provided. This is your total sales or receipts.

- Returns and Allowances: If you had any returns or gave any discounts, subtract those from your total sales.

- The Result: The number you get after subtracting returns and allowances from your total sales is your gross income.

Types of Income

There are different kinds of money your business might make. Here are some common types:

- Payments for Services: You get money for doing a job or providing a service, like fixing someone’s car or cutting someone’s hair.

- Interest: If you have money in a bank account for your business and it earns interest, that’s another type of income.

- Rent from Business Property: If you own a place and rent it out for business, the money you get from rent is also income.

Remember, it’s important to write down how your business makes money. This helps you fill out Schedule C right and ensure you pay the correct amount of tax.

schedule c expenses worksheet by Kristels.com

Expense Categories

Here are some common ones:

- Supplies: Things you buy like paper, pens, or cleaning products.

- Utilities: Bills for electricity, water, or the internet that help keep your industry operating.

- Rent: If you spend to use an area for your company, like an office or a store, that’s your rent payment.

- Wages: Money you pay to people who work for you.

- Advertising: Costs for letting people know about your business, like ads or flyers.

Tracking Expenses

To complete It correctly, you must follow your costs. Here’s how:

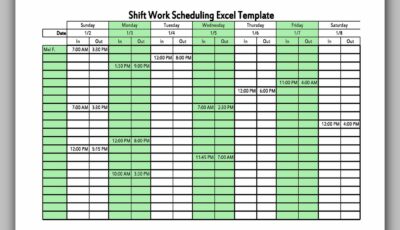

- Use Spreadsheets: You can use programs like Excel to write down your expenses. Make a list with columns for the date, amount, and what the expense was for.

- Accounting Software: There are special computer programs that make tracking expenses easier.

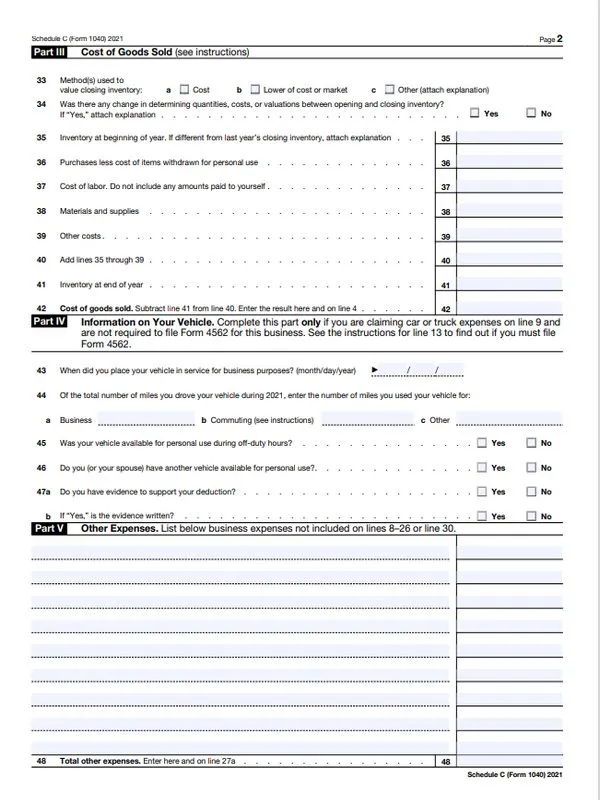

Special Sections and Considerations

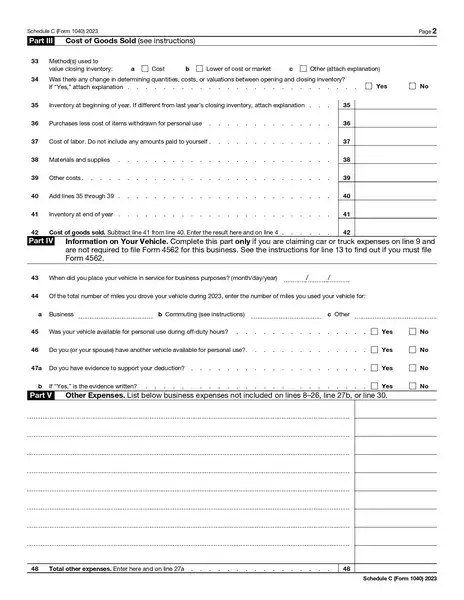

Cost of Goods Sold (COGS):

- Starting Inventory: Write down the value of your products at the start of the year.

- Add Purchases: Add the cost of new products bought during the year.

- Completing List: Subtract the value of products left at the year’s end.

- Your COGS: This is the final number you get after subtracting.

Home Office Deduction:

- Space Used: Determine how much of your home you use for business.

- Simple Method: Multiply the business area by a set rate.

- Regular Method: Add up actual costs like rent and utilities, then multiply by the percentage used for business.

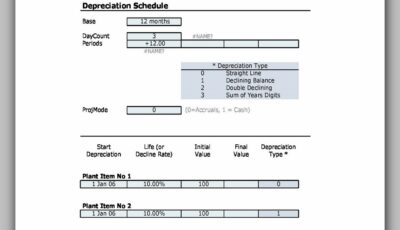

Depreciation:

- Cost of Item: Write down the price of items like computers or machinery.

- Life of Item: Guess how many years you will use them for your business.

- Depreciation Each Year: Divide the cost by the number of years to determine the amount for each year.

It’s always a good idea to talk to a tax expert or look at the IRS website for more details.

Maximizing Deductions with Schedule C

Comprehensive List

Here’s a list of common expenses you can deduct:

- Supplies: Things like paper, pens, and other items you utilize for your company.

- Rent: If you spend money on a space for your company, like an office,

- Utilities: Bills for electricity, water, or internet utilized in your company.

- Advertising: Costs for promoting your company, like ads or flyers.

- Wages: Money paid to people who work for you.

- Insurance: If you buy insurance for your company.

- Travel and Meals: When you travel for company, and sometimes dinners with customers.

- Car and Truck Costs: Costs of operating a car for a company.

- Legal and Professional Fees: Money paid for services like lawyers or accountants.

Documenting Expenses

It’s really important to keep track of all these expenses:

- Save Receipts: Keep all your receipts for what you spend.

- Record Details: Record what each payment was for and when you spent the money.

- Use a System: You can use a notebook, a spreadsheet, or special software to organize your records.

Mileage Tracking

Recording Mileage

If you drive for your business, you can also deduct those miles. Here’s how to record it:

- Write Down Your Miles: Track how far you drive for business. Write down your start and end mileage each time.

- Note the Purpose: Write down why you were driving, like visiting a client or buying supplies.

Using Mileage Templates

You can make mileage tracking easier:

- Use Templates or Apps: Some templates and apps help you track your miles.

- Keep Good Records: Whether you use an app or write it down, keep accurate records of your business driving.

Depending on your expenses and mileage, you can maximize your tax deductions.

Using Digital Tools for Schedule C

Digital vs. Physical Records

Using digital tools for keeping your business records has some big advantages over the old way of writing everything down on paper:

- Easier to Organize: Digital records are easier to sort and find. You can quickly search for what you need on a computer.

- Safer: Digital records can be backed up online, so you won’t lose them if something like a fire or flood happens.

- Space-Saving: They don’t take up physical space like big paper folders.

- Environmentally Friendly: Using less paper is better for the environment.

- Time-Saving: Digital tools can add numbers and organize data faster than by hand.

Integrating Digital Calendars

Digital calendars can be a big help in managing your business finances. Here’s how you can use them:

- Set Reminders: Use digital calendars to remind you of important dates, like when taxes are due or when you have business meetings.

- Track Deadlines: Keep track of when bills need to be paid or when clients need to be billed.

- Plan Ahead: Use your digital calendar to plan your weekly or monthly financial tasks.

Understanding and Mitigating Audit Risk

Common Red Flags

The IRS sometimes checks businesses more closely, which is called an audit. Here are some things that might make the IRS look at your business:

- Losses Every Year: If your business says it loses money year after year, the IRS might wonder why.

- Big Changes in Income: If the money you make goes up and down a lot from year to year, it can be a sign to check.

- Very High Expenses: If your business spends much more money than similar businesses, the IRS might ask why.

- Mistakes on Your Tax Form: Simple mistakes like math errors can also make the IRS look closer.

To avoid these red flags:

- Be Honest: Always tell the truth about how much your business makes and spends.

- Be Consistent: Keep the same way you report your business yearly.

- Check Your Work: Before you send your tax form, make sure everything is correct.

Record-Keeping Strategies

Good records help a lot if the IRS asks about your taxes. Here’s how to keep good records:

- Save Everything: Keep all receipts, bank statements, and records of money you spend and make.

- Write Down Details: For each expense, write down when, how much, what it was for, and why it was a business expense.

- Separate Business and Personal: Keep your business money separate from your money.

- Use Good Tools: You can use computer programs or apps to help keep track of everything.

- Stay Organized: Keep your records in order and up to date.

Engaging a Tax Professional

When to Seek Professional Help

It’s smart to ask a tax expert for help sometimes. Here are good times to do that:

- Complicated Taxes: If your business taxes are hard to understand, a tax person can help make them right.

- Starting a New Business: When you first start your business, a tax expert can show you how to set it up for taxes.

- Big Changes in Your Business: If your business changes a lot, like making more money or selling new things, a tax person can help you know what to do for taxes.

- If You’re Not Sure: If you have questions or need clarification about taxes, it’s a good time to talk to a tax person.

Audit Representation

If the IRS wants to check your taxes closely, a tax expert can be very helpful:

- Expertise: They know much about tax rules and can talk to the IRS for you.

- Less Stress: They can handle the IRS, so you don’t have to worry.

- Better Results: They might help you do better in the audit, especially if it’s tricky.

Tax experts are great when taxes are tough or if the IRS looks at your business.

Schedule C Template

Schedule C Expenses Worksheet – 2023 SCHEDULE C Form f1040sc By IRS GOVE page 0001

Schedule C Expenses Worksheet – 2023 SCHEDULE C Form f1040sc By IRS GOVE page 0002

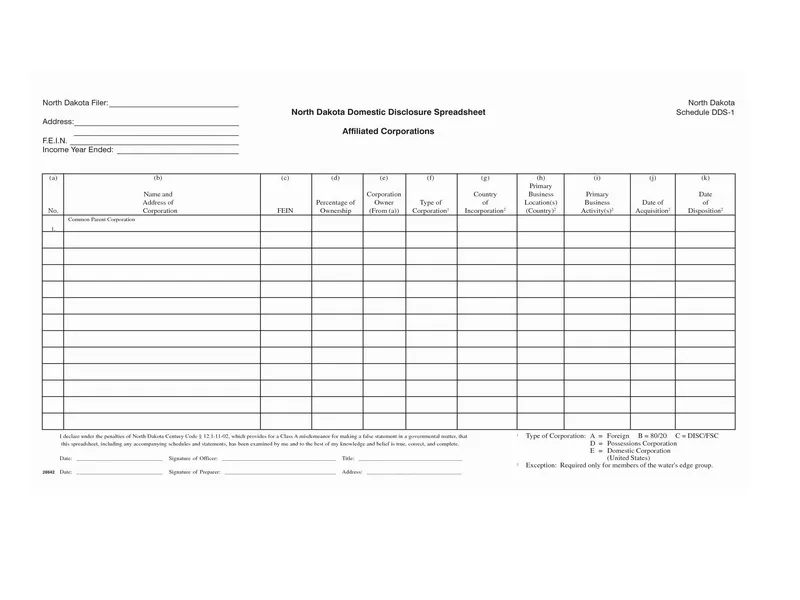

Schedule C Template 01 By irs.gov

Schedule C Template 02 By irs.gov

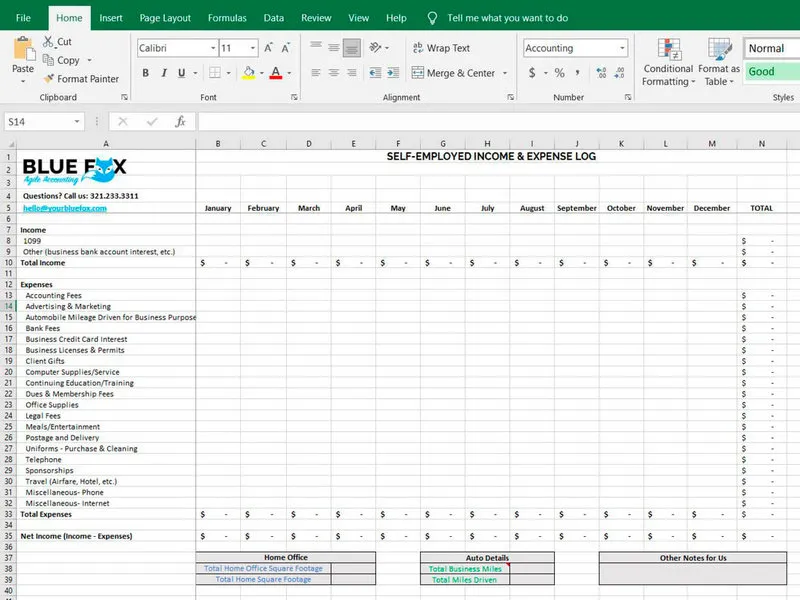

Schedule C Template Excel

Microsoft Excel is the most commonly used software to create schedule c within a business budget. Creating a schedule c plan can be extremely time consuming and a great deal of planning should go into such a task.

Once you have created a c plan for your business, there are certain steps that must be taken to ensure that all the companies’ assets are properly cabled and that your financial data is accurate. One way to create a quality schedule c plan is to use a schedule c template. A schedule c template is a pre made template of your c network that can be edited to incorporate all of the necessary information to complete a proper c plan for your business.

Schedule C Template Excel – Schedule C Expenses Worksheet

Schedule C Expenses Worksheet – Schedule C Template Excel For Self Proprietors By yourbluefox.com

FAQ

Who should use Schedule C?

People who own a business, like a shop or a freelance service, use Schedule C.

What information do I need for Schedule C?

You need to know all the money your business made and spent, like what you paid for supplies or rent.

How does Schedule C affect my taxes?

The profit or loss you report on Schedule C changes how much tax you pay.

Conclusion

- Important for Business: Schedule C is a form for people with a business. It helps tell the IRS about money made and spent.

- Keep Good Records: It’s very important to write down all the money that comes in and goes out of your business.

- Use the Right Categories: Put your business spending in the right groups, like what you spend on supplies or travel.

Final Recommendations

Here are some tips to do well with Schedule C:

- Update Often: Keep your Schedule C form updated. Add new things as they happen.

- Check Your Work: You often look at your Schedule C to ensure everything is right.

- Ask for Help if Needed: If you need more clarification, ask someone who knows much about taxes.

Additional Resources

Further Learning

For more details about Schedule C and taxes, you can look at:

- IRS Website: The IRS has lots of information and guides about Schedule C.

- Tax Help Books: Some books are written to help you understand taxes better.

- Online Courses: There are online classes where you can learn more about taxes for your business.

Remember, doing your Schedule C right is a big part of your business. It helps you stay on track with your taxes!