You can avoid hefty tax penalties this year with just a few simple steps. By following the proper filing procedures and using the right Schedule 3 tax form, you can ensure that your taxes are filed on time and without any punishments. Consult an accountant or tax preparer if you require assistance filing your taxes.

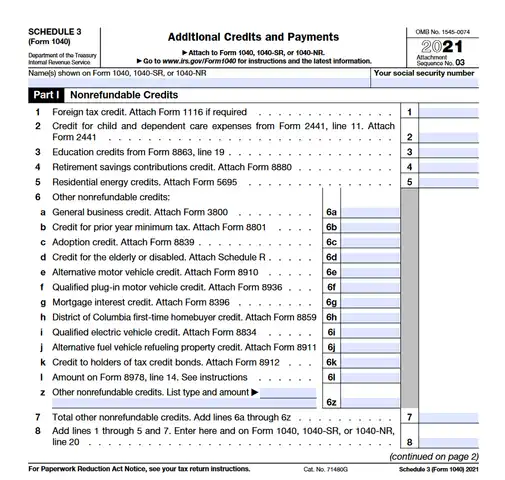

What is a Schedule 3 tax form?

A Schedule 3 tax form is a form that people and sole proprietors must file if they have taxable earnings over $100,000. This form can be used to estimate your tax liability and can be confused. If you are not filing your taxes on time, you may be subject to a 5% punishment.

Schedule 3 Tax Form

How can you avoid the penalty?

There are several ways to avoid punishment. The most common way is to file your taxes using the correct forms. The correct form for you depends on your earnings and filing status. You can also get assistance filing your schedule 3 tax form. Help such as tax preparers, online support, and government websites are available. If you require help filing your schedule 3 tax form, don’t hesitate to reach out for assistance.

What happens if I don’t file a schedule 3 tax form?

You may face penalties if you don’t file your taxes by the due date. The penalty for not filing a schedule 3 tax form can be as high as 5% of your taxable income. If you don’t file your taxes on time, you may be unable to take the benefits of your deductions and credits. You can avoid the penalty by filing your taxes on time and using the correct forms. If you don’t file a schedule 3 tax form, you may be unable to claim certain deductions and credits. Filing a schedule 3 tax form is important for avoiding penalties and getting the most out of your taxes.

What is the penalty for not filing a schedule 3 tax form?

You may face a penalty if you do not file your taxes on time. This penalty can be as high as 5% of your taxable income. To avoid the penalty, file your taxes on time and use the correct forms.

The penalty for not filing a schedule 3 tax form is typically 5% of your taxable income. However, there are certain exceptions to this rule. If you are an individual with a net income under $75,000, the penalty is only 2%. Additionally, if you are a small business or sole proprietor with a net income under $150,000, you are also exempt from the 5% penalty.

If you do not file your taxes by the due date, you may face penalties, including late payment fees, interest charges, and even penalties for late-filed returns. In some cases, the IRS may consider your return to be filed when the agency receives it. However, this is not always the case. If you do not file your taxes on time, it is important to contact the IRS as soon as possible to find out more about your situation.

There are several different ways to file your taxes. You can file your taxes by mail or electronically. You have the option to file them by mail or electronically, but you must file them by the due date. Additionally, if you file electronically, you must use the correct forms. Forms 940, 940-A, 941, 943, and 944 are all used for filing taxes electronically.

Filing your taxes on time is the best way to avoid penalties for not filing a schedule 3 tax form. You can get help filing your taxes by contacting an accountant or using online calculators. If you need assistance filing your taxes on time, don’t hesitate to contact the IRS.

Can I get an extension to file my schedule 3 tax form?

The IRS offers several extensions to file your taxes. You can check the status of your application online or by calling the IRS toll-free number. You may be subject to penalties and interest if you don’t file your schedule 3 tax form on time. You need to know a few things to apply for an extension.

If you are behind on your taxes and need time to catch up, you may be able to get an extension. You may be able to ask for a temporary exemption from the 5% penalty. You can check the status of your application for an extension online or by calling the IRS toll-free number. You may be subject to penalties and interest if you don’t file your schedule 3 tax form on time. However, you also need to know a few things to apply for an extension.

If you have extenuating circumstances that led to your not filing your taxes on time, you may be able to ask for a temporary exemption from the 5% penalty. You will need to provide evidence that shows how filing on time would cause greater hardship than granting the exemption. Additionally, you must show that you have taken all appropriate steps to rectify the situation. There is no guarantee that you will be granted an exemption, but it is worth checking out your options.

You can check the status of your application for an extension online or by calling the IRS toll-free number. You may be subject to penalties and interest if you don’t file your schedule 3 tax form on time. File your taxes on time this year and avoid costly consequences! Read Also: Free Schedule B 941 Form: What You Need to Know

What information do I need to file a schedule 3 tax form?

If you are an individual or sole proprietor, you must file your taxes using the correct forms. To avoid penalties, file your taxes on time and use the correct forms.

Schedule 3 is the most common form used to file taxes. Individuals or sole proprietors typically use it.

To file a schedule 3 tax form, you must include information about your income, expenses, and deductions. You may also need to include information about your losses and credits.

To file a schedule 3 tax form, you must have all the necessary information. Make sure to keep track of your receipts and records to ensure accuracy.

If you don’t have all the necessary information, you can get help from a professional tax preparer. However, you may still be liable for penalties if you file your taxes late.

To avoid penalties for not filing your taxes on time, make sure to file your taxes by the due date. Don’t hesitate to ask a tax professional if you have any questions.

How do I know if I need to file a schedule 3 tax form?

If you are an individual or sole proprietor, you may be liable for a Schedule 3 tax form penalty if you do not file your taxes by the due date. This penalty can be as high as 5% of your taxable income. To avoid the penalty, file your taxes on time and use the correct forms.

If you are unsure if you need to file a schedule 3 tax form, you can contact a tax professional. They can help determine if you are liable for a penalty and give you the correct forms to file.

You can also find more help with filing your schedule 3 tax form online or by contacting a local tax office.