Are you trying to stay on top of your military duties but missing a lot of work because you don’t have a schedule b 941? You’re not alone! If you are in the military or are supporting someone in the military, you need to have an accurate and up-to-date schedule b 941. This schedule keeps track of all your shifts, absences, and other obligations.

Even if you’re not in the military, having a proper schedule b 941 is important. Every person needs some time away from work now and then, so it’s always better to know when those times will be.

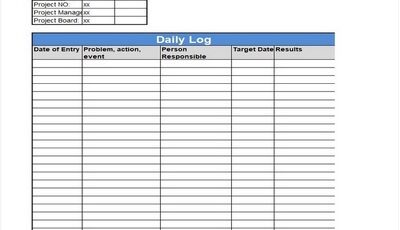

The different columns on your schedule b 941 mean different things depending on your deployment stage. For example, the “Needed” column indicates how many hours per day or week you are needed at work. The “Absence” column shows how many days ago your shift ended, and the “Shifts.”

Everyone needs a schedule b 941, whether you are in the military or not.

The 941b schedule is an important tool that you can use to stay organized and up to date on the latest changes. It keeps you informed of important events and notices, helps avoid missing out on important information and is easier to access and use in electronic format.

Having a 941b schedule does not require extra work; it just happens as part of your daily routine. For example, suppose there are announcements or updates about your job or military unit posted on websites or social media platforms like Facebook or Twitter.

In that case, it’s natural for you to check these sources every day. However, this type of constant monitoring can be stressful and disruptive if everything has to come into focus at once – which is usually the case when major changes happen suddenly.

That’s why having a schedule b 941 in electronic form can be so helpful; it allows all relevant notifications (and their corresponding details) to be easily accessible at your fingertips without having to search through piles of papers strewn all over your desk.

What is schedule b 941?

schedule b 941

A 941b schedule is a type of medical leave where the employee continues to receive their full salary and benefits.

A 941b schedule can be used as a temporary or permanent replacement for regular sick days.

Using a 941b schedule does not affect an employee’s retirement status.

When should you use a schedule b 941?

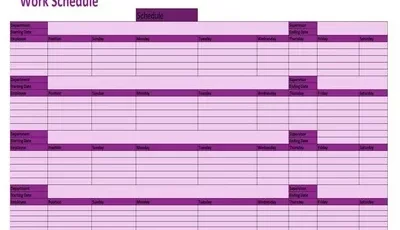

When you have unpredictable work hours or your business is growing rapidly, it’s important to use a 941b schedule. A 941b schedule allows for flexible working hours that can help minimize disruptions and maximize productivity. Additionally, using a 941b schedule will help avoid overtime costs.

A typical workweek in the United States consists of 40-hour weeks with 5 days of paid time off (40 x 5 = 250). But what if you have unpredictable work hours? For example, one week, you might be scheduled for 8 am to 4 pm, but on another week, your job may require you to be at the office from 7 am until 10 pm.

In this case, your employer would need to create two different schedules: one for when your normal routine is followed and another for when necessary deviations. This creates unnecessary paperwork and headaches down the road.

By default, most employees in America are required to follow a standard workweek consisting of Monday through Friday, 8 am – 5 pm, with 1 day off every week (Monday), regardless of their usual working hours or workloads.

Companies who want their employees to adhere strictly to these traditional standards often struggle because their workers frequently request exceptions* (*exceptions include things like maternity leave/ paternity leave).

What do the different columns on my schedule b 941 mean?

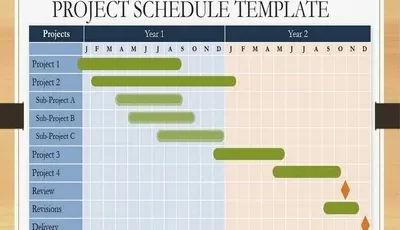

Each column on your schedule b 941 represents a different phase of a project’s life.

The columns on the schedule b 941 represent different stages in a project’s life.

The column headings on the schedule b 941 summarize the information in that column.

How can You get copies of my current schedule b 941?

To keep track of your 941b compliance, you must have a copy of your current schedule. You can email or fax it to us; our customer service team is happy to help you with any questions.

Although the IRS has made many changes to the 941b program in recent years, understanding what’s on your current schedule is still important for avoiding potential penalties. That’s why we highly recommend that all landlords keep a copy of their 941b schedule handy, even if they only occasionally use it as a reference.

When emailing or faxing in your 941b Schedule, ensure all required information is included and send the document in its entirety (including any attachments). It’s also helpful to print out a hard copy for easy reference. And don’t forget: never alter or destroy any copies of this documentation!

If you have any questions about your 941b schedule, don’t hesitate to get in touch with the customer service team at 866-746-9241 ext 2

Who can make changes to my schedule b 941?

As the 941b coordinator for your business, you must understand who can make changes to your schedule b 941. Changes to the 941b schedule require administrative closure and a Notice of Intent to Modify. Only authorized personnel can make changes, and all requests for changes must be submitted in writing.

To ensure compliance with state law and safeguard against unauthorized modifications, only authorized personnel may make significant or substantive changes to your company’s941B tax return filing status or other tax-related information on file with us (see Section 11).

This includes not just employees designated by you as responsible for preparing or administering Uncle Sam’s share of this annual corporate income tax liability but also independent contractors acting within their capacity as officers, directors, trustees, agents, or employees of an affiliated group member respondent engaged in such activity on behalf of the affiliated group member during any part of the calendar year (see Internal Revenue Code Sections 3504(a), 7701(a)(27)).

Note Any individual–whether inside or outside your organization–who attempts without the proper authorization to modify any aspect of our records relating to filings under IRC Section 941 will be subject to criminal penalties, including fines and imprisonment.

How often should I review my 941b schedule?

You should review your 941b schedule at least once a quarter. You are reviewing your 941b schedule more frequently if any changes or updates to the data are also beneficial. By staying organized and keeping track of progress, you can make better decisions that will help improve your business.

The IRS has outlined the following as some reasons why reviewing your 941b schedule is important:

- To confirm required information is accurate and current.

- To determine whether reported amounts align with the taxpayer’s financial results.

- To identify areas where adjustments may be necessary.

- To ascertain compliance with certain filing requirements, such as disclosure statements (Form 8886), Filing Status Reports (Form 4468), etc.

- For planning purposes, estimate future tax liabilities.

Most importantly, reviewing your 941B Schedule helps keep everyone—including yourself—organized and keeps everyone on track!

What happens if I miss a shift on my current schedule b 941?

If you missed a shift on your schedule b 941, you would assume the next available shift.

You may be terminated if you miss more than four shifts in a row. There are some exceptions to this rule- if there is an emergency that requires immediate attention and someone else cannot take your place or if it’s impossible for another person to take your place because of weather conditions. However, these situations are rare and should not result in termination.

Schedule b 941 is unique because it provides short- and long-term employee benefits. The short-term benefits allow workers to move around constantly and learn new skills while still earning their hourly wage; the long-term benefits provide predictability and stability so employees can plan for their future without feeling like they’re at risk of being fired every week.

Read Also: The Schedule C Form 1040 and 5 Best Tips on How to File It

Can I lose pay for missing work due to possession of a false or lost platoon/section/shipment roster computerized deployment status report (PCSR)?

If you cannot access your platoon/section/shipment roster computerized deployment status report (PCSR), you may be eligible for leave without pay.

If you are required to use alternative forms of documentation to track your platoon/section/shipment, you may be able to continue working while awaiting the arrival of your PCSR.

For a service member to receive leave without pay due to possession of a faulty or lost PCSR, four conditions must be met:

- The service member must have been absent from work because they lacked reasonable access to their PCSR.

- The absence was beyond the control of the employee.

- The absence caused significant harm or inconvenience relating directly to military operations or duties.

- Payment would not adequately compensate for lost wages during that time.

Conclusion

A schedule b 941 is something you need if you are in the military or plan on joining the military. It’s a computerized deployment roster that contains important information such as your work schedule, pay rates, and accommodation details. Whether or not you are using it currently is up to you, but we recommend doing so to stay safe and compliant with military regulations.